- Chainlink has slipped into consolidation, trading near major support after losing momentum from its summer rally.

- CCIP adoption and strong DeFi metrics keep the project fundamentally solid despite a bearish chart structure.

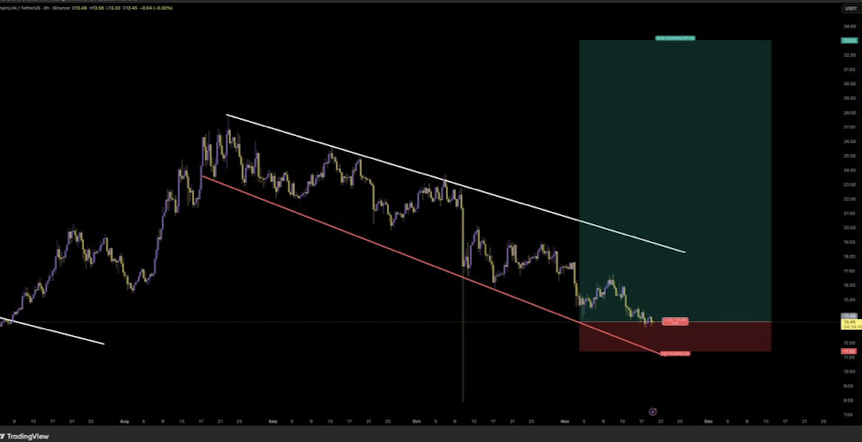

- LINK must break out of its descending channel to flip sentiment, while the $12 support remains the key level for traders.

Chainlink’s LINK token has kinda drifted back into a cooling phase after that hectic summer surge. The jump from about $11 straight to $28 felt explosive at the time, but it didn’t stick for long, and by early November the price had slumped toward the $14 range again. Analysts say this pullback isn’t shocking—it mirrors the broader uncertainty hovering over the whole market, with traders waiting (and waiting…) for clearer signals on interest rates or any hint of what central banks plan to do next. With months of lower highs stacking up, LINK now trades near a major support zone, even as CCIP adoption and DeFi activity quietly keep rising in the background.

Why Chainlink still anchors the DeFi ecosystem

Even after the correction, Chainlink hasn’t really lost its place at the center of crypto’s infrastructure. It’s still the main oracle network connecting smart contracts to real-world data, something the majority of DeFi platforms depend on more than they admit. The system now supports hundreds of protocols, delivering price feeds that secure billions of dollars across on-chain lending, derivatives, and automated markets. DefiLlama lists roughly $48.5B in Total Value Secured through Chainlink oracles—pretty wild for a project supposedly “cooling off.” Meanwhile, perpetual markets connected to the ecosystem recorded around $45B in decentralized trading volume in just 24 hours, though the reports don’t break down how much of that activity actually depends on LINK itself.

CCIP becomes the big narrative as cross-chain demand grows

The next jump for Chainlink seems to be CCIP—the Cross-Chain Interoperability Protocol—designed to move data and messages securely between different blockchains. Sounds simple, but it solves a huge pain point since most chains still operate like isolated islands. What’s even more interesting: some large financial institutions have been studying CCIP for their own internal systems. If that interest keeps building, demand for LINK could naturally pick up too, since the token acts as collateral inside the network’s node economy. Futures data from Coinglass shows open interest at about $582.59M, with roughly $1.1B in trading volume over the past day, hinting at a market that’s active even if the sentiment isn’t exactly bullish.

LINK price outlook as traders eye the oversold zone

A crypto analyst known as Don posted a chart on X showing LINK stuck inside a long-running descending channel. The upper trendline has blocked every real attempt to break higher, while the lower boundary keeps catching the sell-offs. Right now, LINK trades near the bottom of that channel again—hovering in the $12–$13 range that has acted as support since September. The token tapped the area recently but didn’t break beneath it, a small hint that sellers may be losing some steam as oversold conditions deepen. Still, the overall trend leans bearish, with lower highs and lower lows guiding the chart. For a long setup to even make sense, LINK needs to reclaim the mid-range and push out of the channel entirely. The suggested stop-loss sits just under $11.40, while the breakout target lies somewhere around $30–$33. Until that resistance gives way, though, LINK stays in a downward pattern—leaving the $12 support level as the line traders are watching closely. If that zone cracks, the chart has plenty of room to fall.