- Bitcoin briefly plunged below $90K before recovering, but fear remains extreme.

- Jim Cramer suggested a “cabal” may be keeping BTC above $90K, sparking debate.

- Macro uncertainty and a fresh death cross keep downside risks in play.

Bitcoin has been struggling through one of its choppiest months of the year, slipping back toward the $90,000 range and briefly plunging to $89,455 on Nov. 18. That move pushed BTC to its lowest level in seven months, adding fresh anxiety across a market already worn down by October’s heavy correction. Traders watching the charts have grown increasingly uneasy, and the big question floating around is whether Bitcoin is truly finished with this downturn or if something deeper is taking shape beneath the surface.

A Death Cross Forms as Macro Pressure Builds

The downturn picked up speed right after a confirmed death cross, a bearish signal that forms when the 50-day moving average sinks below the 200-day. Historically, this pattern has suggested that extended downside may be ahead, especially when macro conditions are shaky. The Federal Reserve’s next interest-rate decision is adding even more confusion, with policymakers split on whether to cut rates in December or stay cautious because of lingering inflation pressures.

Fear And Sentiment Indicators Flash Red

Even with BTC bouncing back to around $91,352, sentiment remains incredibly fragile. The Crypto Fear & Greed Index has climbed slightly from 11 to 15, but it still sits deep in the “Extreme Fear” zone, a level that usually reflects hesitation rather than confidence. Some analysts argue the pullback is nothing more than a standard reset phase, but others warn that the market has not fully processed the broader liquidity crunch or the steady wave of profit-taking since the October peak.

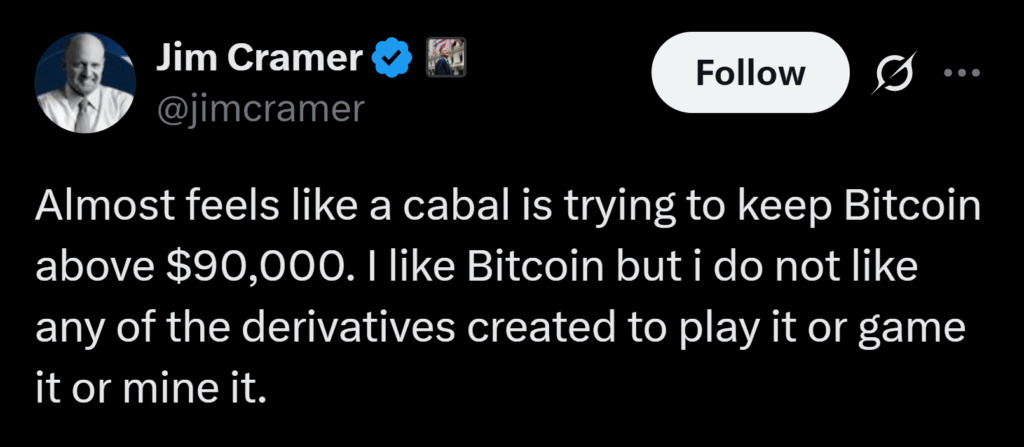

Jim Cramer Sparks Conversation With ‘Cabal’ Comment

Jim Cramer added a new twist to the discussion when he posted on X that it “almost feels like a cabal is trying to keep Bitcoin above $90,000.” His comment instantly stirred debate, with traders questioning whether coordinated players might be stepping in to defend key psychological levels. While Cramer reaffirmed that he supports Bitcoin as an asset, he made it clear he is not a fan of the derivatives, ETF products, or mining plays built around it. His remark fed into an already tense market atmosphere, giving traders one more theory to chew on as Bitcoin fights to stabilize.

BTC’s Future Hinges on Whether This Reset Holds

For now, Bitcoin sits far below its $126,000 October peak, caught in a market stuffed with uncertainty and conflicting narratives. Some see the current levels as a buying opportunity, while others believe the macro headwinds could stretch this correction out much longer. As the market inches toward the end of the year, all eyes remain fixed on whether this reset opens the door for a rebound or becomes the start of a more extended slide — and here is where traders will be watching closest in the days ahead.