- Spot bitcoin ETFs saw massive outflows, triggering an $869M single-day exit and weakening market support.

- Over $1.11B in leveraged crypto positions were liquidated, accelerating the selloff across BTC and major alts.

- Macro worries — fading rate-cut odds, shaky equities, and AI bubble fears — pushed investors into risk-off mode.

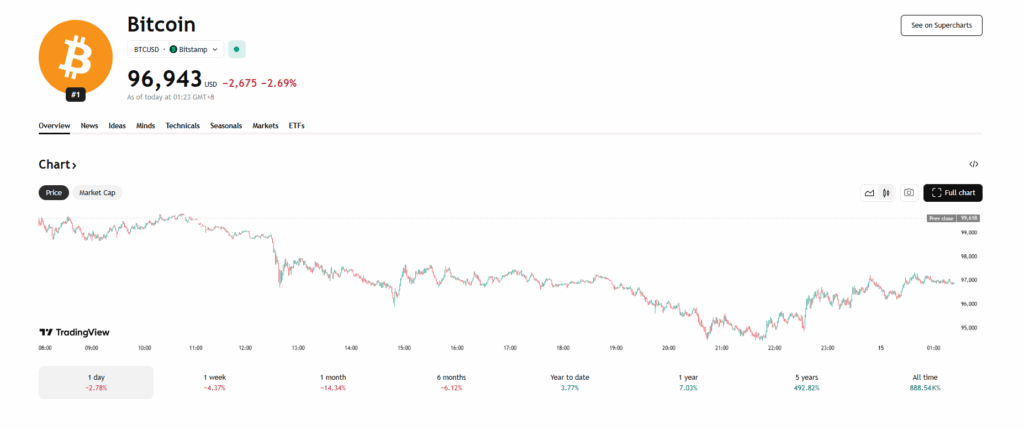

More than $200,000,000,000 disappeared from the crypto market in 24 hours, and the largest fingerprint on the scene came from ETFs. Spot bitcoin ETFs lost $869 million in a single day, the second-largest exit ever recorded. Over the last three weeks, outflows have totaled $2.64 billion, which explains why support felt thin and price drops hit harder than usual. When the “traditional money” pipeline reverses, sentiment flips in an instant.

Liquidations Flooded the Market

As BTC slipped under $100,000, the liquidation cascade kicked in. Over $1.11 billion in leveraged positions vanished in a day. Roughly $887 million came from longs alone. Once that pressure hit, ETH, SOL, ADA, and everything in the top 20 fell in lockstep. It wasn’t a slow bleed. It was a clean sweep of overcrowded bullish positions.

Macro Sentiment Turned Risk-Off

At the same time, markets were dealing with falling odds of a December rate cut, U.S. stock indices dropping across the board, and growing anxiety about a potential AI bubble. Even strong headlines — like the Czech National Bank buying bitcoin and the U.S. launch of the XRP ETF — couldn’t compete with the broader shift toward caution. Traders pulled back, volatility crept up, and liquidity thinned.

The Bottom Line

There wasn’t one culprit. It was a stack of catalysts hitting at once: ETF outflows, forced liquidations, and macro worries. The combination pushed everyone toward the exits, and the result was the fastest $200 billion wipeout the market has seen in months.