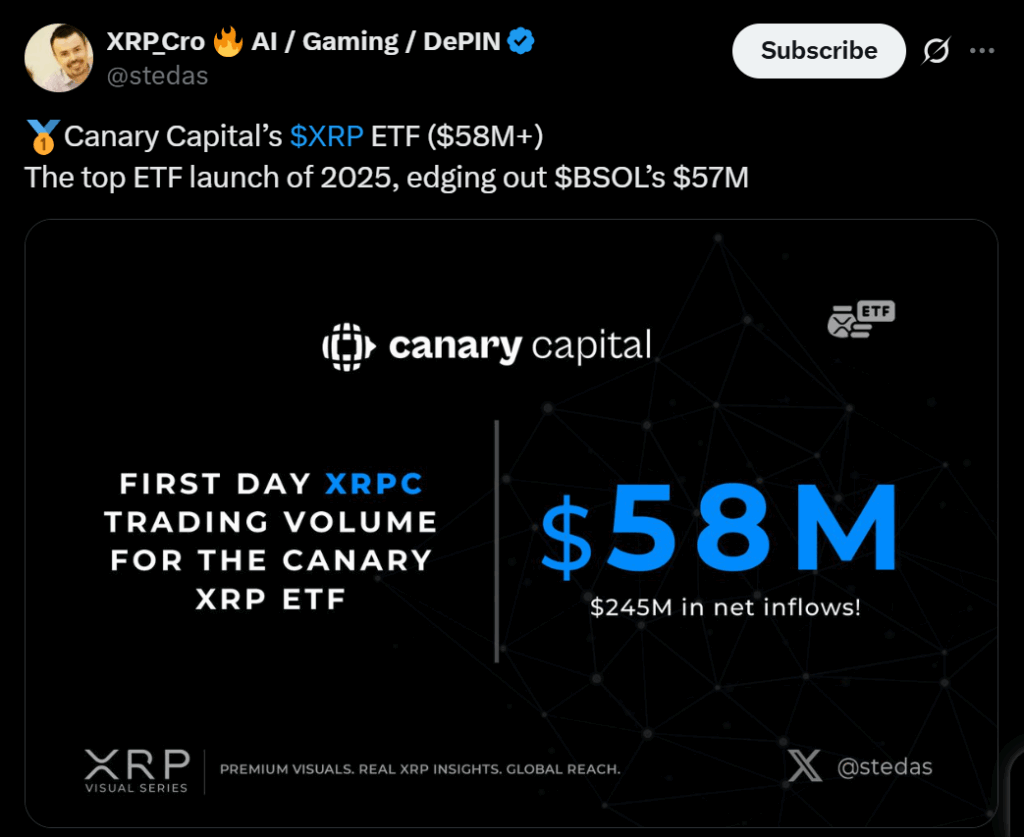

- XRPC ETF launched with a record-breaking $58M in day-one volume, the highest among 900+ ETFs this year.

- It narrowly surpassed Bitwise’s Solana ETF, highlighting strong institutional interest in altcoin-focused funds.

- Sustained volume could signal long-term investor confidence in XRP’s payment utility and regulated market exposure.

Canary Capital’s XRPC ETF, the first U.S. spot exchange-traded fund tied directly to XRP, delivered a standout debut on Thursday. The fund recorded an impressive $58 million in first-day trading volume — the highest of any ETF launched this year out of more than 900 new funds, according to Bloomberg ETF analyst Eric Balchunas. This puts XRPC at the top of 2025’s ETF leaderboard, signaling powerful demand for regulated XRP exposure.

XRPC Edges Out Solana’s Dominant ETF Launch

The record-setting volume narrowly beat Bitwise’s Solana ETF (BSOL), which saw $57 million on its launch day. Both funds now sit far ahead of every other ETF introduced this year, with the third-place product trailing by more than $20 million. The tight race between XRPC and BSOL highlights a clear trend: investors are increasingly seeking structured, compliance-friendly ways to access leading altcoins.

Institutional Interest Moves Beyond Bitcoin and Ethereum

The ETF’s meteoric debut reflects growing institutional appetite for diversification beyond the usual pillars of BTC and ETH. Even though XRP’s market price didn’t immediately react, the strong volume tells a different story — one of rising demand for mainstream, regulated investment vehicles that offer exposure to assets with real-world utility. For XRP, that means tapping into investor confidence in the XRP Ledger’s speed, scalability, and payment-focused design.

Will This Momentum Continue?

The big question now is whether XRPC’s explosive first-day energy can sustain itself in the weeks ahead. The ETF’s early success hints at broader investor curiosity about XRP’s role in global payments, institutional settlement, and cross-border transactions. And here is what matters most: if trading activity remains strong, it could signal a long-term shift in how institutions choose to allocate capital within the crypto sector.