- TRX sits inside a descending triangle with weakening momentum and heavy selling pressure.

- Negative funding rates indicate bears dominate and short squeezes are unlikely.

- A recovery requires a trendline breakout and volume surge; downside targets lie at $0.25, $0.22, and possibly $0.21.

The past few months have not been kind to altcoins… and Tron is right in that pile. Over the last 90 days, TRX has dropped nearly 20%, keeping that long-hyped $1 target far, far out of reach. Some analysts still float the idea that TRX could hit $1 this cycle, but when you zoom out and actually look at the structure, the odds feel pretty thin.

Tron looks trapped — and not just in price, but in momentum.

A Strong Rally… and Then a Sudden Trap

Between June 23 and August 18, TRX printed nine straight green weekly candles, one of its most impressive runs in years. Hype exploded, social sentiment turned bullish, and traders started convincing themselves a parabolic move was coming. Some even claimed Tron was about to break into the “majors.”

But momentum flipped. Hard.

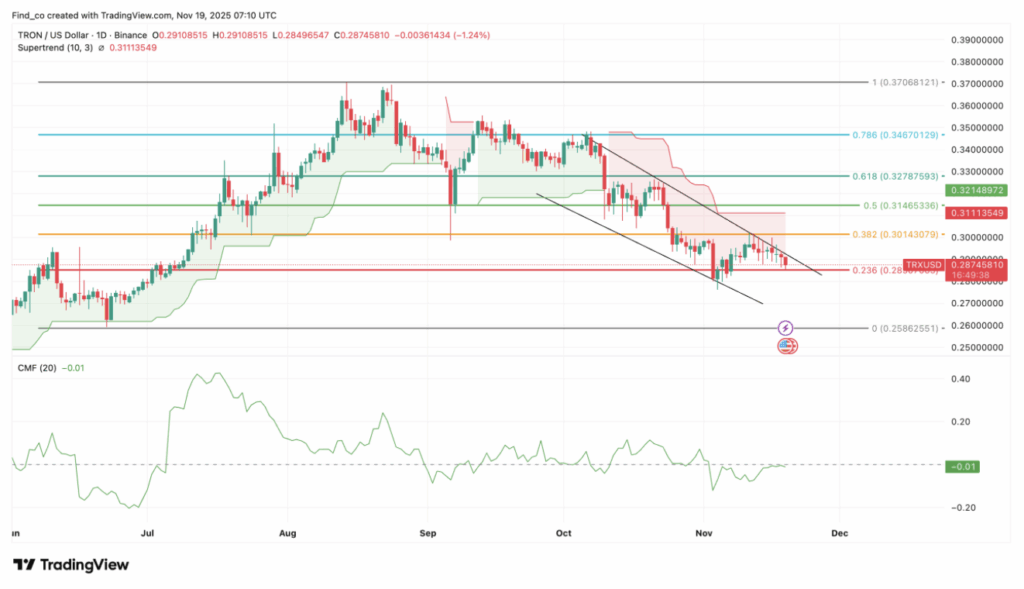

Price action reversed into a descending triangle, a pattern that usually hints at weakening strength and increasing downside risk. Support near $0.29 is still holding, but the structure above it is falling apart — lower highs forming again and again, sellers stepping in at every bounce. MACD? Bearish crossover. Momentum? Weak. Confidence? Slipping.

If this trend continues, TRX could drop to $0.25, and in a deeper slide, even $0.22.

On-Chain Data Adds Another Red Flag

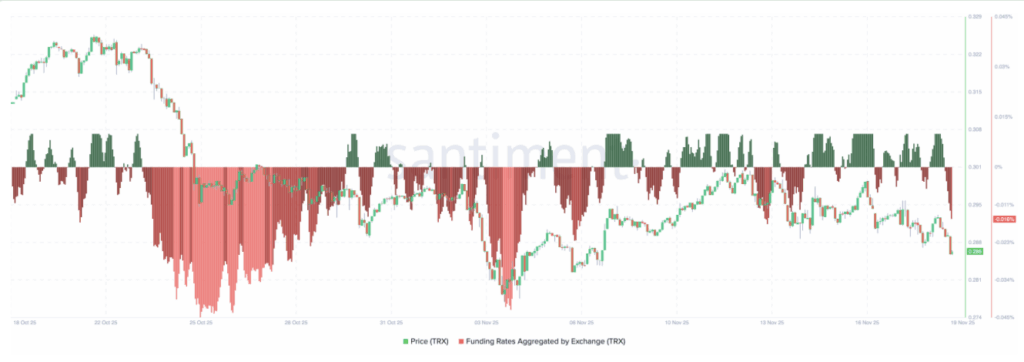

Santiment’s data showed TRX’s funding rate flipped negative — and stayed there.

Negative funding + falling price = shorts are crowding the market.

Typically, when there’s too much short exposure after a long decline, short squeezes become less likely, not more. Bears are not overextended; they’re comfortably in control. Unless demand suddenly shows up, TRX could break down under $0.25 sooner than bulls expect.

Daily Chart Confirms the Pressure

On the daily timeframe, TRX is trapped inside a falling channel, and the Chaikin Money Flow (CMF) has slipped below zero — meaning capital is flowing out, not in.Supertrend? Bearish. Resistance is sitting right overhead. Demand is weak.

All signs point the same direction: unless something changes fast, TRX could retest $0.26, and if sentiment worsens, even $0.21 isn’t off the table.

Is a Recovery Even Possible? Yes… but With Conditions

A turnaround isn’t impossible — just unlikely without a major shift. TRX would need to:

- Break above the descending trendline,

- On strong volume,

- Reclaim the 0.382 Fibonacci at $0.30.

Only then does a move toward $0.35 become realistic, where it’ll hit old resistance again.

And only in a highly bullish market — the kind of environment where everything is ripping — would TRX have any plausible path toward $1. Right now, though? The chart isn’t showing anything close to that setup.