Tron (TRX) has been around long enough to survive multiple market cycles, but as November kicks off, it’s suddenly drawing fresh eyes again. October was a mixed month for the token, and now traders are watching closely to see if TRX can finally flip its recent momentum into something more convincing — maybe even outperform last month’s numbers if market sentiment doesn’t shift too harshly.

TRX slows down volatility, hinting at quiet consolidation

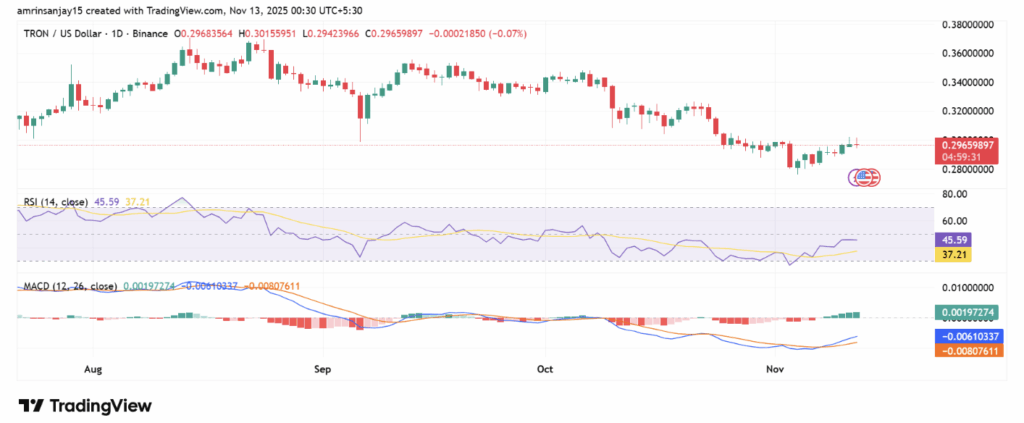

This month, Tron has calmed down a lot compared to October’s choppy price action. Right now, TRX is hovering close to the $0.297 level, dipping only about 0.14%, which suggests the market’s entering a consolidation phase instead of a selloff. This is a big contrast to October, when the token slid about 5.6%, reflecting much heavier selling pressure back then.

If TRX can reclaim the $0.30 mark with real volume behind the move, that could shift momentum in its favor. A breakout above that zone might push the token toward $0.31–$0.32 before November ends, giving bulls a reason to stay optimistic after weeks of muted action.

TRX market structure: tight resistance, cautious support

As of now, Tron’s market capitalization sits around $28.07 billion, with 24-hour trading volume near $752 million. The price has dipped about 1.22% over the past day, sitting around $0.29 at press time.

Structurally, TRX is still leaning slightly bearish on the short-term chart and is testing resistance near $0.297. If it manages to break through, $0.30 becomes the next critical level — the real gateway for any meaningful upside trend.

On the downside, support sits near $0.290. A clean break below that could drag TRX toward the $0.28 area, where buyers have stepped in before but not always with strong conviction. The chart is showing a very tight range, which usually hints that a decisive move could be coming sooner rather than later.

Indicators show early bullish sparks

Despite the slow price action, a couple of technical indicators are flashing some early bullish signals. The MACD just flipped into a bullish crossover, with the MACD line lifting above the signal line. It’s not a strong surge yet, but it does suggest that momentum could tilt upward if buying volume increases even slightly.

The RSI, sitting around 45–37, remains in a neutral-to-lightly oversold region. That means the token still has room to move upward before bumping into overbought conditions. In simple terms: there’s space for a rally if the market decides to wake up.

Key resistance zone will decide the breakout

The level everyone is watching is $0.301. TRX has tapped that resistance multiple times this month but hasn’t managed to break above it with conviction. If Tron finally closes above $0.301 on strong volume, it could open the door to a move toward $0.315–$0.325, confirming that upward momentum is returning.

If not, the token might stay stuck in the same tight range until whales or broader market sentiment shift the momentum needle.