- Bitcoin’s macro thesis collapsed as rate-cut expectations fell and real yields stayed high.

- Institutions rebalanced out of spot ETFs while long-term holders sold 815K BTC.

- Without new buyers, BTC is drifting toward deeper support near $80,000.

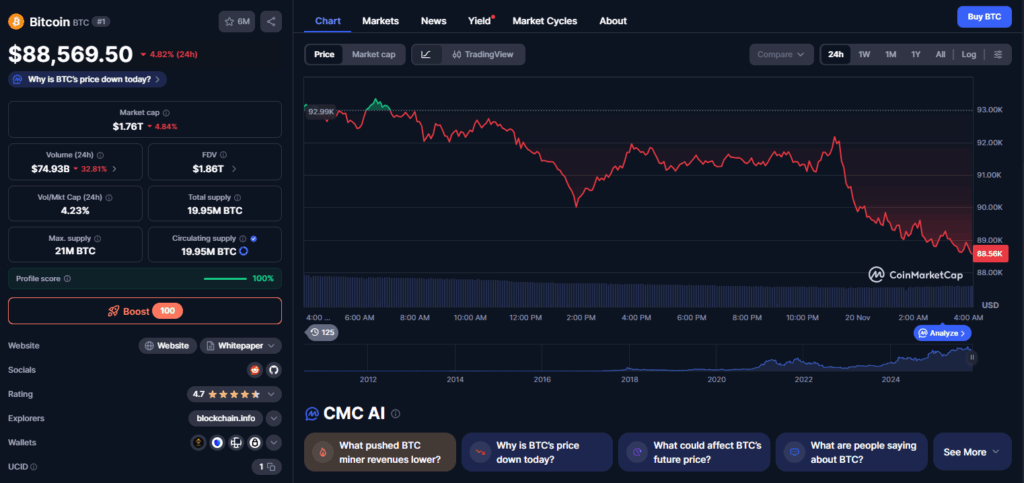

Bitcoin has spent the past several weeks grinding through one of its most persistent declines in years. The drop has erased hundreds of billions in market value, pulling BTC far below its October all-time high of $126,000 and dragging sentiment into deep uncertainty. Traders are still searching for the real cause of this sudden reversal, and according to crypto analyst Tracy Shuchart, the answer isn’t one trigger — it’s a chain reaction of macro shifts and structural selling that hit all at once.

The Macro Thesis That Powered Bitcoin’s Run to $126K Has Collapsed

Shuchart explains that Bitcoin’s breakout from $40,000 to $126,000 relied almost entirely on a single dominant narrative: a Federal Reserve easing cycle alongside heavy institutional demand via spot ETFs. Rate cuts were assumed to be a given, liquidity was expected to expand, and institutions were projected to absorb supply throughout the year.

But when the Federal Reserve abruptly reversed course, expectations collapsed. The likelihood of a December rate cut plunged from 90% down to 40%. Real Treasury yields stayed above 5%, and a strong-dollar environment returned in full force. The moment the macro thesis died, Bitcoin’s valuation near six figures became hard to justify, and institutions responded immediately.

ETF Outflows and Long-Term Holder Selling Delivered a Double Shock

Spot Bitcoin ETFs, which had been absorbing supply all year, began offloading instead. More than $1.1 billion left the ecosystem in days — not from panic but from systematic rebalancing as institutional models shifted away from risk. This removed the first major support layer.

The second blow came from long-term holders. Addresses that accumulated BTC between $40,000 and $80,000 began distributing aggressively once volatility returned, unloading 815,000 BTC within 30 days. That wave of realized profit further weakened the market and removed the buying cushion that historically slows down corrections.

Is Bitcoin Now Drifting Toward $80,000?

According to Shuchart, the market’s core issue isn’t capitulation — it’s the absence of buyers. Institutions are reducing exposure, long-term holders want cheaper entries, and retail traders have mostly stepped back. Without fresh demand, BTC continues to drift lower as macro conditions stay unfavorable.

The analyst argues that a bottom won’t form until three things happen: leverage flushes out, long-term holders stop selling and start accumulating again, and real capital finds the price compelling. None of those conditions have fully aligned yet.

BTC Is Testing Lower Support as the Downtrend Deepens

Bitcoin briefly dipped below $90,000 on November 18, touching $89,000 before bouncing to the $91,000 range. That downside probe signals the market is already searching for deeper support — and the next major zone sits around $80,000. Until the macro environment improves or natural demand returns, the trend remains vulnerable to further unwinding. Here is the reality traders must face: Bitcoin is no longer pricing in the dream scenario — it’s pricing in the new macro backdrop.