- Cardano (ADA) is struggling near key support at $0.51, after dropping over 12% in early November — a close below this level could trigger a fall toward $0.32.

- Short-term relief rally possible, with potential upside toward $0.56–$0.62 as traders target liquidity zones before another possible rejection.

- Overall market sentiment remains bearish, and ADA’s recovery depends heavily on Bitcoin’s price stability and buyer volume returning.

Cardano’s been having a rough ride lately. After sliding more than 12% since November 3, ADA’s price now hovers around $0.53, down from the $0.61 highs earlier in the month. The sharp move lower came after a volatile start to the week and another round of weakness from Bitcoin, which pulled the rest of the market down with it.

Despite small signs of accumulation from whale wallets, selling pressure still dominates. The big question now: can Cardano hold its crucial support at $0.51—or are lower levels waiting just around the corner?

Cardano’s Structure: Bulls Hanging by a Thread

On the weekly chart, ADA has returned to a major support base that’s been active since June. Even though the larger trend still technically leans bullish, a close below $0.51 could break that structure and send prices into a deeper correction.

The daily chart, on the other hand, already looks pretty rough. Momentum indicators are leaning bearish, and the On-Balance Volume (OBV) sits near its summer lows. In short, $0.51 isn’t just another price level—it’s the line in the sand. Lose it, and the door opens to $0.32 next.

The Moving Averages have been flashing warning signs for weeks, confirming downward momentum that’s been growing since early October.

Short-Term Bounce Possible, But Don’t Get Too Comfortable

Zooming into the 4-hour chart, things get a bit more interesting. Despite the bearish backdrop, ADA might be due for a short-term relief bounce. The $0.51 zone has acted as a strong demand area before, and liquidity data shows there’s still interest around that price.

If ADA manages to hold that support, a move toward $0.56–$0.60 looks possible. Those levels line up with overhead supply zones where sellers have previously stepped in. The challenge? Volume remains weak, meaning buyers might not have enough strength to push through resistance for long.

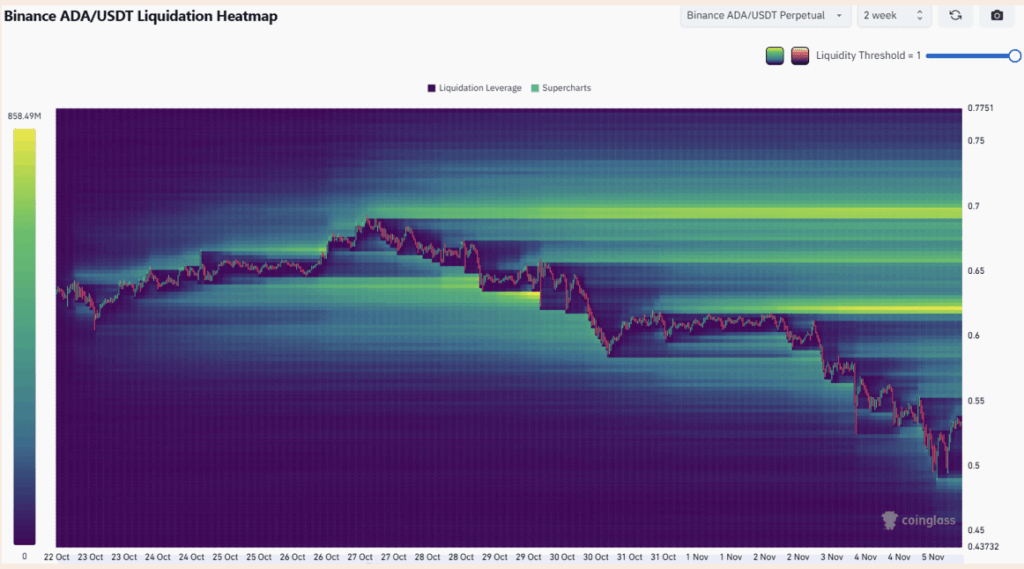

Liquidity Hints at One More Move Up Before Another Drop

The CoinGlass liquidation heatmap shows a cluster of short liquidations sitting just above $0.62. This makes that zone a likely “magnet” for price in the short term. In other words, ADA could see a temporary squeeze higher—maybe up to $0.62—before the next leg down begins.

But if Bitcoin stays shaky, ADA’s rebound might be short-lived. The broader market mood remains risk-off, and traders are quick to sell rallies.

Bottom Line

The near-term setup for Cardano is a tug-of-war between short-term liquidity plays and long-term bearish structure. Here’s the breakdown:

- Critical support: $0.51 — losing it could trigger a fall toward $0.32.

- Upside targets: $0.56–$0.62 — short-term bounce zones before potential rejection.

- Market tone: Still bearish, but a temporary rebound is possible if Bitcoin steadies.

For now, traders might want to stay flexible. The $0.62 region could see one last push higher—but if ADA fails to hold $0.51, the next stop might be a much lower floor.