- Tether invested in Parfin to expand USDT’s institutional settlement and stablecoin infrastructure across Latin America.

- Inflation and banking instability in countries like Argentina and Brazil are driving massive regional demand for stablecoins.

- LATAM has become a major global crypto hub, with nearly $1.5 trillion in transaction volume and growing reliance on USDT.

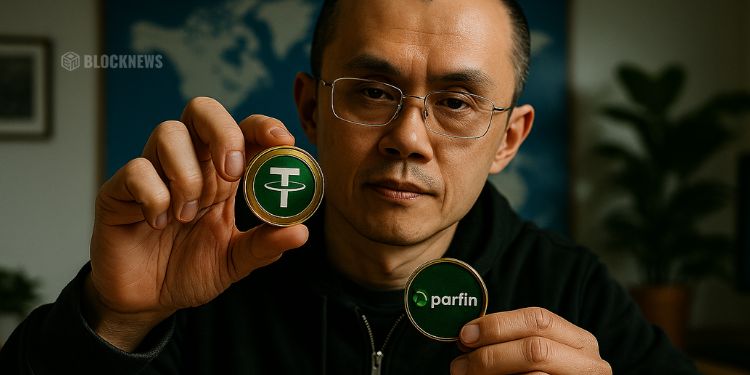

Tether is stepping deeper into Latin America, placing a fresh investment behind Parfin as the region’s appetite for institutional crypto rails keeps heating up. The move is meant to speed up onchain settlement, something a lot of major players across LATAM are already leaning toward as traditional systems hit their limits. It’s a sign that stablecoins, especially USDT, are becoming more than just a trading tool; they’re turning into actual financial plumbing for businesses that move serious value. And honestly, the timing feels almost too perfect given how quickly LATAM is adopting digital finance.

Expanding Onchain Settlement And Institutional Infrastructure

Parfin, which operates out of London and Rio de Janeiro, has been building the kind of backbone institutions need to handle custody, tokenization and settlement since 2019. Tether’s new investment, even though they didn’t share the number, aims to push USDT into that flow as a primary settlement asset. They see USDt as a rail for high-value operations like cross-border payments, tokenized real-world assets, and credit markets tied to commercial receivables. Parfin recently grabbed official registration in Argentina as a virtual asset service provider, just adding more fuel to the effort. It’s also been running in Brazil since 2020, giving it a strong regional position to scale these tools quickly.

Tether Sees Latin America As A Major Force For Blockchain Growth

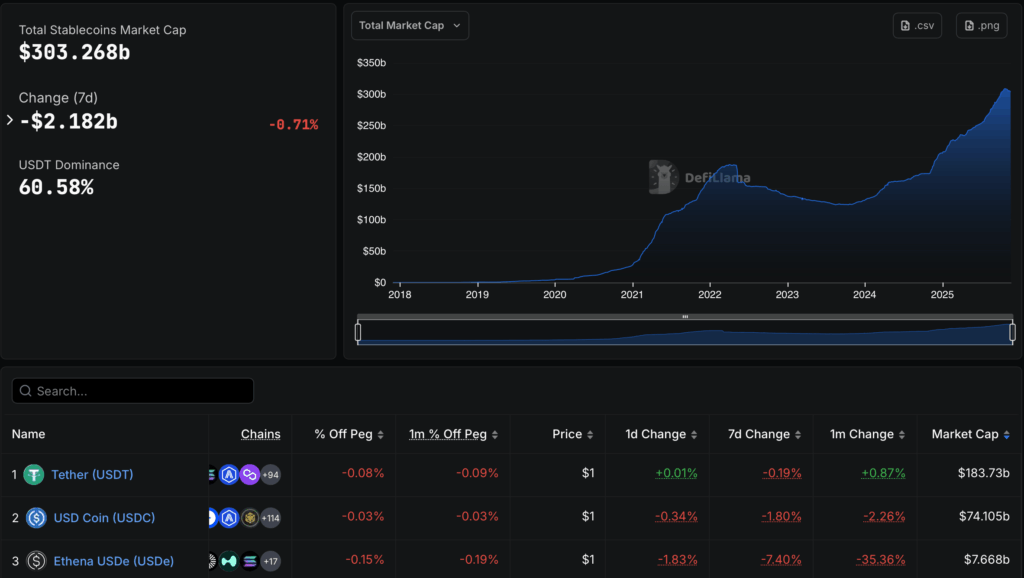

Paolo Ardoino, Tether’s CEO, said the move reflects the company’s belief that Latin America is becoming one of the world’s top blockchain innovation zones. And he might not be wrong; USDT already dominates the stablecoin market with around a $183.73 billion market cap, according to DefiLlama. The entire stablecoin market is sitting near $303.2 billion, so Tether basically owns the largest slice. This Parfin deal also comes just days after a separate investment into Ledn, a Bitcoin-backed lending platform, showing Tether is doubling down across multiple fronts to strengthen its ecosystem. The broader strategy seems pretty clear: build out stablecoin rails wherever adoption and structural demand are already exploding.

Latin America’s Crypto Boom Shows No Signs Of Slowing Down

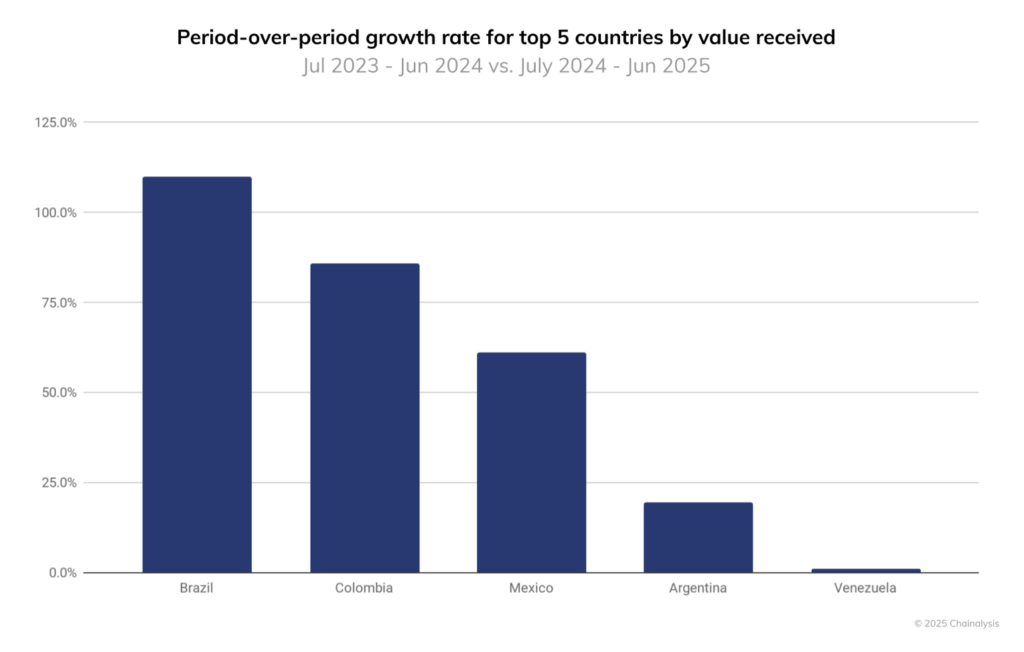

Chainalysis reported in October that LATAM handled nearly $1.5 trillion in crypto transactions from mid-2022 to mid-2025, making it one of the biggest hotspots globally. Brazil alone pulled in around $318.8 billion, almost a third of the region’s activity, while Argentina followed with $93.9 billion. A lot of this surge comes from inflation pressure—especially in Argentina, where currency issues have pushed people toward anything more stable than the peso.

Stablecoins have become a kind of digital safe zone; Bitso even said USDT and USDC made up 39% of all crypto purchases on its platform in 2024. Beyond protection from inflation, stablecoins are being used for everyday payments, savings, and cross-border transfers without SWIFT’s heavy fees. As Bybit’s LATAM chief put it, crypto isn’t just growing—it’s literally changing lives in the region, reshaping how people move and store money.