- JRNY Crypto says the October 10 crash wasn’t random but triggered by MSCI’s proposed reclassification of Bitcoin-heavy companies.

- JPMorgan amplified panic with a bearish report while reportedly increasing their own crypto exposure.

- Uncertainty remains until MSCI’s January decision, but Tony believes short-term market conditions still lean bullish.

JRNY Crypto’s Tony opened his latest breakdown by saying he didn’t even plan to make this video right now — the situation, in his words, “was already getting twisted.” According to him, the crypto community’s sudden boycott of JPMorgan isn’t some random emotional flare-up. It’s tied to a deeper accusation: that the bank played a strategic role in amplifying panic at the exact moment retail sentiment was at its weakest.

Tony pointed out that JPMorgan dumped around $134 million in Strategy stock (formerly MicroStrategy) right as market fear was peaking. The timing, he said, “felt a little too convenient,” especially paired with the bearish note JPMorgan published just days later.

The MSCI Bombshell Everyone Missed at First

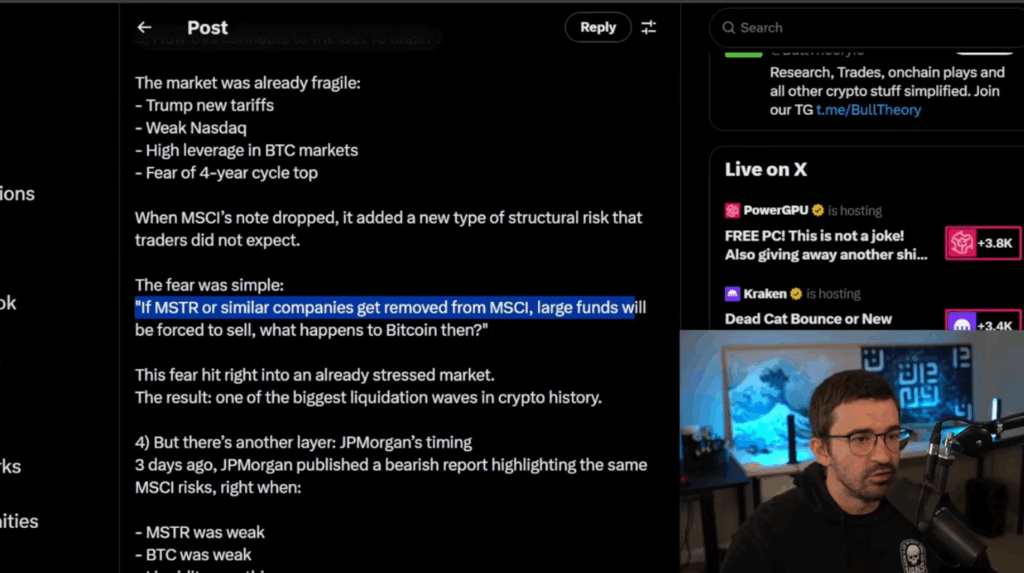

Tony said the real spark behind the October 10 meltdown wasn’t something obvious or dramatic on the surface. Instead, MSCI quietly put out a consultation note proposing that companies with more than half their assets in Bitcoin or other digital assets might be removed from major indexes.

For Strategy, that’s a massive problem. As Tony explained, index funds don’t get to pick and choose — “they’re forced to sell.” If MSCI follows through, institutional funds would be required to dump Strategy stock, which is heavily tied to Bitcoin’s movements.

That alone created what he described as “a brand-new kind of structural risk nobody saw coming.” Crypto was already stretched thin from recent volatility, and this pushed the first domino. The result? One of the largest liquidation cascades the market has ever seen.

JPMorgan’s Report: Just Bad Timing or Something Sharper?

Three days after MSCI’s warning, JPMorgan released its own bearish analysis — one that highlighted the same risks and poured gasoline on the situation. Tony argued this wasn’t unusual behavior for big institutions. They often turn negative during fear-driven markets, accumulate quietly while prices drop, and then flip bullish once they’ve filled positions.

“This isn’t illegal,” he added. “It’s strategy.”

The suggestion wasn’t that JPMorgan orchestrated the crash, but that the bank knows exactly how to use fear to its advantage — and the timing here was a prime example.

Saylor Responds: “We’re Builders, Not a Bitcoin Wrapper”

As panic spread, Michael Saylor stepped in to reframe the narrative. Tony summarized Saylor’s message clearly: Strategy isn’t a passive Bitcoin vault. It’s an operating software company with a $500 million business behind it, and its Bitcoin treasury strategy is part of a broader structured-finance model.

Saylor emphasized that painting the company as a “leveraged BTC wrapper” — as JPMorgan hinted — is misleading. Still, Tony admitted the uncertainty will linger until January 15, when MSCI publishes its final decision. Any rule changes are set to begin in February 2026.

The Backlash Explodes Into a Boycott

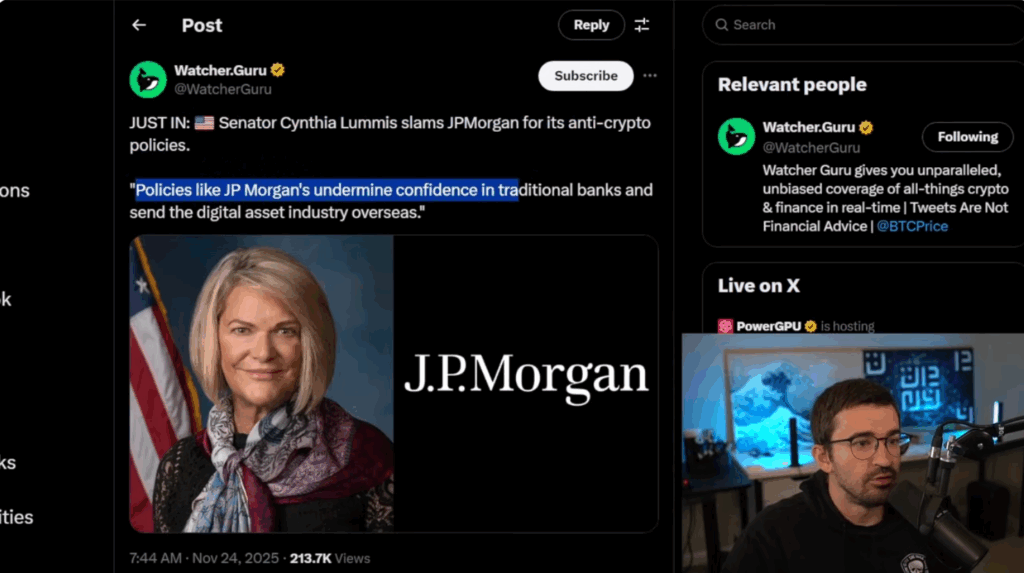

Tony said the reaction across the crypto world was immediate and, honestly, pretty intense.

Jack Mallers accused JPMorgan of debanking him.

Grant Cardone publicly said he shut down his Chase accounts.

Max Keiser rallied behind the boycott, calling for people to “crash JPMorgan.”

Even Senator Cynthia Lummis pushed back, saying these kinds of policies push innovation offshore and damage trust in traditional banks.

According to Tony, the vibe across X is simple: “People feel like they’re under attack, and they’re pushing back now.”

Short-Term Market Outlook: Still Fear, but With Some Real Relief Signs

Despite the chaos, Tony said he’s seeing the early signs of a recovery forming underneath the panic. Bitcoin climbed back above the 89k range, Ethereum tested 3k again, and rate-cut odds for December suddenly surged to around 84%.

With quantitative tightening ending soon, he argued that liquidity conditions are improving faster than many expect.

“There’s still extreme fear, no doubt,” he said, “but the ingredients for a recovery are building.”

He thinks a move back toward the 95k–100k range in December is pretty realistic if the trend holds.

Final Thoughts

Tony’s core argument is that the October 10 crash wasn’t a random flash event — it was a combination of structural fear, aggressive liquidations, and perfectly timed institutional messaging. He didn’t claim coordinated foul play, but he did make it clear that JPMorgan’s timing wasn’t innocent either.

Looking ahead, he believes the MSCI decision in January is the next biggest moment for Bitcoin’s trajectory. Until then, he expects turbulence — but the short-term setup, in his words, is “actually starting to lean up again.”