- Cardano never shut down; node operators voluntarily patched the issue and kept the valid chain alive through normal consensus.

- Confusion spread across social media, with rumors of chain splits, rollbacks, and even AI-driven attacks before official details arrived.

- ADA now trades near $0.414, with bearish pressure still present unless the price can reclaim the $0.48–$0.50 resistance range.

Cardano’s community spent most of the past week wrestling with confusion—not an outage. A brief slowdown in network performance somehow snowballed into a storm of speculation online, and before any official details surfaced, the whole conversation shifted away from the technical issue itself and toward a much bigger question: Did Cardano just prove its decentralization under real pressure, or did it expose a weakness?

The answer, depending on who you ask, is a little messy… but the chain never went down.

Cardano Didn’t Shut Down — But the Panic Sure Made It Look Like It Did

The verified incident summary makes it clear: the mainnet never halted, the protocol wasn’t compromised, and Ouroboros kept doing its job. What actually happened was a slowdown triggered by a rare edge-case in the node software. Independent stake pool operators noticed something off, ran diagnostics, and—without any centralized orders—applied a patch voluntarily.

Because enough nodes adopted the fix on their own, the valid chain remained dominant. In other words, the system recovered because it’s decentralized, not in spite of it.

Still, that nuance didn’t survive the social-media spin cycle.

Social Media Turned a Slowdown Into a “Chain Split Crisis”

Before a single official explanation appeared, rumors were already flying everywhere. Some users claimed Cardano suffered a chain rollback… others insisted one malicious transaction shut down the network. A few even blamed some rogue AI attack for the whole thing.

The narratives were loud, dramatic, and—almost entirely—wrong. But uncertainty spreads fast when a popular network shows any sign of weakness, and the speculation filled the void long before accurate info caught up.

Hoskinson Steps In, Finally Calming the Noise

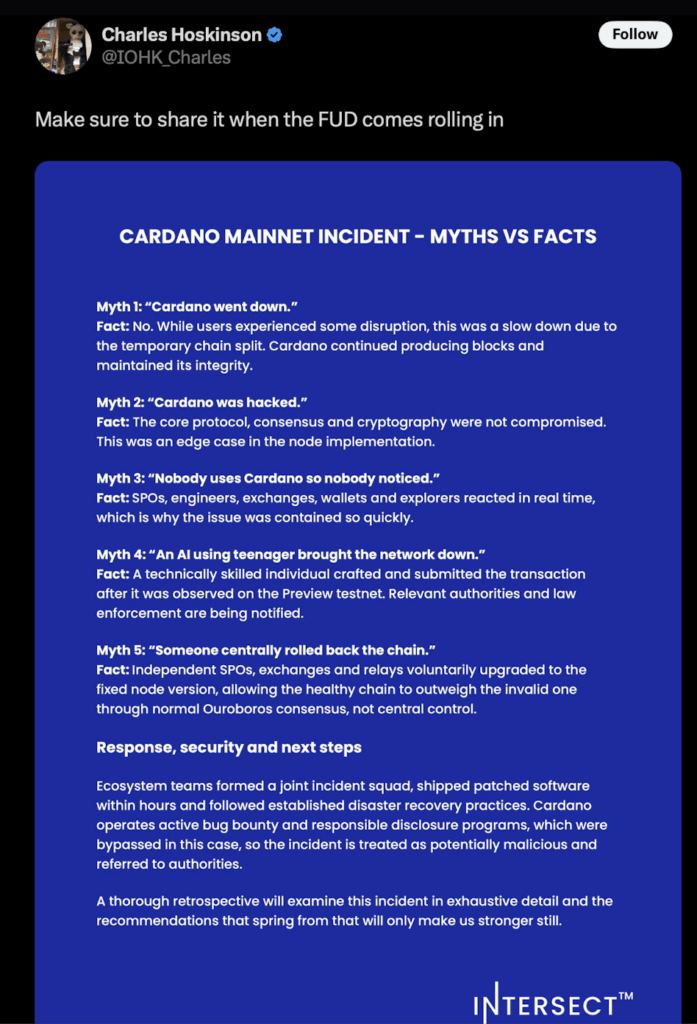

After the conversation had already gone off the rails, Charles Hoskinson released a breakdown clarifying what actually happened:

- The Cardano mainnet did not shut down

- The protocol remained secure and intact

- The event stemmed from a rare node-implementation scenario, not a protocol flaw

He labeled the slowdown an operational incident, not a consensus or protocol failure.

Intersect, meanwhile, described the event using different language—calling it node divergence and referring to a “chain split”—but both sides agree on the key point: the network kept running.

ADA Price Struggles as Sentiment Remains Bearish

At the moment, ADA is trading around $0.414, hovering just above its lowest point since the June recovery. The 4-hour chart is showing a soft bearish tone:

- RSI sits near 37, bearish but not oversold yet

- MACD histogram is basically flat, hinting that downside momentum is cooling but not finished

- $0.40 remains the immediate support; below it, the danger zone stretches into $0.36–$0.38

For any meaningful recovery, ADA needs to break above $0.48–$0.50, which lines up with both structural resistance and the mid-RSI zone. Until then, the trend leans bearish-to-neutral with room for small relief bounces.

A Full Technical Review Is Still on the Way

Intersect confirmed a complete post-incident retrospective is being prepared. The review will outline what happened, how operators responded, and what changes will be implemented to prevent similar situations in the future.

But according to early statements, recovery mechanisms behaved as intended, and coordination among independent node operators—arguably the heart of Cardano’s decentralization—proved effective under stress.