- LINK jumped 4.17%, pushing toward $14 and outperforming BTC and the broader market.

- Volume spiked 95% above average, signaling real accumulation behind the move.

- Breaking above $14 could open the door to $14.25–$14.50 if momentum continues.

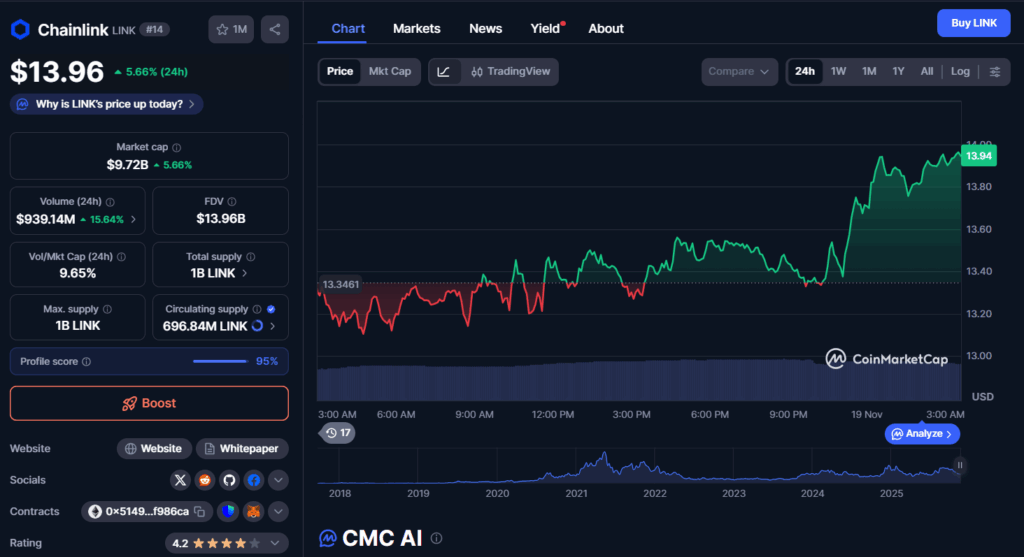

Chainlink’s LINK token finally showed some real strength on Tuesday, posting a clean 4.17% rally and pushing just under the $14 mark. The move sliced through multiple resistance levels that had capped price action for weeks, and it arrived right as institutional demand for oracle infrastructure quietly picked up behind the scenes. With bitcoin and the broader CoinDesk 5 Index moving far more modestly, LINK’s breakout stood out in a market that has mostly been drifting sideways.

Volume Spikes as LINK Clears Major Resistance

The breakout started right as LINK punched above the $13.58 resistance zone. Trading volume then exploded — up nearly 95% compared to its daily average — signaling that this wasn’t just retail noise or a brief wick. Instead, the flow suggested deliberate accumulation, with steady buying pressure pushing the token higher throughout the session.

CoinDesk Research’s technical model highlighted a well-structured pattern of higher lows forming ahead of the breakout, creating a clean step-ladder structure. In a market filled with choppy price action, LINK’s smooth progression looked unusually disciplined — a sign that larger players may be positioning for the long term.

Momentum Builds as LINK Eyes the $14 Barrier

The next critical level is the psychological $14 barrier. If LINK can flip that level into support, the next upside targets sit in the $14.25–$14.50 region, where previous sell walls have formed. With sustained volume and strong technical structure, the setup suggests this rally could extend if broader market sentiment stabilizes.

It’s also notable that oracle infrastructure has seen renewed attention from funds and analytics platforms. Chainlink’s role in powering tokenized assets, RWA feeds, and cross-chain communication continues to grow, making it one of the few altcoins supported by fundamental institutional demand rather than pure speculation.

What Comes Next for LINK?

A rejection at $14 could send LINK back toward the mid-$13 zone, but for now, the structure remains bullish. Traders will be watching to see if this breakout marks the beginning of a fresh trend rather than another short-lived bounce. With institutions showing interest and technicals lining up cleanly, Chainlink may finally be shifting into a stronger phase — and here is where traders should keep their eyes next.