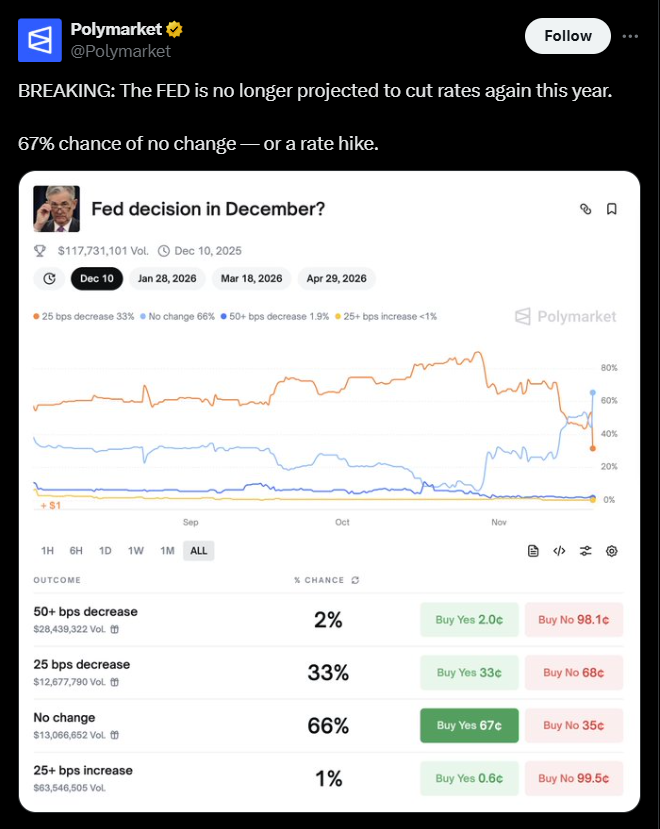

- Odds of a December rate cut plunged from ~90% to ~30%.

- The shutdown delayed October and November jobs reports until Dec. 16.

- Traders now overwhelmingly expect no move at the December meeting.

Expectations for a December Federal Reserve rate cut have plunged after the Bureau of Labor Statistics confirmed it will not release October’s jobs report due to the record-length government shutdown.

According to Polymarket, the probability of a 25 bps cut has collapsed from nearly 90% three weeks ago to just 32% today, while “no change” odds have surged to 66%.

The missing report was the final trigger. Traders had been pricing aggressive easing heading into the end of the year, but the sudden loss of a critical dataset forced markets to dramatically recalibrate. As one top Polymarket participant summarized: “No data, no cut.”

Shutdown Leaves Fed With No Visibility Ahead of Decision

Instead of releasing October data, the BLS confirmed it will merge the numbers with November’s report — now delayed until Dec. 16, six days after the Fed’s Dec. 9–10 meeting. That means the Fed will make its final policy decision of the year without two months of employment data, one of the indicators it relies on most heavily.

This unprecedented level of uncertainty has pushed traders into defensive positioning across equities, crypto, and macro markets. With no clean read on jobs, the consensus has shifted toward the Fed holding rates steady until clearer signals emerge.

How Markets Are Reacting

The recalibration in rate expectations comes at a time when volatility across risk assets is already elevated. Crypto markets, in particular, felt the shock: Bitcoin dipped below key levels as traders adjusted for a potentially longer period of restrictive monetary policy.

The deeper issue goes beyond the shutdown itself. With data releases compromised, the Fed must rely on incomplete information — and traders are now forced to price a wider range of outcomes heading into December.