- BlackRock’s IBIT saw a record $523.2M one-day outflow amid November’s ETF slump.

- The average spot BTC ETF buyer sits near a $90,146 cost basis, barely in profit.

- Despite some inflows elsewhere, U.S. Bitcoin ETFs posted a net $372.8M outflow.

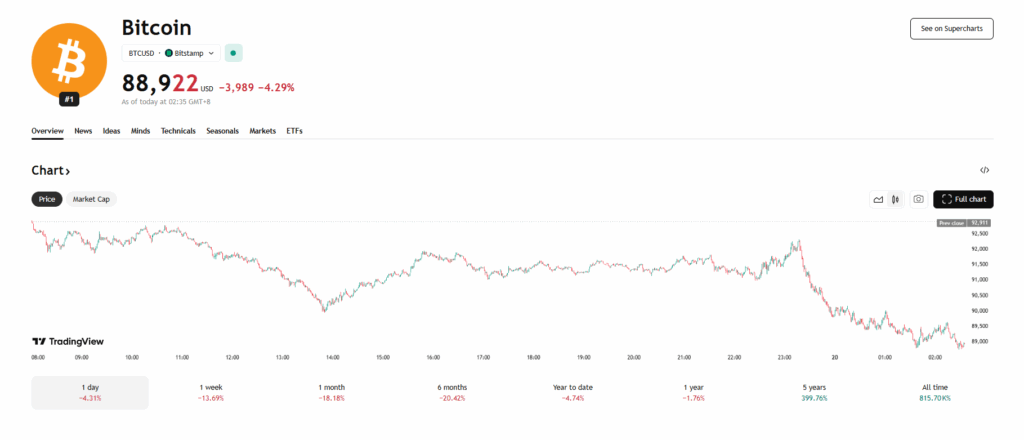

BlackRock’s spot Bitcoin ETF, IBIT, just logged its worst single-day outflow since launching in January 2024, with $523.2 million exiting the fund on Tuesday. The timing is notable: the withdrawal wave arrived even as Bitcoin briefly climbed above $93,000, highlighting a growing disconnect between ETF flows and short-term price action. November has already been a brutal month for ETF demand, and IBIT’s record day only deepens the trend.

Most ETF Buyers Sit Near Break-Even

Despite heavy redemptions, data shows the average spot Bitcoin ETF buyer entered at roughly $90,146. With BTC trading just above that level, most investors remain near break-even—slightly in the green, but not enough to inspire conviction. CoinDesk Research notes that BTC’s November slide has not been matched by a proportional ETF unwind, signaling that the bulk of selling pressure is happening outside ETFs, not within them. Still, five consecutive days of net outflows point to a cautious and increasingly defensive investor base.

ETF Landscape Shows Mixed Flows Amid Market Stress

While IBIT bled heavily, not every fund saw withdrawals. Franklin Templeton’s EZBC added $10.8 million in inflows, and Grayscale’s Bitcoin Mini Trust attracted $139.6 million. But combined ETF flows still landed negative at $372.8 million for the day, extending the November reversal. With Bitcoin now down roughly 30% from its October all-time high, overall sentiment remains fragile, and ETF investors appear hesitant to deploy fresh capital until the market stabilizes. Here is where things stand: flows are thinning, volatility is rising, and IBIT’s record outflow confirms that even top-tier issuers aren’t immune to the pressure.