- HIP-3 growth mode slashes taker fees by 90%+, enabling permissionless perp markets to launch cheaply.

- Community sentiment turned bullish, expecting new exotic markets and increased chain activity.

- More builders and traders entering the ecosystem could boost long-term demand for HYPE.

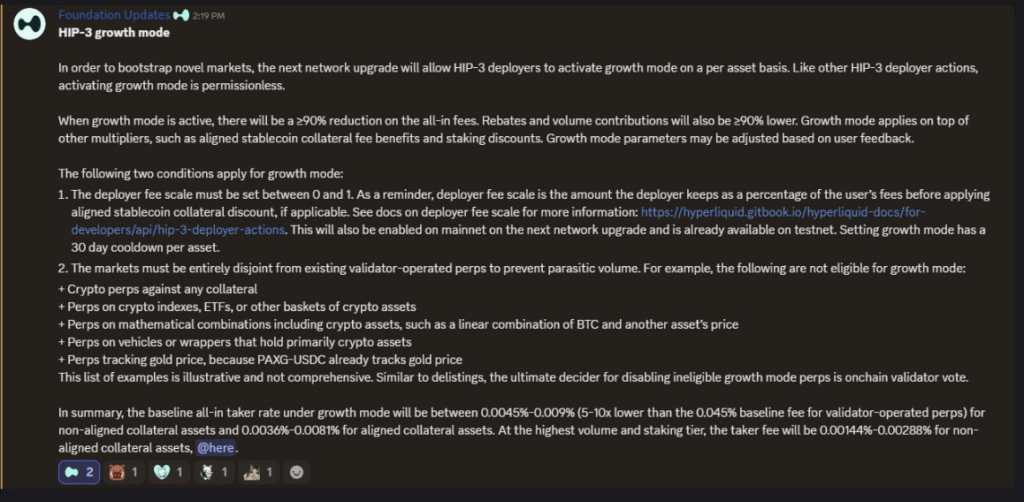

Hyperliquid rolled out its newest upgrade to HIP-3, and honestly, it feels like one of those changes that could quietly reshape the entire ecosystem. The original HIP-3 already let anyone spin up a perpetuals market on-chain—as long as they held 500,000 HYPE. But this new addition, called growth mode, takes that idea and basically pours rocket fuel on it. Announced on November 19th, the update allows permissionless, builder-deployed perp markets to activate ultra-low taker fees, making it easier for new assets, new traders, and new market makers to enter the ecosystem.

Growth mode cuts fees by more than 90%, creating a playground for new assets

When growth mode flips on for a specific asset, taker fees drop by at least 90%. The usual 0.045% taker fee now falls to a tiny 0.0045%–0.009%, and top-tier traders can even see fees between 0.00144% and 0.00288%. Rebates and volume requirements also drop by 90%. That’s an enormous incentive for new markets—basically a “turbo-discounted launch lane.”

Not everything qualifies, though. No Bitcoin markets, no existing markets, and no ETF or index-style baskets—Hyperliquid wants to avoid parasitic volume that cannibalizes established liquidity. Validators can also vote to shut down growth mode for any market breaking the rules. Still, for most new perp markets, permissionless access + lowered fees is a massive tailwind.

On-chain sentiment turns bullish as users brace for an avalanche of new markets

Hyperliquid’s stats show steady growth this year: more daily users, more activity, and, before the 10/10 crash, an explosion in Open Interest. Even with the OI pullback, the community’s reaction to HIP-3 growth mode has been loud. Some Crypto Twitter voices called it a “you’re not bullish enough on HIP-3” moment. Another user hyped the upgrade as a “turbo-boost for innovation on the fastest L1 for derivatives,” pointing out that costs are now 5–10x lower than the big legacy chains.

People are expecting exotic new assets—real-world yield products, tokenized commodities, strange derivatives that never touch centralized exchanges—to pour onto the chain. Deployers are already talking about “flooding Hyperliquid with alpha markets,” while traders brace for insane volume spikes and razor-thin spreads once growth mode kicks in across different assets.

What this means for HYPE holders

More markets + more activity + more builders = more long-term demand for HYPE. It’s not instant, but the logic is clear: if HIP-3 attracts a flood of new perps, more traders will need HYPE exposure as part of market creation, staking, and broader participation. Throughout November, HYPE traded inside the $36.5–$43.3 band, and since May it has mostly stayed between $32.5 and $50. Growth mode could eventually push it toward the upper end of that range again—especially if the market flips back risk-on.

And the bigger picture? Hyperliquid is positioning itself as the go-to onchain venue for permissionless derivative markets. If this path holds, HYPE’s relevance only grows from here.