- Coinbase is acquiring Solana-based Vector to boost its on-chain DEX trading speed and asset access.

- Solana dropped 9% amid heavy derivatives liquidations despite the acquisition announcement.

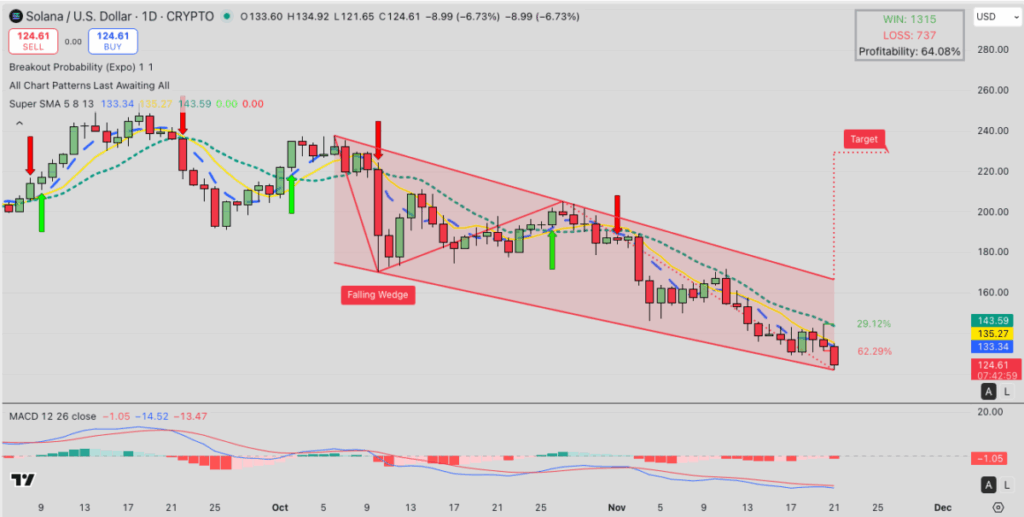

- A falling wedge pattern shows SOL could rebound nearly 29% if bulls defend the $124 support level.

Coinbase has made another pretty bold move this week, revealing that it’s acquiring Vector, a Solana-native social trading platform that’s been popping up all over crypto Twitter lately. The exchange says Vector’s tech will get folded into its main consumer trading stack, mainly to give users faster access to high-velocity DEX markets… y’know, the stuff people love Solana for. It’s another step in what Coinbase keeps calling its 2025 expansion push, and honestly, it fits right into the whole “on-chain everything” theme the market’s been drifting toward.

What’s interesting is how big Solana DEX activity has become in 2025 – volumes cruising over $1 trillion already this year – making it kind of obvious why Coinbase would want tighter hooks into the Solana ecosystem. In their announcement, Coinbase mentioned that Vector’s engineering team (all Solana-native builders) will be joining the exchange to help integrate Vector’s operating system into its DEX interface. The idea is to boost execution speed, deepen liquidity, and offer way more assets without forcing users to hop across multiple apps. As part of the transition, Vector’s own mobile and desktop apps will slowly shut down, which feels bittersweet but expected.

The deal doesn’t touch Tensor or the Tensor Foundation at all, even though some folks online were speculating about a bigger Solana land grab. Coinbase made it clear Tensor stays independent. The acquisition still needs to pass the usual closing checks, but it’s expected to wrap up before the end of the year. The market, though… didn’t exactly celebrate.

Solana Drops 9% as Market Liquidations Hit Hard

Even with the Coinbase announcement, Solana couldn’t dodge the heavy wave of end-of-week selling. SOL slid another 9%, right alongside other top altcoins like ETH and XRP, which took similar hits as derivatives markets flushed out overleveraged positions. Liquidations piled up fast, dragging prices lower across the board while institutional trading desks closed their books for the week.

Derivatives data painted a pretty stressful picture. According to Coinglass, trading volume for SOL jumped 46%, but open interest fell 9% down to $6.75 billion. That combo usually signals aggressive unwinding, which matched the price action almost perfectly. The long-to-short ratio slipped to 0.91 — another sign traders were loading up on downside bets expecting the weakness to bleed into the weekend. The momentum wasn’t subtle; it was just… down.

Solana Price Outlook: Falling Wedge Hints at 29% Bounce if $124 Holds

Heading into the weekend, Solana is sitting right at the base of a two-month falling wedge, hovering around $124.51 after that sharp daily drop. Since early October, SOL’s been carving out lower highs and lower lows in a structure that usually hints at an eventual bullish breakout — assuming buyers don’t let support collapse beneath them.

Short-term technicals aren’t super friendly, though. The SMA 5 at $143.58, SMA 8 at $135.26, and SMA 13 at $133.32 are all stacked above price, creating a sort of overhead pressure zone that SOL will need to chew through on any recovery bounce. The MACD isn’t helping either, with the line at –14.53 still below the signal line at –13.48, while the histogram keeps dipping deeper into the red.

If the wedge resolves fully to the upside, Solana could theoretically stretch all the way toward $220. But for now, the more grounded target sits around a 29% relief bounce, which becomes realistic only if bulls defend $124 and push price back above $160 — the level that basically breaks the bearish spell. Until then… it’s patience time.