- Wintermute warns that crypto rallies are running on recycled capital, not new inflows.

- Liquidity from ETFs, VC funds, and stablecoins is slowing as investors grow cautious.

- Broader liquidity is flowing into equity markets, reducing capital available for crypto.

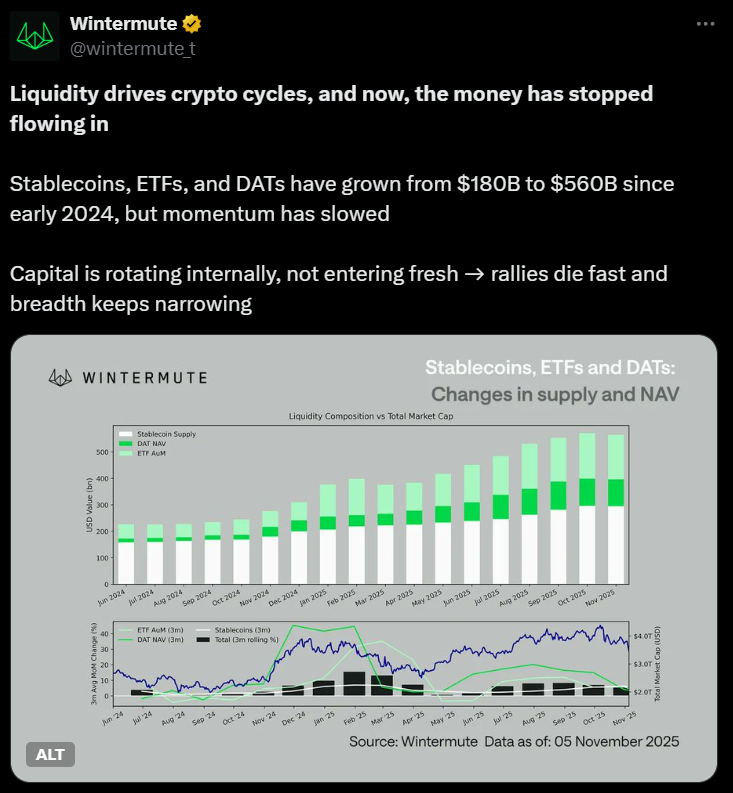

Wintermute, one of crypto’s most influential market makers, has warned that new liquidity is no longer entering the market, signaling a potentially fragile recovery for digital assets. According to the firm, recent price movements are being driven mostly by internal turnover of existing capital, rather than by fresh inflows of money.

Liquidity Dries Up Despite Higher Market Capitalization

While the crypto market overall is better capitalized than in previous years, liquidity flows have slowed dramatically, Wintermute said. This stagnation could mean that any rallies in Bitcoin or altcoins will likely be short-lived and weaker than in past cycles.

At present, much of the activity appears to involve whale reallocation and fund reshuffling among existing players rather than genuine outside investment. Wintermute cautioned that a true bull market will only emerge once new capital inflows return to the space.

Despite broader expectations of an expanding money supply, the firm noted that crypto inflows aren’t automatic. Recent volatility has made many investors cautious, potentially setting the stage for a prolonged bear phase instead.

Market Maker Influence and Trading Behavior

Wintermute, which holds more than $549 million in crypto reserves, remains deeply embedded across centralized exchanges, DEXs like PancakeSwap, and perpetual futures platforms such as Aerodrome. The company has been accused in some circles of intentionally amplifying BTC sell pressure during the latest correction — claims it has not confirmed.

Operating primarily through Binance, Wintermute’s activity often has a noticeable impact on short-term price movements, contributing to the more dramatic volatility seen in recent weeks.

Liquidity Now Drives Prices More Than Adoption

According to Wintermute, while crypto adoption continues to expand — even through bear markets — it’s liquidity, not adoption, that truly determines price momentum. Historically, bull markets have coincided with major inflows of fresh capital, typically visible through stablecoin minting, ETF investments, or corporate treasury allocations.

However, the current market cycle is seeing fewer of those inflows. Venture capital funding has become a modest source of liquidity, but it’s often drawn from existing reserves rather than new outside money. Even token sales are increasingly funded by crypto-native insiders recycling profits from prior cycles.

Wintermute cautioned that while the turnover of existing stablecoins can keep markets active — and occasionally spark record rallies — “new hot money” is staying away from crypto for now. Demand for crypto ETFs and Digital Asset Trusts (DATs) has also cooled.

Broader Liquidity Flows Favor Stock Markets

Following the latest Federal Reserve policy decisions, Wintermute noted that global liquidity is rising again — but most of it is heading to equities, not crypto. Traditional stock markets are offering strong returns without the same downside risk, drawing capital that might otherwise have entered digital assets.

Even in typically active regions like South Korea, liquidity has been shifting toward equities, including crypto-mining stocks that now serve as indirect exposure to the sector. This shift, Wintermute said, is further cutting into new inflows for crypto and weakening momentum for the next big rally.