- Bitwise’s spot Chainlink ETF appeared on DTCC under ticker CLNK, signaling it may launch soon.

- The ETF tracks Chainlink’s price via the CME CF Chainlink–Dollar Reference Rate but still awaits SEC approval.

- Other asset managers like Grayscale and Franklin Templeton have also listed crypto ETFs, suggesting more launches ahead.

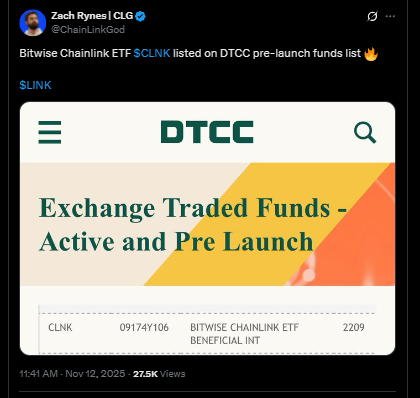

Bitwise Asset Management, as noted by Zach Raynes, just made another big move toward launching its spot Chainlink ETF, which recently showed up on the Depository Trust and Clearing Corporation (DTCC) registry. That’s usually a solid sign the product’s getting close to going live, though it still doesn’t mean the SEC has given a full green light yet. The ETF, listed under ticker CLNK, signals rising confidence in Chainlink’s role as one of the main data bridges driving crypto’s institutional side forward.

Getting Closer to the Finish Line

The listing, spotted on November 11, placed the Bitwise Chainlink ETF in DTCC’s “active” and “pre-launch” categories — a status often seen shortly before approval. Historically, funds that appear in these categories have been in the final stages before trading opens, though the SEC’s nod is still the biggest hurdle. Bitwise first filed for this ETF back in August through an S-1 registration, aiming to track Chainlink’s price performance via the CME CF Chainlink–Dollar Reference Rate (New York Variant), managed by CF Benchmarks.

Structure and Next Steps

The ETF will be structured as a Delaware statutory trust, with its net asset value (NAV) directly tied to LINK’s benchmark rate. Bitwise has yet to file its Form 8-A — one of the last steps before a listing can go live — but once that lands, a launch could happen fast. While Bitwise hasn’t disclosed which U.S. exchange will host the ETF, speculation points toward major venues like NASDAQ or NYSE Arca, where most crypto-related funds debut. The market’s watching closely now since similar filings have quickly followed through to live trading once DTCC registration went public.

The Bigger ETF Push

Bitwise isn’t alone in the race. Other firms like Franklin Templeton, 21Shares, Canary Capital, and CoinShares have also listed their spot XRP ETFs on DTCC, a sign that the market for crypto-backed funds is heating up across the board.

Meanwhile, Grayscale filed to convert its existing Chainlink Trust into a spot ETF, further validating LINK’s growing position among institutional investors. While none of these products are trading yet, these back-to-back DTCC appearances hint that multiple crypto ETFs — including Chainlink’s — could finally go live within weeks.