- Older Dogecoin supply is re-entering circulation as long-term holders take profit, dragging down Mean Coin Age and hinting at a deeper correction phase.

- Derivatives data shows declining DOGE futures Open Interest, reflecting a risk-off mood and weaker bullish conviction among traders.

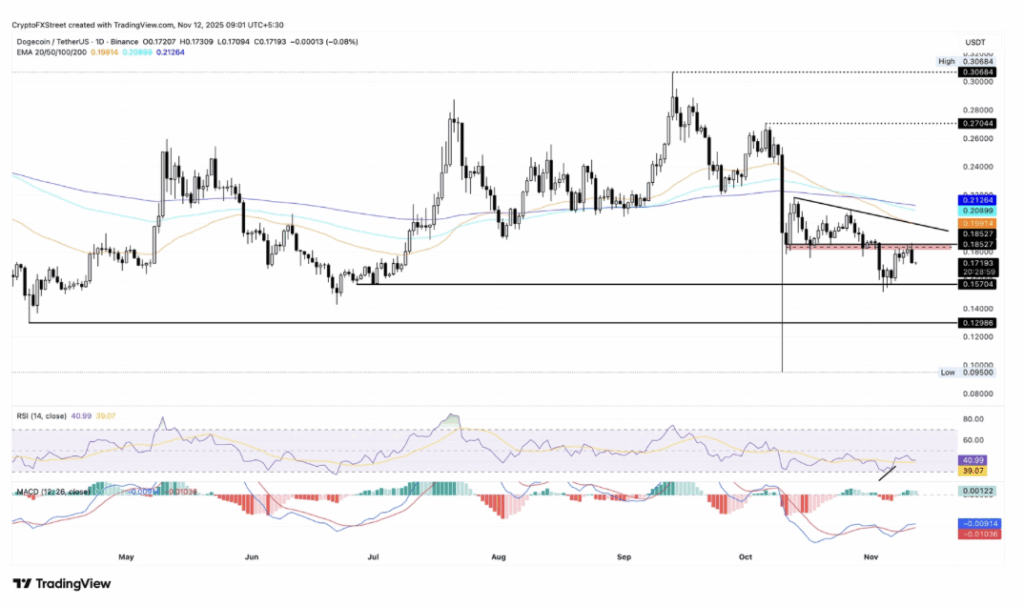

- Technically, failure at the $0.18527 zone puts $0.15704 and possibly $0.12896 at risk, unless bulls can reclaim resistance and push toward the 50-day EMA near $0.19914.

Dogecoin’s recent price action is starting to look pretty shaky, with old coins moving again and traders quietly stepping back from risk.

Dogecoin slips toward $0.17 as selling pressure builds

Dogecoin (DOGE) is drifting back toward the $0.17000 region on Wednesday, after dropping around 5% the previous day. This marks the third straight week of losses, and the structure is beginning to look like a deeper correction rather than just a quick dip. On-chain data shows older DOGE supply coming back into circulation, which usually means long-time holders are locking in profits.

At the same time, derivatives markets are showing fading enthusiasm. DOGE futures activity has been cooling off as traders lean into a risk-off mood. When both spot holders and futures traders start to trim exposure, it often sets the stage for steeper moves, especially in a volatile meme coin like Dogecoin.

Old DOGE supply wakes up as investors offload

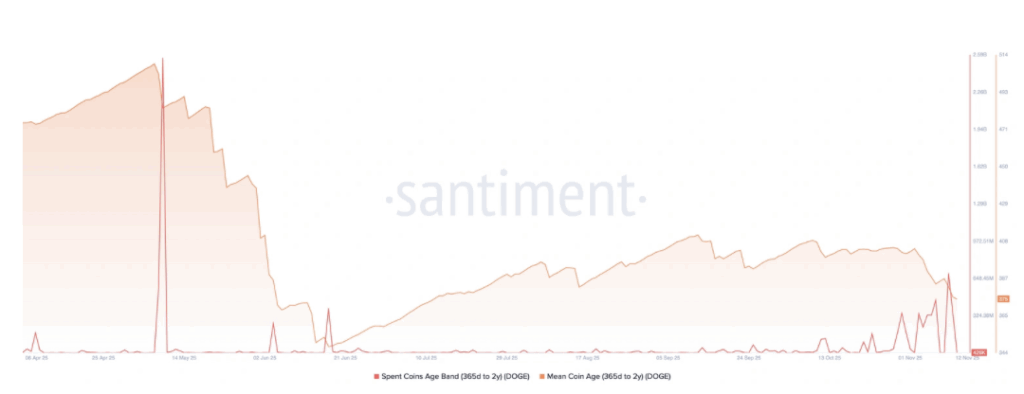

Dogecoin, still the largest meme coin by market cap, is seeing clear signs of reduced conviction among long-term holders. Supply that has been sitting still for over a year is now re-entering circulation. Data from Santiment shows that the Mean Coin Age — which tracks the average age of tokens, focusing here on coins held between 365 days and two years — has fallen to about 375 days, down from 404 days on November 2.

That drop might sound small at first glance, but it’s meaningful. It suggests that older, previously dormant coins are being moved into new wallets, likely by holders taking profit or exiting their positions. In other words, the “patient money” is not quite as patient anymore, and that’s often a caution flag for trend sustainability.

The Spent Coins Age Band for the 365-day to two-year range adds more weight to this idea. This metric tracks how much of that older supply is being spent each day. In November, there were repeated spikes, with a major jump to around 693.07 million DOGE on Monday — the largest single-day wave of selling since the 2.56 billion coins spent on May 9. That kind of spike doesn’t happen by accident; it usually reflects coordinated or broad sell decisions from seasoned holders.

As dormant coins get activated and sold, the overall mean age of coins on the network falls. This reset in age structure can act like a canary in the coal mine, hinting that the market may be transitioning into, or deepening, a corrective phase rather than gearing up for a strong continuation rally.

Futures data hints at fading risk appetite in DOGE

It’s not just on-chain data telling this story. The derivatives side is echoing the same sentiment. Retail and leveraged traders seem less willing to bet aggressively on Dogecoin in the short term. Data from CoinGlass shows a persistent downtrend in DOGE futures Open Interest (OI). OI has slid to roughly $1.43 billion, down from $1.48 billion on Tuesday.

A decline in OI means there are fewer open futures contracts, which typically points to traders closing out positions instead of adding new ones. When this contraction in open positions happens while price is under pressure, it often signals that bullish conviction is weakening. The market shifts into a risk-off posture, with traders preferring to de-leverage rather than “buy the dip” with leverage, which is what you’d expect in a strong uptrend.

In short, both spot and futures participants are quietly stepping away at the same time. That combo can leave price more vulnerable because there’s less fresh demand to absorb any new waves of selling.

Key levels to watch as Dogecoin risks a deeper correction

From a technical standpoint, Dogecoin recently failed to break through a key supply zone near the $0.18527 close from October 11. That rejection triggered Tuesday’s 5% pullback. As of now, DOGE is struggling to hold above the psychological $0.17000 mark, while bears appear to be eyeing the next major support around $0.15704, which lines up with the June 27 low.

If confidence doesn’t return — especially from the long-term holders and leveraged traders who’ve been scaling out — the corrective phase could extend further. The next notable downside target sits near $0.12896, defined by the April 7 low. A move toward that area would represent a much steeper reset of the recent rally and might flush out a lot of late buyers.

Momentum indicators are not exactly helping the bullish case either. On the daily chart, the Relative Strength Index (RSI) is hovering near 40 after pulling back from the midline. That shows growing downside momentum and suggests sellers are gaining the upper hand again. At the same time, the Moving Average Convergence Divergence (MACD) is curving back toward the signal line, flirting with a potential bearish crossover that would further reinforce the idea of renewed selling pressure.

There is still a potential upside scenario, but it requires strength to actually show up. If DOGE can reclaim and hold above the $0.18527 level, buyers might regain some control and open the door for a push toward the 50-day Exponential Moving Average (EMA) around $0.19914. Clearing that zone would not magically fix everything, but it would at least signal that bulls aren’t done yet and that the correction might be losing steam.