- Whales dumped over 4 million ADA, signaling rising sell pressure.

- Cardano TVL has dropped 47%, though Hoskinson says the issue isn’t technical.

- ADA adoption still trails major chains as liquidity migrates to faster ecosystems.

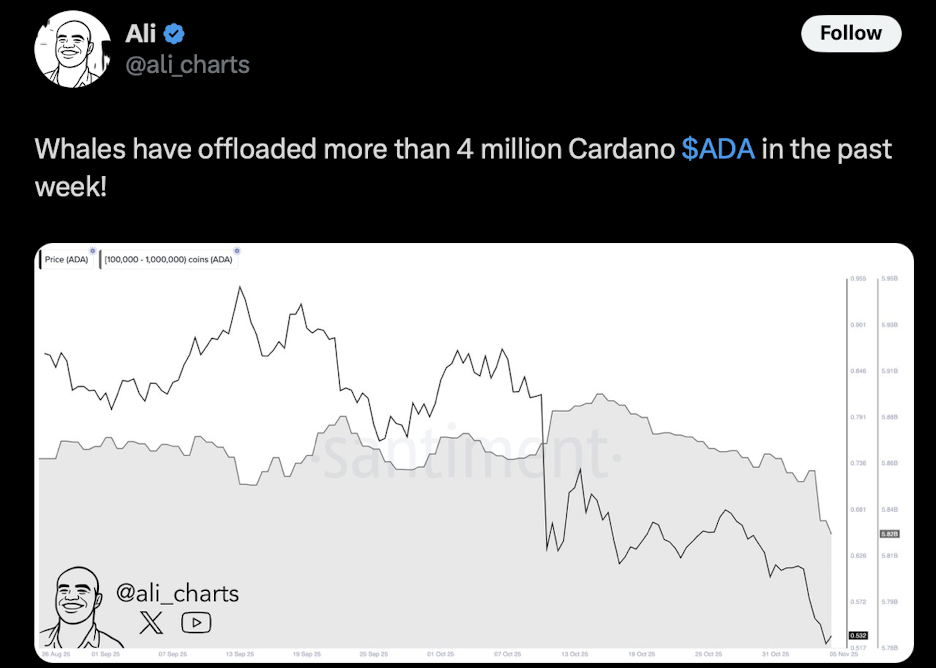

Crypto analyst Ali Martinez has flagged a wave of whale selling that looks a bit, well… heavy. More than 4 million ADA has been dumped over the past week, hinting at rising selling pressure and some possible volatility ahead for Cardano. Martinez, who keeps a close eye on on-chain flows, noticed wallets holding between 100,000 and 1 million ADA letting go of their bags — a move that usually signals that bigger investors and institutions might be cooling off for now. When whales start shifting around this much liquidity, it often shakes the market a little, pushing short-term price swings and nudging confidence in different directions.

ADA Stalls as Momentum Fades

This wave of selling isn’t happening in a vacuum either; ADA has been trading sideways and struggling to keep any real bullish energy above the $0.582 mark. After showing signs of strength back in October, that momentum kinda fizzled out, leaving traders wondering what’s next. With ecosystem updates around the corner and the broader market moving in unpredictable ways, the hesitation isn’t too surprising. But it does raise questions about whether investor confidence is slipping a bit faster than expected… or just taking a breather.

Hoskinson Pushes Back on TVL Concerns

Cardano’s total value locked hasn’t been helping the mood either. The network’s TVL has dropped nearly 47% over the last three months, sitting stubbornly around $240 million. Founder Charles Hoskinson addressed the concerns head-on, saying the slump isn’t caused by any technical flaws. Instead, he called it “non-technical,” pointing to slower DeFi engagement and thin liquidity rather than structural weaknesses. Hoskinson emphasized Cardano’s fundamentals — scalability, interoperability, security — arguing that the chain is still built for long-term strength even if users are a bit quieter right now.

Cardano’s Slow Climb Compared to Competitors

Over the past year, Cardano has rolled out more functionality for users and pushed developer activity forward. But even with those upgrades, its DeFi adoption still lags behind chains like Ethereum, Solana, and Avalanche, which continue to dominate in liquidity and transaction volume. The slower pace comes down to Cardano’s more careful infrastructure rollout and the gradual flow of liquidity leaving for rival ecosystems that move a bit faster. Meanwhile, Hoskinson recently tipped his hat to Bitcoin’s legacy as the crypto world celebrated the 17th anniversary of the original white paper — a small reminder of how far the space has come, and how much further Cardano hopes to go.