- How to Trade on Solana Like a Pro: Full Archer Bot Walkthrough

- The bot supports limit orders, DCA, auto-buy, customizable trade settings, and full wallet security features like 2FA and private key export.

- Upcoming features include copy trading, sniping tools, and multi-chain expansion, giving users a wider set of automated and manual trading options.

Archer is a Telegram-based trading bot for Solana built by Aiur Labs and JRNY Club. It hooks directly into Jupiter, Raydium, and Pump.fun so you can trade tokens, track positions, and manage your wallet without leaving Telegram. It’s free to use, quick to set up, and the guide you’re reading will walk you from the first wallet connection all the way to more advanced tools once you’re comfortable.

In this walkthrough we’re going to go through Archer from scratch – starting at the basics and then get into the more advanced stuff like tracking positions and routing through Jupiter, Raydium, and Pump.fun.

Archer lives entirely in Telegram, so once it’s set up you can trade and manage your Solana tokens without switching apps. It’s built by Aiur Labs and JRNY Club, free to use, and takes just a couple minutes to get started.

Getting Started:

Initialize Archer:

To get started with Archer, the first step is to download the Telegram app.

Once you’re on Telegram, join the Archer Bot channel here.

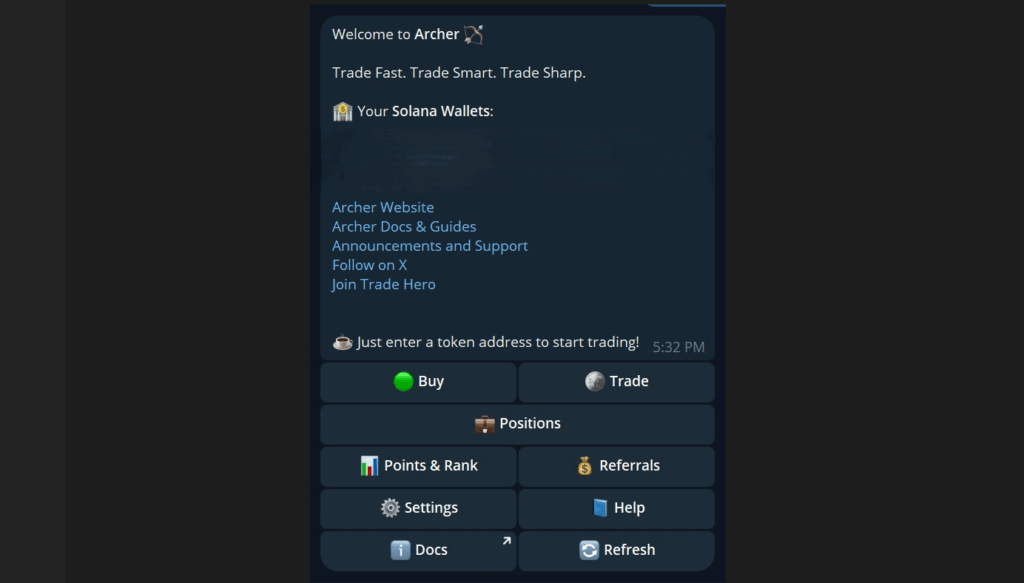

Tap Start or type /start, and you’ll receive the welcome message.

Accept the terms and conditions and you’re all set! You’ve just initialized an empty wallet, which you’ll use for buying and selling directly within Telegram.

Next you will need to fund your wallet with Solana $SOL and then you’ll be ready to trade!

Getting started on Solana:

Once you’ve initialized Archer, you’ll want to get started with Solana. Here’s how:

Type /home in Archer to access the main menu:

Your wallet address will be displayed on your home page. Just click it to copy it. Send any amount of $SOL to this address and you’re ready to go!

To access your wallet and wallet settings:

From the Home menu, tap “Settings” and then go to “Wallet”.

Here you will find your primary wallet address, wallet settings, the ability to create a new wallet or import an existing wallet and more

Buy some $SOL on an exchange or Solana based wallet

Fund your ARCHER wallet by sending your SOL from your Solana wallet or exchange to your ARCHER wallet address.

Once your wallet is funded, we highly recommend setting up 2FA (Two-Factor Authentication) and securing your private key before you begin trading for added security.

Buying and Selling Tokens:

How to Buy Tokens Using Archer

- Make sure your Archer wallet has SOL: This is your base currency for trades. Confirm your balance before doing anything.

- Grab the token’s contract address: You can paste it directly into the chat or enter it through the Buy menu.

- Paste the contract address into Archer: Archer will pull up a buy menu showing details like creator balance, holder breakdown, and market stats.

- Choose how much to buy: Select the amount (e.g., 0.1 SOL). The transaction processes in seconds.

- View your position: Go to the Positions tab to see your holdings and check any tokens you previously bought.

- Alternative way to buy: From the home screen, tap Buy, paste the contract address, choose the amount, and confirm the transaction.

How to Sell Tokens Using Archer

- Open the Positions tab: Select the token you want to sell.

- Review token stats: You’ll see price, liquidity, market cap, P&L, and your position details.

- Choose how much to sell: You can sell 100 percent of your position or select a partial amount.

- Confirm the transaction: The sell order processes in seconds, and you’ll see a success message.

- Check updated balances: Go back to Positions to confirm the token is reduced or removed and your SOL balance is updated.

Limit Orders: How to trade while on the go:

How to Place a Limit Buy Order in Archer

- Open ArcherBot and go to the Limit Orders menu: From the home screen, tap Limit Orders and then tap New Limit Order.

- Paste the token’s contract address: The bot will pull up the token details and give preset buy options or let you enter a custom amount.

- Choose how much SOL you want to allocate: Enter an amount based on your wallet balance.

- Set the trigger price: This is the exact price you want the order to execute at when reached.

- Set an expiration time for the order: Choose how long the limit order stays active (e.g., 3 days).

- Confirm the order: The order becomes active and will execute automatically once the price hits your trigger level.

- Monitor active limit orders: Check the Limit Positions tab to view, track, or manage open orders.

- Check filled orders: Once executed, the position moves to your regular Positions tab like a normal buy.

How to Place a Limit Sell Order in Archer

- Open the Limit Orders menu and create a new order: Paste the token’s contract address again.

- Select the position amount to sell: You can sell a portion or the full position.

- Set a price higher than the current market price: This defines the price target where the sell will trigger.

- Choose how long the order should stay active: Select the expiration window.

- Confirm the limit sell order: It activates and will auto-execute once price reaches your target.

- Verify execution: When the order fills, you’ll see a confirmation message and updated wallet balance.

- Check positions afterward: The token will disappear from Positions once sold.

How to Use Dollar-Cost Averaging (DCA) in Archer

- Open the Limit Orders section and select DCA: Navigate through the menu to access the DCA feature. A password may appear while it’s still in testing, but this will be removed once fully live.

- Start a new DCA order: Tap New DCA and you’ll see a popup showing your wallet details.

- Paste the token’s contract address: Archer will pull up the token and show preset amounts or let you enter a custom allocation in SOL.

- Choose how much SOL to allocate: Enter your total spend for the entire DCA sequence (e.g., 0.3 SOL).

- Select how many splits to break the order into: This controls how many separate buys will occur (e.g., 3 orders of 0.1 SOL each).

- Set the time interval between each buy: Pick the delay between each execution, such as 1 minute, 5 minutes, or multiple hours.

- Confirm the order: Archer schedules the buys and executes them automatically over your chosen time period.

- Monitor your fills: Transactions appear as they execute, and completed trades show up in the Positions tab with P&L, balance in SOL, and USD value.

Additional Rules & Limits

- Minimum splits per order: 2

- Maximum splits per order: 15

- Time intervals can range from 1 minute to 3 hours

- The longest possible DCA cycle (15 splits every 3 hours) lasts roughly 45 hours

- Useful for catching dips gradually instead of timing the bottom, especially during volatile retraces

How to Access & Adjust Settings in Archer

- From the home screen, tap Settings.

- You’ll see three main sections:

- Wallet Settings

- Trade Settings

- Security / Two-Factor Authentication

Wallet Settings Overview

- View and manage wallets:

- See your active wallet, balance, and rename it if needed.

- See your active wallet, balance, and rename it if needed.

- Deposit funds

- Select a wallet, copy the deposit address, and send funds from an exchange or another wallet directly into Archer.

- Select a wallet, copy the deposit address, and send funds from an exchange or another wallet directly into Archer.

- Withdraw funds

- Select the wallet and choose a custom amount or withdraw all to another wallet or exchange.

- Select the wallet and choose a custom amount or withdraw all to another wallet or exchange.

- Rename wallets:

- Useful for managing multiple wallets (e.g., trading wallet, vault, test wallet).

- Useful for managing multiple wallets (e.g., trading wallet, vault, test wallet).

- Create new wallets

- Instantly spin up new addresses for organization or security.

- Instantly spin up new addresses for organization or security.

- Delete wallets

- Remove wallets you no longer use.

- Remove wallets you no longer use.

- Change the default wallet

- The wallet marked with a green dot is active by default. Switch it from the menu if needed.

Private Keys & Device Syncing

- Export private key

- Allows you to use your Archer wallet across multiple devices.

- Allows you to use your Archer wallet across multiple devices.

- Must enable 2FA first

- Exporting keys is blocked unless 2-factor authentication is turned on.

Enabling 2FA (Required for Key Export)

- Go to Security / Two-Factor Authentication.

- Enable 2FA and add it to Google Authenticator or another compatible app.

- This protects your wallet if someone gains access to your Telegram account by preventing unauthorized exports or withdrawals.

How to Use Auto-Buy in Archer

- Go to /settings and select the Trade Settings menu.

- Tap Auto buy amount: Off and enter the amount of SOL you want automatically spent per trade.

- Once enabled, pasting a token contract address triggers an immediate buy with no confirmation prompts.

- Turn Auto Buy off – Return to Trade Settings and either set the amount to 0 or click Turn Off.

What Auto-Buy Does

- Executes a buy instantly when you paste a contract address

- Saves time when moving quickly on new tokens

- No pop-ups or confirmation screens

Best Use Cases

- Fast entries

- Trend chasing

- Buying into new tokens as soon as you find them

Important Warning

Auto Buy skips confirmations, so trades execute automatically. It gives you speed, but there’s no safety net—use it only when you’re sure about the token you’re entering.

How to Customize Buy/Sell Buttons in Archer

- Open Trade Settings: Go to /settings and select the section that configures trading preferences.

- Set Buy Button Amounts: Assign preset SOL amounts for quick buys (for example, 0.1, 0.5, or 1 SOL). These appear as tap-to-trade options during order execution.

- Set Sell Button Percentages: Choose preset exit percentages like 33 percent, 50 percent, or 100 percent to quickly take profits or close positions without typing custom values.

- Save your preferences: Once configured, these buttons appear automatically in your trade interface.

Why This Helps

- Faster entries during rapid price movement

- Easier partial exits and profit-taking

- Reduces typing and decision time while trading

How to Configure Slippage in Archer

- Open Trade Settings: Go to /settings and navigate to the slippage options for buying and selling.

- Set Buy Slippage: Choose the maximum price movement you’re willing to tolerate when entering a trade. This prevents overpaying during spikes or low-liquidity moments.

- Set Sell Slippage: Define the acceptable price impact when closing a position so you don’t get filled far below the expected exit price.

- Save and trade normally: Your settings apply automatically to future transactions until changed.

Why Slippage Matters

- Helps avoid bad fills during high volatility

- Reduces risk when trading new or thin-liquidity tokens

- Gives predictable execution without constant manual adjustments

How Archer Points Work

- Earn points on every trade: Every buy or sell made through Archer adds points to your account, regardless of trade size or frequency.

- Points increase your leaderboard rank: As you accumulate points, you move up Archer’s public leaderboard, unlocking rewards, perks, and recognition within the community.

- Points determine your future $JRNY airdrop: When Archer launches its token, your total point balance will play a direct role in how much $JRNY you receive.

- Beta users get 50 percent extra points: During beta, all trades earn a 1.5x multiplier, giving early users a head start toward leaderboard placement and the token drop.

- Check your rank anytime: Open the bot and click Points & Rank on the home screen to see real-time progress.

How to Enable 2FA in Archer

- Open the Security Settings

- Go to Settings > Security / 2FA and tap Activate 2FA. This opens the Archer 2FA setup page.

- Go to Settings > Security / 2FA and tap Activate 2FA. This opens the Archer 2FA setup page.

- Scan the QR Code or Copy the Backup Key

- You’ll be shown a QR code and a text key. Use either one to link Archer to your authenticator app.

- You’ll be shown a QR code and a text key. Use either one to link Archer to your authenticator app.

- Add Archer to Your Authenticator App: In apps like Google Authenticator or Authy:

- Tap the plus icon

- Select Scan QR Code or Enter Setup Key

- Make sure the setup type is Time-based

- Enter the Code to Confirm: Your authenticator will generate a 6-digit code. Enter it in Archer to finish activation.

- Store Your Backup Key: Save the key somewhere secure so you can recover access if your app or device is lost.

- Disable 2FA (Optional): Return to the Security menu to turn off 2FA. You’ll need to enter a valid code to proceed.

Copy Trading (Coming Soon)

- Select a Wallet to Follow: You’ll enter the address of a wallet on Solana that you want Archer to monitor for trades.

- Enable Copy Trading: Once activated, Archer will automatically mirror that wallet’s buys and sells in real time.

- Set Custom Rules & Filters: You’ll be able to define constraints such as minimum trade size, liquidity requirements, contract filters, or token-type exclusions.

- Copy Trades Automatically: When the tracked wallet executes a trade, Archer will execute the same action on your behalf based on your settings.

- Maintain Full Control: You can pause, stop, or adjust copy settings at any time without disconnecting from the wallet.

- Await LaunchL This feature is still under development and not yet live. It will integrate directly into the bot when released.

Sniping (Coming Soon)

- Activate Sniping Mode: You’ll enable the sniping tool inside Archer so the bot can automatically watch for newly launched tokens.

- Set Detection Rules: Configure what counts as a valid new launch to snipe. This may include contract age, liquidity thresholds, creator conditions, or other safety filters.

- Define Buy Parameters: Choose how much SOL to allocate per snipe and whether you want repeat attempts or one-time execution.

- Execute Automatically at Launch: When a token meets your criteria, Archer will place a buy instantly without manual input or refresh-spamming.

- Add Optional Exit Rules Set automated sells based on price moves, percentage gain, stop loss, or other conditions to lock in profits or minimize downside.

- Await Release: The feature is still under development and will go live directly inside the bot once testing is complete.

Onboarding Complete

Multi-chain support is on the way, opening access to Cardano, Ethereum, EVM chains like Abstract, and more—all without changing how you use the bot. You’ll still trade from the same interface, but with a wider range of tokens, new ecosystems, and more room to spot early opportunities. Once the rollout is live, switching chains, checking balances, and trading across networks will happen from the same place you already trade today.