• T. Rowe Price’s ETF filing lists SHIB as an eligible crypto asset — a first for meme tokens.

• Technical indicators show bullish divergence and falling wedge reversal signals.

• Burn rate up nearly 2,000%, reducing circulating supply and boosting sentiment.

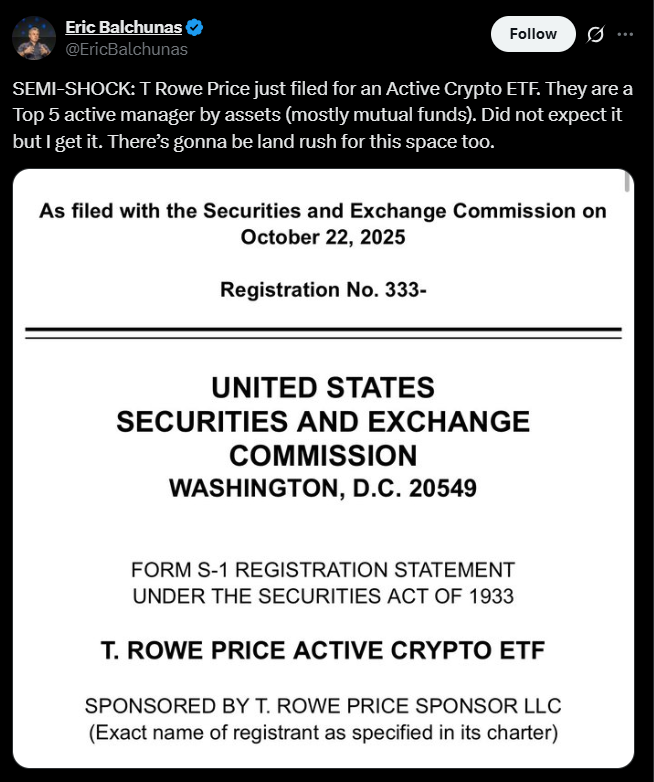

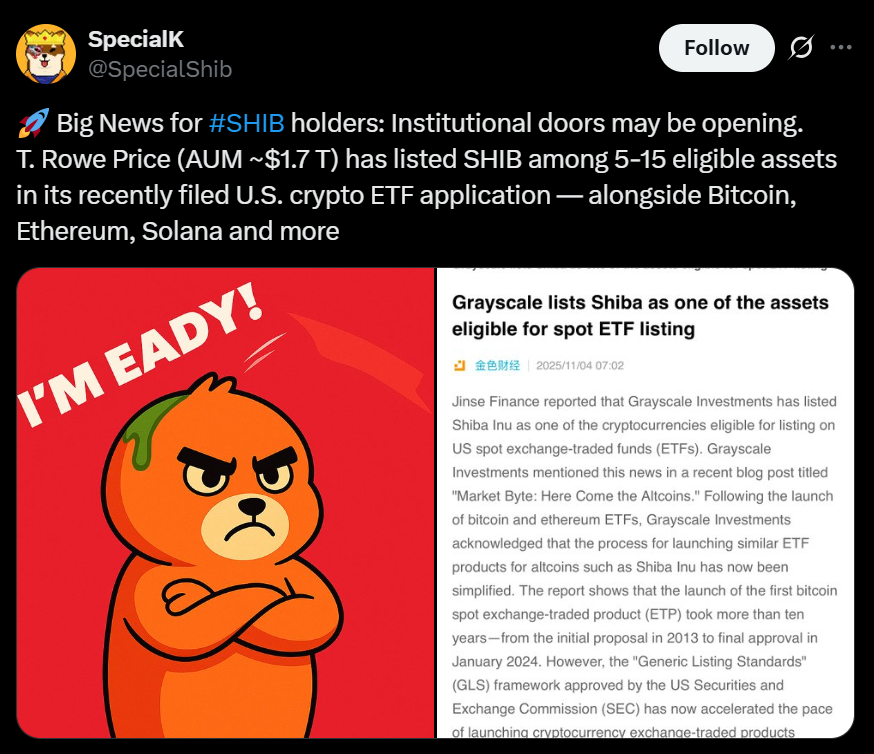

Shiba Inu’s market outlook has turned notably bullish after T. Rowe Price, a $1.7 trillion asset manager, included SHIB in its U.S. SEC filing for a proposed Active Crypto ETF. The move, filed on October 22, 2025, marks the first time SHIB has been named in an SEC-registered ETF proposal, signaling growing institutional recognition of the meme token.

The ETF filing lists Shiba Inu alongside 13 other digital assets, officially acknowledging SHIB as a tradable component in a regulated investment vehicle. Shiba Inu marketing lead Lucie commented,

“T. Rowe Price, a huge $1.7 trillion investment company, just filed paperwork with the U.S. SEC to launch a new crypto ETF. Guess what’s on the list of coins it can hold? Shiba Inu.”

This institutional nod has amplified optimism across the SHIB community and raised expectations that ETF-related inflows could bolster liquidity and demand in the coming months.

Technicals Point to Imminent Breakout

According to crypto analyst Javon Marks, SHIB’s chart against Bitcoin shows a bullish divergence and a falling wedge pattern — both early indicators of potential trend reversals. Marks noted that SHIB could “climb hundreds of percent higher” if momentum continues to build.

The Relative Strength Index (RSI) sits near 35.4, hovering close to oversold territory, which historically precedes rallies. Additionally, SHIB’s market capitalization has been fluctuating between $5.6 billion and $6.4 billion, while steady trading volume suggests investors remain active during the consolidation phase.

Burn Rate Accelerates as Supply Tightens

Adding fuel to the bullish case, Shiba Inu’s burn rate skyrocketed by 1,993% this week, removing 10 million tokens from circulation. Following this, another 300% burn rate increase was recorded — reflecting sustained community participation aimed at reducing supply and boosting long-term token scarcity.

Although the burned tokens’ dollar value remains modest, analysts see these surges as a positive psychological driver for SHIB’s price narrative, especially when paired with institutional momentum.

Institutional and Regulatory Shifts Favor Crypto Adoption

Bitwise Asset Management CEO Hunter Horsley commented that regulators are increasingly open to broader crypto access:

“SEC Chair Paul Atkins and the crypto task force have been very clear with their intentions of opening up the asset class. The outlook for digital assets has never been more constructive.”

With institutions like T. Rowe Price moving into crypto ETFs, analysts believe Shiba Inu could mirror the 20–50% rallies seen during Bitcoin and Ethereum ETF approvals in prior cycles.

Bottom Line

The combination of institutional ETF recognition, accelerating burn rates, and bullish technical setups positions Shiba Inu for a potential breakout phase. While SHIB still faces volatility, the token appears to be entering one of its strongest accumulation and sentiment phases in months.