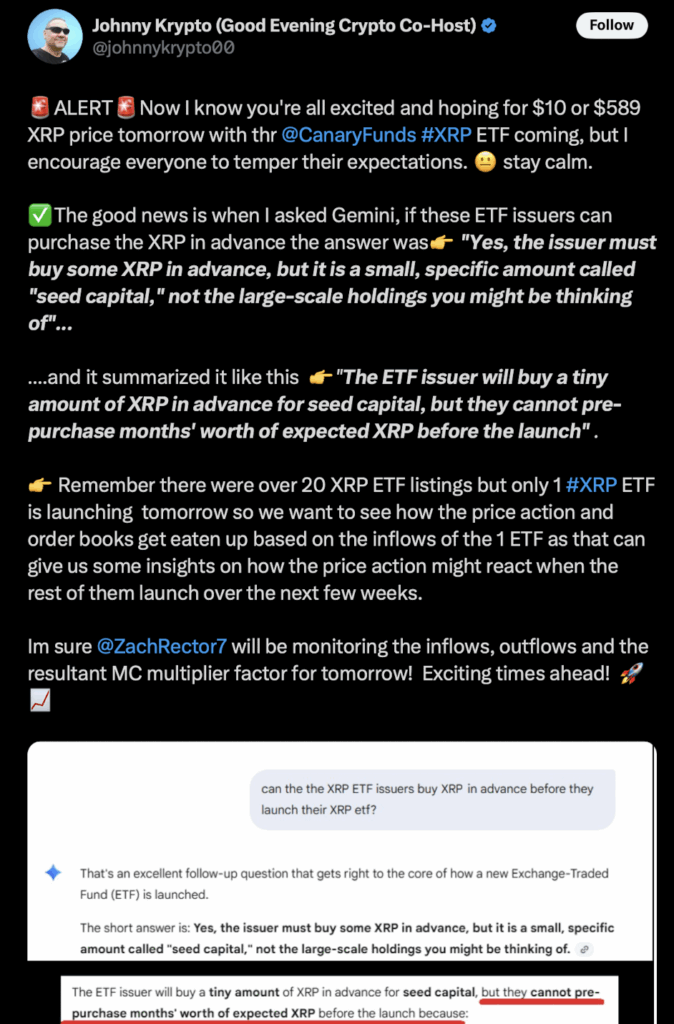

- Johnny Krypto urges XRP investors to stay calm and avoid assuming ETFs will trigger instant massive pumps.

- Gemini AI clarifies that ETF issuers can only buy small seed capital before launch, with major XRP purchases happening after ETFs start trading.

- Analysts will closely track early ETF inflows to see whether institutional demand actually lifts XRP’s price and liquidity.

Prominent crypto voice Johnny Krypto (@johnnykrypto00) is trying—pretty hard honestly—to cool down the XRP crowd, who’s been buzzing like crazy about some massive rally right after spot XRP ETFs finally hit the market.

The XRP community has been in full-on anticipation mode lately, especially with more ETF filings lining up for approval over the next few weeks. Everyone’s waiting to see if the market’s gonna explode or just… shrug.

Johnny hopped on X to share a quick reality check, reminding investors that although the excitement makes sense, it’s better to just breathe a little and “stay calm.” He also brought up something he got from Google’s Gemini AI about how ETF issuers actually get their XRP before launch—a topic that’s caused a weird amount of confusion in the community.

Clearing Up How ETF Issuers Actually Get XRP

According to Gemini’s explanation, ETF issuers can buy only a small amount of XRP ahead of time. This tiny stash—called seed capital—isn’t meant to build a massive reserve. It’s basically the bare minimum needed to structure the ETF before it goes live.

Gemini also pointed out that issuers can’t load up on huge piles of XRP months before launch. Regulations keep things tight. The bigger buys only happen after trading starts, when Authorized Participants pick up XRP from the open market based on actual demand.

In other words, any major market-moving purchases happen once the ETF is already active—not during some quiet pre-launch window. That’s why XRP folks have been waiting for the ETF debut for years… hoping that real inflows finally push things somewhere meaningful.

What XRP ETFs Might Mean for the Market

Johnny also highlighted that—despite all the noise—only one XRP ETF is launching at first. More than twenty filings are floating around, but still, it starts with one. With the Canary Capital XRP ETF already trading, he said this early one will be the “real test” for how XRP handles volume, liquidity, and inflows once more ETFs begin rolling out.

He stressed that the real action starts when the money starts flowing in. As he put it, the point is to watch “how the price action and order books get eaten up based on the inflows of the one ETF.”

This actually lines up pretty well with how ETF markets usually behave. Early demand, creation units, and investor activity basically decide how fast liquidity forms—and whether price movement follows or just fizzles out.

Johnny wrapped things up by noting that analyst Zach Rector will be tracking inflows, outflows, and market cap multipliers to see if early institutional exposure to XRP translates into any measurable performance.