- Grayscale’s Dogecoin (GDOG) and XRP (GXRP) ETFs begin trading Monday on NYSE Arca.

- Both products offer direct spot exposure after transitioning from private placements.

- The launch joins a wave of altcoin ETFs driven by rising institutional demand.

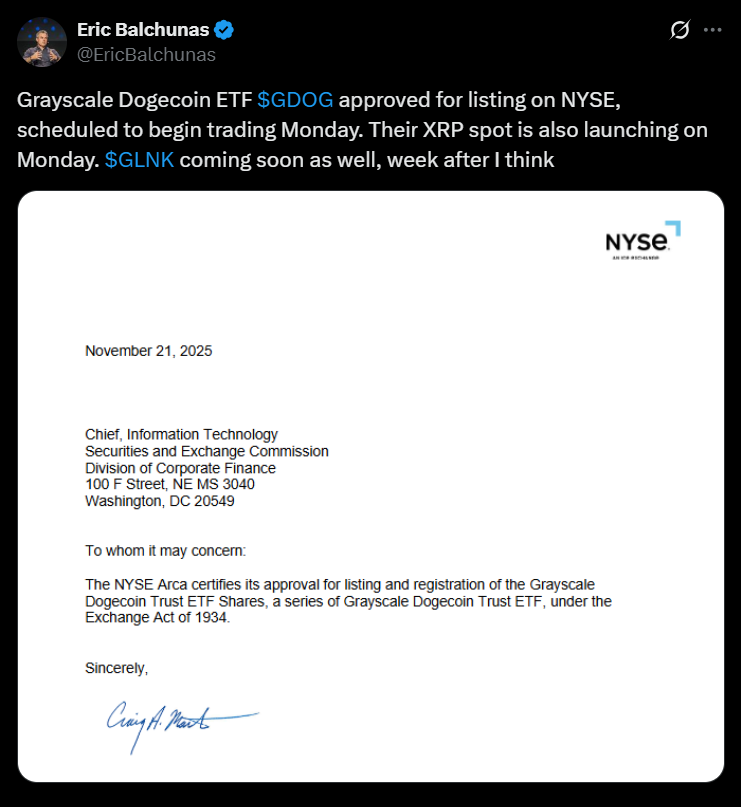

Grayscale is expanding its reach into the altcoin ETF arena as its Dogecoin and XRP products officially go live on NYSE Arca this Monday, marking a major milestone for U.S. investors seeking direct, regulated exposure to both assets. The newly listed Grayscale Dogecoin Trust ETF (GDOG) and Grayscale XRP Trust ETF (GXRP) will each hold spot allocations of their underlying tokens, opening the door for traditional investors to engage with two of the market’s most active cryptocurrencies without navigating exchanges or self-custody.

A New Era for DOGE and XRP Access

For Dogecoin, the move represents a significant leap from meme coin origins to mainstream legitimacy. DOGE has consistently ranked among the highest-volume traded digital assets, and its ETF debut signals that institutional interest has shifted decisively toward broader crypto diversification. XRP, meanwhile, enters the ETF landscape as the XRP Ledger approaches its fourteenth year, having processed more than four billion transactions since inception.

From Private Placement to Public Markets

Both GDOG and GXRP were previously available only as private placements, but the transition to NYSE Arca gives them far wider visibility and liquidity. Their launch expands Grayscale’s product lineup to more than 40 offerings, further anchoring the firm as one of the most influential players in crypto investment products. With renewed attention on altcoin ETFs, demand for regulated exposure continues to build across U.S. wealth channels.

Part of a Growing Altcoin ETF Wave

The timing of Grayscale’s rollout aligns with a broader surge in altcoin ETF activity. Bitwise launched its XRP ETF earlier this week, while Franklin Templeton is preparing its own Dogecoin product for release next week. Bitwise’s Solana ETF (BSOL) has already pulled in more than $400 million in inflows this year, underscoring the rising institutional appetite for assets beyond Bitcoin.

What This Means for Investors

The introduction of GDOG and GXRP to public markets could reshape how both assets trade in the months ahead, especially as liquidity deepens and institutional allocators begin assessing their long-term roles in diversified portfolios. While market conditions remain turbulent, the arrival of these ETFs signals that traditional finance continues building bridges into the broader crypto ecosystem.