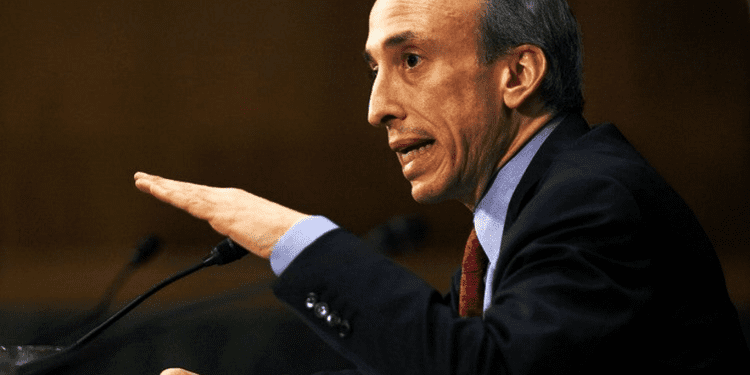

Gary Gensler made assertions about the regulation of cryptocurrencies, and crypto attorneys responded, arguing that the Securities and Exchange Commission doesn’t have the authority required by law to oversee the industry.

- Gary Gensler said that all cryptocurrencies, other than Bitcoin, are securities, and cryptocurrency lawyers refuted this assertion.

- Lawyers contend that the SEC lacks the jurisdiction to regulate cryptocurrencies since Gensler’s position is not the law.

Lawyers Rebuffed Gensler’s Claims

In a recent interview, the head of the U.S. securities regulator asserted that all cryptocurrencies, except Bitcoin, are securities that fall within its purview. Nevertheless, cryptocurrency attorneys have rejected this assertion.

In a lengthy interview on cryptocurrencies with New York Magazine on February 23, Gary Gensler stated that “everything other than Bitcoin” is subject to the agency’s examination. In contrast to Bitcoin, he noted, other cryptocurrency projects “are securities because there’s a group in the middle, and the public is anticipating gains based on that group.”

Lawyers’ Stance

Jake Chervinsky, a lawyer and policy lead at the Blockchain Association, tweeted on February 26 that Gensler’s “opinion is not the law” despite his alleged influence over the cryptocurrency business. The SEC “lacks the power to govern any of them,” he continued, unless it “proves its court case” for having jurisdiction over each token “one at a time.”

In response, attorney Logan Bolinger tweeted on February 26 that “Gensler’s judgments on what is or is not a security are not legally dispositive” — i.e., they are not the final legal judgment. Bolinger continued that judges, not SEC chairs, ultimately decide what the law means and how it should be applied.

According to Jason Brett, the policy director at the advocacy group Bitcoin Policy Institute, Gensler’s remarks “shouldn’t be praised, but feared,” He added that “there are methods to win other than via a regulatory moat.”

Delphi Labs Counsel

In the meantime, the general counsel of investment firm Delphi Laboratories, Gabriel Shapiro, described the seemingly impossible enforcement that the SEC would have to take out on the sector to enshrine its rule in a series of tweets.

As noted by Chervinsky, the agency would need to launch a lawsuit against each token inventor. According to Gensler, Shapiro claimed that over 12,300 tokens worth approximately $663 billion are unregistered securities prohibited in the U.S.

Shapiro claims that the SEC has dealt with cryptocurrency in one of two ways: fining token makers and mandating that the issuer register or fining token creators and ordering that the produced tokens be destroyed and delisted from exchanges.

Shapiro stated: “There is no obvious mechanism for registration of tokens. SEC registration is not simply too expensive for most token producers. What are your goals here? Due to the impossibility of registration, the only option is for everyone to pay exorbitant fines, stop developing protocols, destroy all development environments, and delist tokens from trade. That would mean 12,305 lawsuits.”

SEC’s Stealthy Overreach

In connection with an insider trading prosecution involving former Coinbase employees, the United States Securities and Exchange Commission has once again drawn criticism for acting outside of its authority and incorrectly designating digital holdings as securities.

In an amicus brief submitted on February 22, the US-based Chamber of Digital Commerce argued that the case should be dismissed because it furthers the SEC’s “regulation by enforcement” objective and attempts to define secondary market transactions as securities transactions.

The Chamber stressed that Congress never authorized the “SEC’s incursion into the market for digital assets” and noted past Supreme Court rulings that held that legislators must first grant regulatory agencies jurisdiction.