- Solana fell 4% as 21Shares launched its new TSOL ETF, adding $111M in fresh seeded capital to the growing list of SOL investment products.

- Active Solana ETFs now hold $421M with zero negative flow days, while staking APY at 6.3% and a 67.3% staking ratio tighten circulating supply.

- SOL trades near key support around $124 as RSI approaches oversold levels, needing a break above $146.39 to hint at recovery.

Solana had a shaky day, dropping about 4% to the $134 zone on Nov. 19 just as 21Shares rolled out its brand-new SOL ETF (TSOL) on the CBOE. Kinda odd timing — a fresh ETF launch usually brings some buzz, but broader market turbulence dragged prices down anyway. The listing puts 21Shares alongside names like Fidelity, Bitwise, Grayscale, and VanEck, all of which have been stacking Solana products since ETF approval landed. According to the firm, investors can grab TSOL through their usual banks or brokers, making regulated SOL exposure even easier to access.

ETF Inflows Still Strong as Staking Keeps Supply Tight

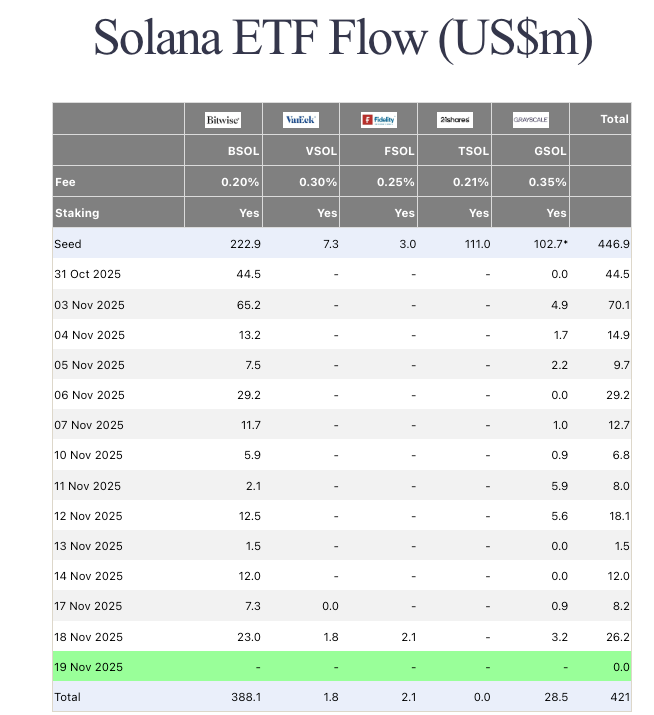

Despite the price wobble, Solana ETFs have been on a pretty wild streak. Since debuting on Oct. 28, none of the active SOL ETFs have posted a single negative flow day. Together they now hold around $421 million worth of SOL — and Bitwise leads the pack with a massive $388.1 million in BSOL. 21Shares seeded TSOL with $111 million on day one, the second-largest ETF seed after Bitwise’s $222.9 million. All these ETFs are staking-enabled now too, thanks to the SEC’s latest green light, meaning investors get staking rewards passed through to them. With staking APY sitting around 6.3% and the staking ratio rising to 67.3%, the circulating supply keeps tightening even as price chops around.

SOL Near Support as Indicators Hint at Early Stabilization

Solana’s price is still stuck in a steady downtrend, closing around $133.88 on the last 12-hour candle. Price action remains below the middle of the Bollinger Bands, which keeps the bearish pressure front and center. The lower band near $123.99 is the next big support area if sellers keep pressing. Meanwhile the upper band, sitting near $168.79, is basically the ceiling no one’s touching until momentum really picks up. RSI at 35.93 puts SOL close to oversold territory — not full capitulation, but getting there. A jump back above 40 would hint that bulls are finally waking up.

What’s Next for Solana?

Solana needs to reclaim the $146.39 mid-band region to flip its short-term outlook from neutral-to-bearish back toward recovery. If market sentiment gets worse, SOL could take another leg down toward the $124 support level. But if it catches a bounce here — especially with staking tightening supply — a quick move back toward $145 isn’t off the table. For now, though, the chart still leans cautious, waiting for buyers to prove they’re actually serious again.