- Exchange reserves dropped from 180M to 146M LINK — a clear sign of long-term accumulation.

- Buyers are defending the $15.61 support, with $18–$23 acting as key breakout zones.

- On-chain and futures data show bullish divergence — hinting a rebound might already be forming.

Something big is brewing around Chainlink (LINK). Exchange reserves have been dropping fast — and that’s not usually a bearish sign. It’s actually the opposite. Since January, the total LINK supply sitting on exchanges has fallen from over 180 million to around 146 million, a massive reduction of roughly 34 million tokens.

That’s a clear signal of accumulation — investors are pulling their holdings off exchanges and locking them up for staking or long-term storage. Over 15 million LINK have left centralized exchanges in just the past month, shrinking the liquid supply to about 15% of total tokens. Fewer tokens on exchanges usually mean fewer tokens available to sell, and historically, that kind of setup builds the foundation for big upside moves once demand returns.

So yeah, while prices have cooled, the underlying structure looks quietly bullish.

Buyers Still Holding the Line Around $15.61

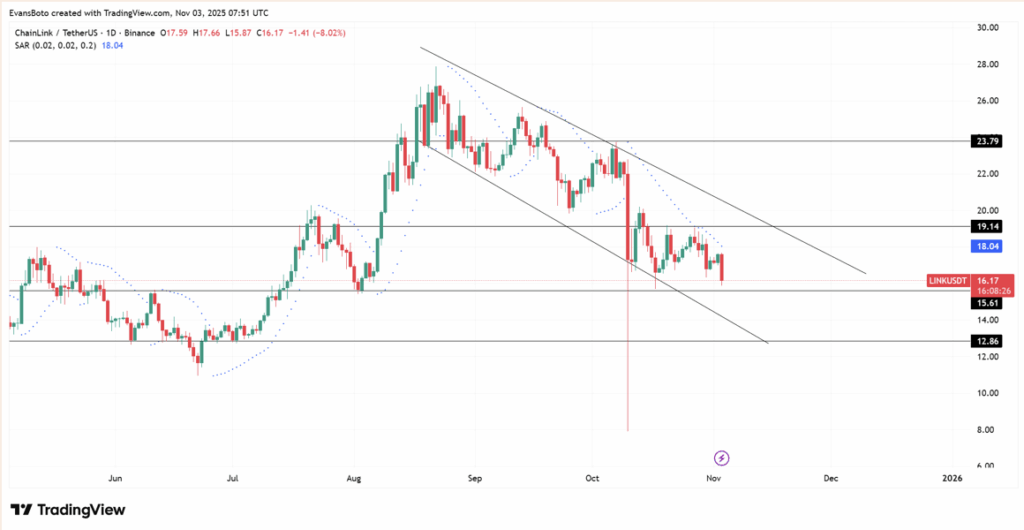

At the moment, LINK’s trading near $16.17, down about 8% in the past 24 hours — a healthy dip inside what still looks like a controlled, technical pullback. The price action has been tracking a descending channel, which might sound bearish, but it’s often just consolidation before another push higher.

The critical support zone right now is $15.61, where buyers have stepped in several times already. If that level gives way, the next safety net is down at $12.86, but so far, bulls are defending it well. On the flip side, the Parabolic SAR sits near $18.04, and clearing that level could flip the short-term trend back to bullish. Above that, resistance zones at $19.14 and $23.79 will be the real test for a breakout.

In short — if accumulation continues and LINK manages a clean daily close above $18, we could be looking at the start of a reversal phase.

On-Chain Data Backs the Accumulation Story

The on-chain picture adds even more weight to this setup. On November 3, Chainlink saw a $5.41 million net outflow, continuing a trend that’s been running since mid-year. Exchange-held supply dropped from 18% to 15% of total tokens, suggesting holders are becoming increasingly confident — moving their LINK into staking contracts and cold wallets rather than keeping it liquid for trading.

This type of persistent outflow usually points to reduced selling pressure. It also creates what analysts call a “liquidity imbalance”, where the circulating supply tightens faster than demand can adjust. Historically, those conditions have preceded LINK’s biggest rebounds — a pattern we’ve seen play out in several past cycles when large holders used market dips to build positions quietly.

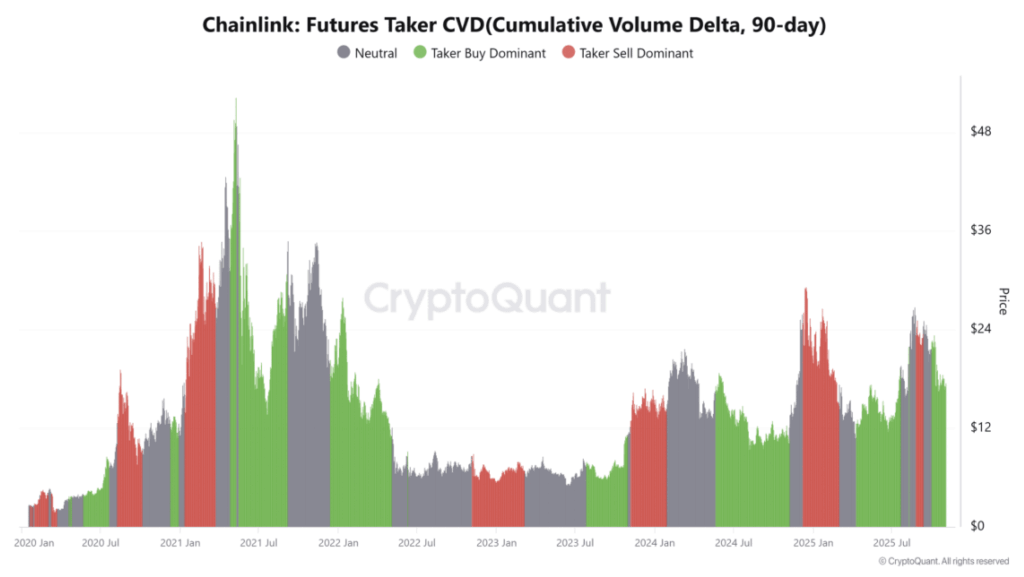

Derivatives Data Shows Traders Turning Bullish

The story gets even more interesting when you look at the derivatives side. The 90-day Futures Taker CVD shows a clear case of taker buy dominance, meaning traders are increasingly opening long positions. That’s a strong indicator of growing optimism and aligns perfectly with the spot accumulation happening on-chain.

When both spot and futures traders start leaning the same direction — especially during a correction — it often means they’re positioning early for the next move up. Sure, there’s always room for short-term volatility, but right now, sentiment seems to be quietly shifting toward an upside phase.

If buyers keep defending support and volume ticks up, LINK could be gearing up for another strong leg higher.

Final Take — LINK’s Supply Squeeze Is Real

Chainlink’s fundamentals are starting to show real strength beneath the surface. The ongoing supply drain from exchanges, consistent whale accumulation, and increasing taker buy activity all suggest that LINK’s current weakness is more like a coiled spring than a collapse.

If the $15.61 level continues to hold and the price pushes above $18.04, it could confirm the start of a trend reversal targeting $19.14 first, then $23.79.

It might take time for sentiment to catch up, but the setup’s already forming — fewer tokens available, stronger hands holding, and traders quietly loading up before the next move.