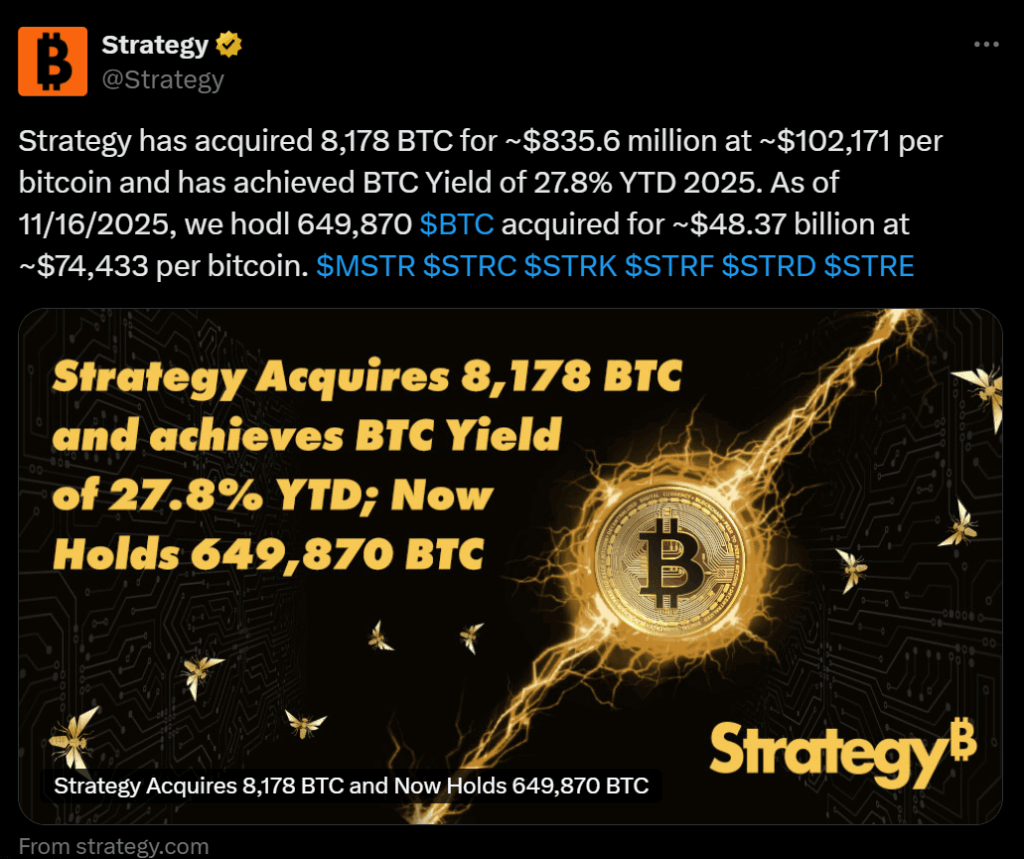

- Strategy purchased 8,178 BTC for $835.6M, averaging $102,171 per coin.

- The buy was funded through the company’s STRE (Steam) and STRC (Stretch) preferred offerings.

- Despite a sharp drop in MSTR’s stock, Strategy now holds 649,870 BTC and continues to expand its treasury.

Michael Saylor’s Strategy (MSTR) is back in aggressive buying mode. While weekly bitcoin purchases have become routine for the company, large buys had taken a back seat for months — until now. Strategy just acquired 8,178 BTC for $835.6 million, paying an average of $102,171 per coin. It’s one of their largest purchases in recent memory and a clear signal that Saylor is leaning even harder into the downturn.

How Strategy Funded the Massive Bitcoin Purchase

The bulk of this new BTC buy was funded by Strategy’s latest preferred offering, STRE (Steam), which attracted around $715 million from European investors earlier in the month. The company also raised an additional $131.4 million through its STRC (Stretch) preferred series, according to Monday’s regulatory filing. These two funding rounds set the stage for Strategy to jump back into the market with enough capital for another huge accumulation.

Following the purchase, Strategy now holds 649,870 BTC — worth over $48.37 billion at an average cost basis of $74,433 per coin. With this addition, the company remains the largest corporate bitcoin holder in the world by a massive margin.

Why the Timing Matters

For months, Strategy’s bitcoin accumulation had slowed to smaller, incremental buys. The primary reason was the sharp decline in MSTR’s stock price, which had fallen roughly 56% over the past four months. With shares trading so low, issuing new common stock would be highly dilutive — effectively ruling out major BTC purchases funded through equity. But using preferred offerings instead gave the company a non-dilutive way to raise fresh capital.

MSTR is currently trading around $199, which puts its enterprise value only slightly above the market value of the bitcoin it holds. That dynamic makes traditional equity financing unattractive — but also shows how deeply tied Strategy’s valuation has become to BTC itself.

Bitcoin Market Still Under Pressure

Bitcoin was trading around $94,500 on Monday, only slightly below Friday’s levels. The broader market remains tense, with ongoing macro concerns and risk-off sentiment holding BTC below psychological levels. And here is why Strategy’s move stands out: Saylor appears to be treating the downturn not as a caution flag, but as another window to scale aggressively while prices and sentiment remain weak.