- DOGE has defended the $0.15 level for over a month, backed by strong on-chain bid support and a bullish exchange net position.

- Whale cohorts accumulated more than 5B DOGE in December, reinforcing deeper support zones around $0.08 and $0.15.

- With two major support layers and rising buy interest, Dogecoin looks stronger than most top caps heading into December.

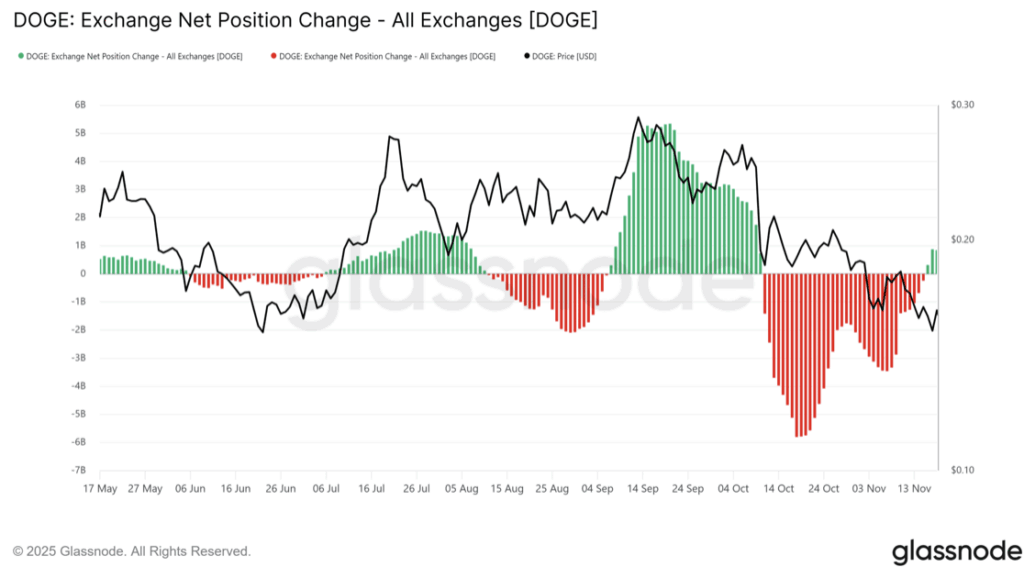

Dogecoin has been showing a kind of stubborn strength this cycle that almost feels out of character for a meme coin. Even with the broader market wobbling, DOGE kept its November losses to about 15%—a small hit compared to what many other top caps suffered. Now, a couple weeks into December, it’s still clinging to that $0.15 range. And the longer it stays there, the more that level starts acting like a real floor rather than just a temporary bounce point. On-chain numbers back that up too, with DOGE’s exchange net position flipping green for the first time in over two months, a shift that often signals growing buy interest.

Bid support and bullish flips help strengthen DOGE’s base

A positive exchange net position might sound a bit boring, but it basically means more DOGE is flowing onto exchanges than leaving. Historically, these flips have lined up with short-term rebounds—moments where buyers quietly step in at key levels. One famous example was DOGE’s jump past $0.30 in September, backed by the net position spiking to 5 billion DOGE. These kinds of patterns aren’t perfect signals, but they hint that the $0.15 level isn’t just psychological, it’s reinforced by real bid strength under the surface.

Whales seem to agree. The most influential whale cohort—wallets holding 100 million to 1 billion DOGE—has scooped up roughly 5 billion DOGE this month alone. That’s a noticeable wave of accumulation even while other whale groups stay mostly inactive.

Two major support zones give DOGE a stronger foundation

There’s another piece worth noting. Analysts flagged that a massive 27.4 billion DOGE was accumulated around $0.08 earlier this year. That makes $0.08 a deep—and extremely strong—support base. If heavy holders defended that level aggressively, and now DOGE is holding at $0.15 with fresh whale buying, it creates a layered structure of support underneath the price. That kind of foundation is rare for meme coins, which usually move on hype more than hard data.

On the chart, DOGE continues trading above these key zones, making it one of the more technically resilient top-cap assets right now—something that sets it apart from many other large-cap altcoins showing weaker structures.

Why Dogecoin looks stronger than the rest of the pack

All of this—bid support, whale accumulation, strong lower levels—helps explain why DOGE has stayed afloat while other majors slipped harder. The resilience isn’t random. It’s backed by measurable on-chain shifts and buyers stepping up at the right moments. If the market flips back to risk-on anytime soon, Dogecoin already looks well-positioned to take advantage of that shift.

In short, the $0.15 floor isn’t just holding because of luck. It’s holding because actual, committed capital is supporting it. And as long as that remains the case, DOGE stays one of the stronger top-cap contenders heading into the next leg of the cycle.