- VanEck CEO raised concerns about Bitcoin’s privacy, pushing longtime BTC holders to explore Zcash’s stronger encryption features.

- Zcash surged 930% in 2025, reaching a $9.43B market cap and gaining momentum ahead of its OKX relisting.

- Industry voices, including Vitalik Buterin, warned that quantum computing could threaten current cryptographic systems, adding pressure to Bitcoin’s privacy debate.

Bitcoin’s privacy features were thrown under the spotlight this week after VanEck CEO Jan van Eck openly questioned whether BTC still provides enough encryption for today’s standards. During a CNBC interview, van Eck said the conversation inside the Bitcoin community has shifted from price action to deeper concerns about transparency and privacy. His comments ended up steering a lot of attention toward Zcash, a privacy-focused coin that has been ripping higher this year with a pretty unreal 930% surge. As Bitcoin traded around $86,204 on Sunday, down nearly 8% year-to-date and still about 31% under its all-time high, the contrast between the two narratives became hard to ignore.

Why Bitcoin Holders Are Exploring Zcash

Van Eck explained on Power Lunch that some long-term Bitcoin holders are now reassessing their assumptions, especially as privacy becomes a bigger priority in the space. He noted that Bitcoin’s transparent ledger, where anyone can trace how coins move from one wallet to another, goes against the rising expectation for transactional privacy. Zcash, on the other hand, uses zero-knowledge proofs to shield sender, receiver and amount — essentially offering the privacy many users thought would eventually emerge around Bitcoin but hasn’t yet.

He also emphasized that VanEck evaluates Bitcoin the same way it evaluates traditional assets, saying the firm would “walk away” if the underlying thesis ever became fundamentally broken. After the interview, van Eck even posted on X that Bitcoin’s current bear market is partly tied to halving cycle dynamics, quantum encryption concerns, and the fact that Zcash provides stronger privacy guarantees. Around the time of the interview, BTC hovered near $84,643 before recovering slightly.

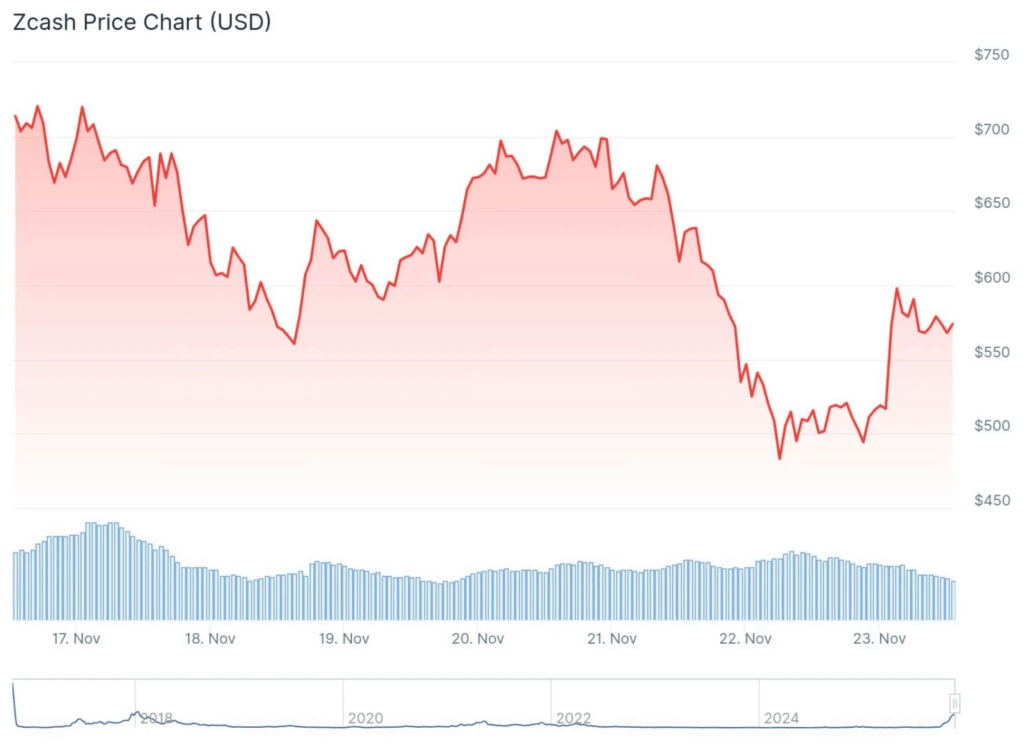

Zcash Becomes a Top-15 Crypto as Exchanges Reopen Trading

Zcash’s massive rally has pushed it into the 13th-largest cryptocurrency spot, with a market cap around $9.43 billion. ZEC was trading near $578 at the time of reporting, showing just how aggressively capital has rotated into privacy narratives lately. The momentum got another boost when OKX announced it would relist Zcash, with ZEC/USDT spot trading restarting on November 24 at 12:00 UTC. This relisting marks a significant step since Zcash has often dealt with regulatory concerns tied to privacy coins, making the comeback even more surprising.

Industry Reacts to Privacy, Encryption, and Quantum Concerns

Van Eck’s comments triggered plenty of discussion across the crypto space. Some traders argued that Bitcoin’s transparency is a feature, not a flaw.

But others pointed to legitimate long-term risks, especially as quantum computing advances faster than expected. Vitalik Buterin spoke at a November 17 event in Argentina and warned that elliptic curve cryptography — the foundation of both Bitcoin and many blockchains — could be vulnerable to quantum breakthroughs. These warnings, combined with the rising demand for privacy-first technology, have given Zcash a fresh narrative tailwind at a moment when Bitcoin is facing new scrutiny.