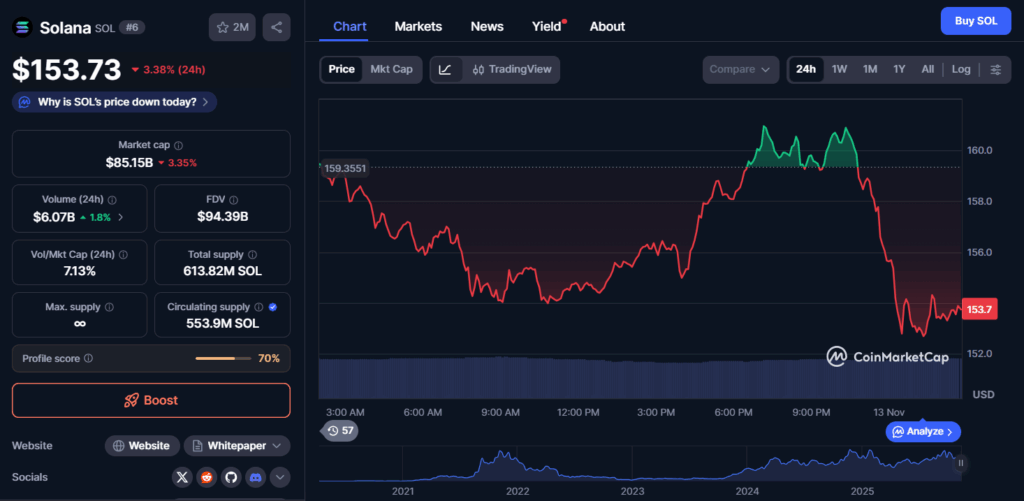

- Solana slipped nearly 5% to $153.49, breaking key support despite $336 million in weekly ETF inflows.

- Alameda Research unlocked another 193,000 SOL worth $30 million, adding selling pressure as part of ongoing bankruptcy distributions.

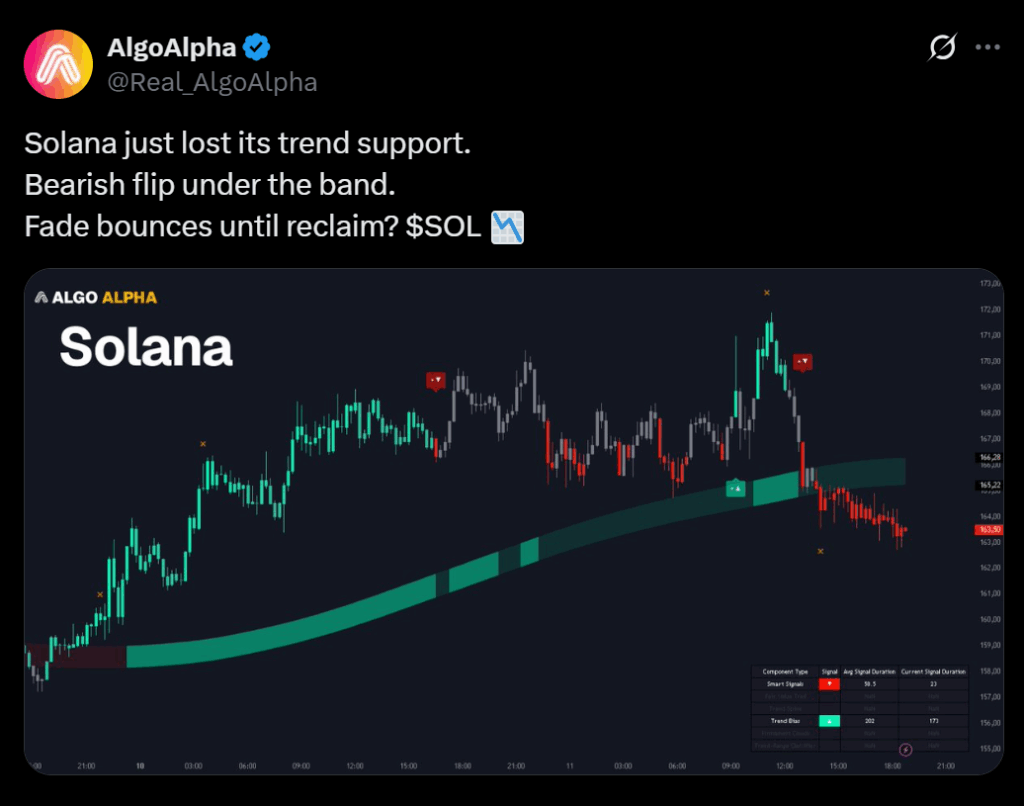

- Technical breakdowns below $156 triggered heavy volume and confirmed bearish momentum, though ETF inflows suggest longer-term accumulation.

Solana’s latest pullback comes amid renewed supply pressure from Alameda Research’s bankruptcy estate, which released another 193,000 SOL tokens valued at about $30 million on November 11. The vesting program has been gradually distributing over 8 million tokens since late 2023, and these structured unlocks often hit exchanges to repay creditors.

Despite this, institutional interest remains strong. Solana-based ETFs recorded $336 million in inflows this week — their tenth straight day of net gains. Major institutions including Rothschild Investment and PNC Financial Services added exposure, while Grayscale introduced options trading for its Solana Trust ETF to expand hedging tools for professional traders.

Even with robust inflows, the fresh token supply appears to have outweighed demand in the short term, creating headwinds for SOL’s price action.

Technical Breakdown and Market Reaction

The sell-off accelerated after SOL lost its footing below the $156 support zone. Within one hour, prices slid from $155.40 to $152.86 on volume 123% higher than average. That flush confirmed a breakdown and established a descending channel, targeting the $152.50–$152.80 demand zone as the next area of support.

Analysts say institutional traders are still active, using the dip to reposition rather than fully exit. The 24-hour trading volume surged over 17% above the seven-day average, hinting at aggressive rotation instead of panic selling.

Outlook: Range-Bound for Now

Technically, Solana faces resistance near $156 and $160 — levels it must reclaim to break the bearish structure. Support sits at $152.80 and $150, with deeper downside risk toward $145 if selling continues. Still, ETF accumulation and staking yield demand near 7% annually could provide a cushion once selling from Alameda slows.

For now, traders expect consolidation between $150 and $160 until clearer catalysts emerge, but the bias remains cautious as supply overhang and market volatility persist.