- XRP dropped 9% after Ripple’s Swell conference despite major announcements.

- Bear flag and death cross patterns point to a potential retest of $1.65–$1.70 support.

- Market-wide weakness and profit-taking continue to weigh on sentiment.

XRP has erased much of its post-conference momentum, falling over 9% to $2.19 just hours after Ripple’s Swell 2025 event concluded in New York. Despite major announcements, the token’s decline suggests that investors were quick to take profits, repeating a pattern that has historically followed Ripple’s annual flagship gathering.

Swell Announcements Fail to Ignite Momentum

Ripple’s Swell conference unveiled several key developments, including a $500 million funding round led by Citadel Securities and Fortress Investment Group, fresh integrations for the RLUSD stablecoin, and early details of a decentralized lending protocol built on the XRP Ledger (XRPL).

However, traders responded coolly, with XRP dropping from a Nov. 5 peak near $2.40 to $2.19, reflecting a classic “buy the rumor, sell the news” reaction. Historically, this pattern has repeated across four of the last five Swell events since 2020 — each followed by negative price action through year-end.

Technical Breakdown: Death Cross and Bear Flag

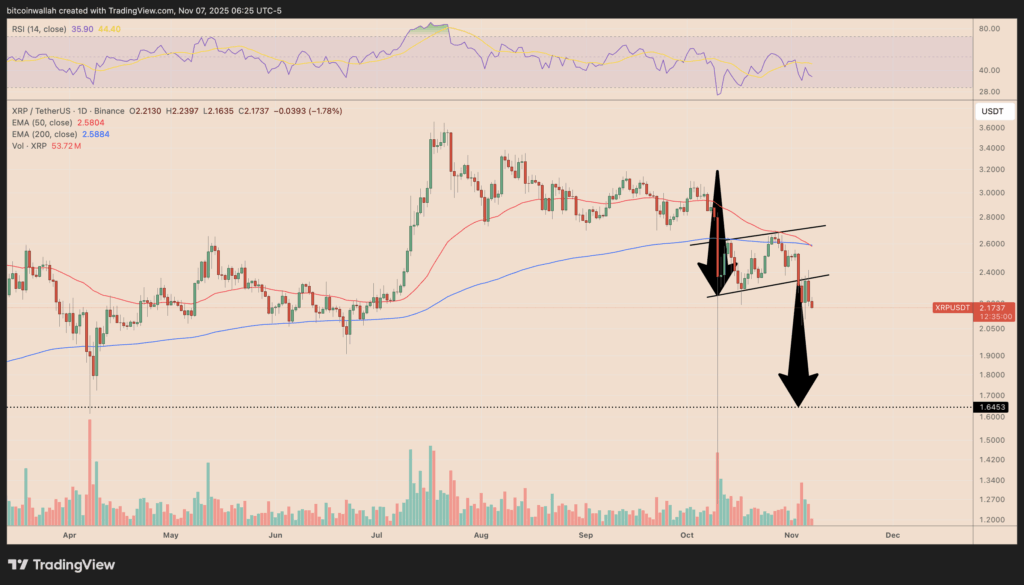

From a technical perspective, XRP’s chart is flashing several bearish signals. The token recently confirmed a bear flag continuation pattern that formed after its sharp decline from $3.60 in early September. Following a brief upward consolidation, XRP broke below the lower trendline, confirming renewed selling pressure.

Adding to the downside risk, XRP is on the verge of a death cross, where the 50-period EMA drops below the 200-period EMA, signaling a deeper trend reversal. Analysts now see potential for the token to fall toward the $1.65–$1.70 zone, which aligns with April’s support range and the aggregated realized price tracked by Glassnode — a level where long-term holders historically begin accumulating.

Broader Market Pressure Adds to the Slide

The sell-off also comes amid broader market weakness. Bitcoin’s brief dip below $100,000 and tightening U.S. liquidity conditions have dampened risk appetite across altcoins. While whale activity around XRP wallets has slowed, exchange flows suggest cautious positioning rather than new accumulation.

If the $1.65–$1.70 range holds, it could serve as a technical and psychological floor, but without renewed volume or a macro catalyst, XRP’s short-term bias remains tilted to the downside.