- Bitwise has filed for a spot Dogecoin ETF that could quietly go live around November 26, 2025 if the SEC doesn’t intervene, with Grayscale also pursuing its own DOGE product.

- Dogecoin has broken out of long consolidation and now sits just below key resistance at $0.186, while whales have accumulated roughly 11.12 billion DOGE around the $0.20 zone.

- Elliott Wave and historical DOGE mania suggest a speculative path toward $1+ (and even $1.20) if ETF approval, whale demand, and bullish sentiment all line up, though nothing is guaranteed.

Dogecoin is back in the spotlight again, and this time it’s not just memes doing the heavy lifting. Bitwise has filed for a spot Dogecoin ETF, and the timing of it all has traders whispering about a possible November launch. Add in whales quietly loading up on DOGE and a chart setup that’s starting to look suspiciously bullish, and yeah – people are already throwing around that $1.20 target like it’s not a big deal.

It might sound wild, but then again, so did 2021

Bitwise Filing Kicks Off the Countdown

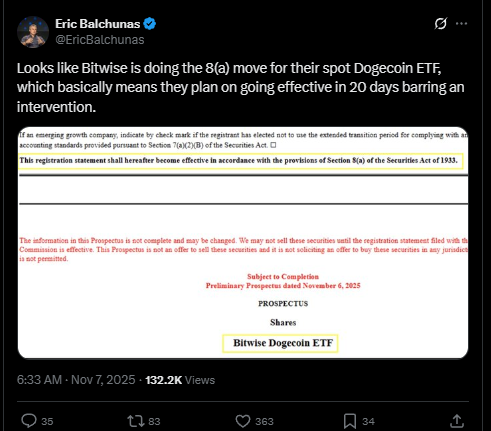

The whole ETF story really started to gain traction after Bloomberg ETF analyst Eric Balchunas pointed out that Bitwise updated its S-1 registration and removed the “delaying amendment.” That little legal tweak actually matters a lot.

Once that clause is gone, the filing falls under Section 8(a) rules of the U.S. Securities Act. In simple terms: if the SEC doesn’t actively step in, the ETF can automatically go effective 20 days after the updated filing. No big press conference. No dramatic yes-or-no headline. It just… becomes live by default.

If regulators stay quiet, the Bitwise spot Dogecoin ETF could technically go live around November 26, 2025. Grayscale has also entered the arena with its own DOGE application, starting a separate approval clock.

If either of these gets the green light, Dogecoin would jump into a pretty elite category: one of the first altcoins with a U.S-listed spot ETF. That would give both regular traders and big institutions a clean, regulated way to gain DOGE exposure without touching an actual wallet or exchange account.

Price Action: From Sleepy Consolidation to Bullish Jolt

According to market analyst BitGuru, Dogecoin reacted quickly once the ETF chatter picked up. After months of dragging through extended consolidation, $DOGE finally snapped its downtrend and bounced sharply. That move didn’t send it to the moon (yet), but it did flip the vibe from “dead meme” to “wait, something’s happening.”

Right now, DOGE is sitting just under a key resistance zone around $0.186. This level is basically the line in the sand. If price can flip that resistance into support, the market structure leans back to bullish, and the narrative shifts from “random bounce” to “okay, this might be the start of something bigger.”

Behind the scenes, whales have been busy. On-chain data from Glassnode shows that roughly 11.12 billion DOGE has been accumulated around the $0.20 area. That’s a massive stack sitting right near a major resistance level. It also means two things at once:

- $0.20 is going to be a tough wall to break.

- If it does break, there’s a ton of prior demand that could turn into rocket fuel.

So yeah, it’s a headache and a launchpad at the same time.

Elliott Wave Suggests Room for One Last Big Run

Zooming out to the weekly chart, analysts using Elliott Wave Theory see Dogecoin in a pretty interesting spot. The current structure suggests that DOGE has already completed major impulse waves I, II, III, and IV. That would mean the market is gearing up for wave V — the final big bullish leg in this sequence.

The key level to watch in this count is the “protected wave 4 low” around $0.18. As long as Dogecoin holds above that area, the bullish Elliott Wave structure stays intact. Lose that level decisively, and the wave count starts to fall apart, along with a lot of the high-timeframe hopium.

From this framework, a $1.20 target doesn’t look like pure fantasy. It’s ambitious, sure, but not completely disconnected from how DOGE moved in the past. Remember the 2021 cycle? Dogecoin pumped more than 350x, jumping from roughly $0.05 in February to $0.73 by May. Nobody believed those numbers on the way up either, until they were staring at them on the chart.