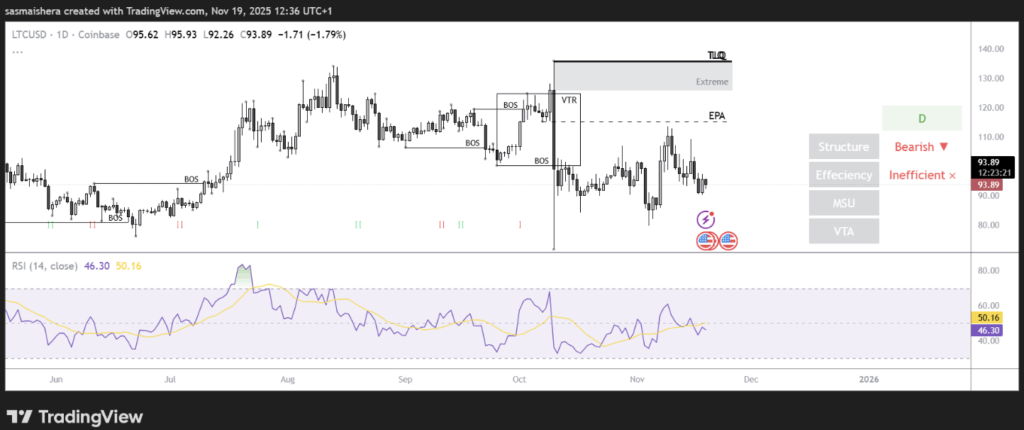

- Litecoin is trading slightly lower, hovering just above $93 after failing to break past $95 resistance.

- ETF demand remains weak while derivatives data shows short sellers gaining influence.

- A drop below $90 could open the door to $80, while a strong bounce may target the $116 zone.

The crypto market kicked off the week on a rough note, and Litecoin didn’t escape the drag. Prices slipped earlier, then steadied a bit in the last several hours, though the coin is still sitting about 1% lower on the day. LTC floats just above $93 now—still shy of the $95 weekly peak it briefly tapped before momentum fizzled out. The mood feels a bit muted, almost like the market is catching its breath after a small wave of selling that came and went faster than expected.

Investors shift positions as profitability dips

Under the hood, Litecoin’s fundamentals are leaning neutral, even if the chart looks a little more bruised. Data shows that only about 57% of LTC’s supply is currently in profit, a drop that triggered heavier selling as traders rushed to lock in gains or accept losses before things moved further south. Santiment’s numbers suggest this sell-side pressure is mostly from holders who bought within the past couple months—quick movers reacting to the slightest shift in sentiment. It’s not panic-selling, but it’s definitely not confidence either.

ETF demand cools off while derivatives tilt bearish

The weakness is also showing up in Litecoin’s US-based spot ETF flows, which have been… honestly pretty underwhelming. Since launching in October, these products have only managed to pull in around $7.26 million in net inflows. Canary’s LTCC remains the only US-listed spot Litecoin ETF, and despite early excitement, the demand just hasn’t materialized. Meanwhile, in the derivatives market, funding rates dipped into the negative twice over the past two days, hinting that short traders are slowly taking the wheel. Open Interest has crawled back to 5.57 million LTC, but it’s still nowhere near the hefty 8.80 million LTC levels seen before the big leverage flush on October 10.

Key levels to watch if Litecoin loses momentum

On the charts, LTC’s daily setup leans bearish and a bit inefficient, with the coin shedding roughly 8% in the last week. It briefly slipped to about $90.2 on Tuesday before bouncing toward $95.4, only to get smacked back down by that stubborn resistance. At the moment, prices are hovering around $93.66, trying to decide whether to drift lower or take another shot upward. Both the RSI and Stochastic Oscillator sit below their midpoints—basically flashing that bears still have the upper hand. If buyers manage to regroup, LTC could attempt a push toward the $116 efficiency zone sometime soon. But if the market rolls over again and bulls can’t hold the $90.2 support, a slide toward the $80 region becomes very real, maybe quicker than traders expect.