- PENGU trades near $0.018 amid strong support and rising social buzz.

- Oversold RSI and volume contraction hint at a potential reversal soon.

- A break above $0.025–$0.030 could trigger a short squeeze toward $0.034.

PENGU is hovering around a key support zone, and the market’s starting to buzz again. The chart looks heavy, sure, but not broken. Social chatter’s rising, technical signals are tightening, and traders are watching closely — this could be one of those moments where everything lines up right before the move.

Even after cooling off from its highs, Pudgy Penguins’ token hasn’t lost attention. In fact, it’s the opposite. Most analysts see this current sideways chop as more of a setup than a setback — a pause before the next leg. The market’s been whispering it, but lately, those whispers are getting louder.

Sentiment Heats Up Around PENGU

Momentum around PENGU has been building again, especially as small-cap traders hunt for high-upside plays heading into Q4. Anon Cooker, among others, called it one of the “standout plays of the quarter,” and that alone has drawn fresh liquidity into the mix. Community discussions have taken a more speculative turn too, boosted by updates on development and renewed ETF chatter.

That kind of social buzz tends to front-run trend reversals in tokens that are still in accumulation. If sentiment holds — and liquidity keeps flowing in — PENGU might finally break free from this consolidation range and move into a stronger upside cycle. And with meme-linked assets heating up again, timing doesn’t look bad at all.

Technicals Point Toward a Possible Reversal Zone

Right now, PENGU is testing the lower edge of its descending parallel channel, sitting near $0.0175 — right inside the golden pocket (0.618 Fibonacci retracement). The RSI is hovering around 30, meaning it’s oversold, and the MACD, while still negative, looks like it’s starting to flatten out. That combo usually hints that sellers are getting tired.

Volume’s also contracting, which often happens before a big move. If momentum shifts, the first short-term target sits near $0.022, then $0.028–$0.030 where multiple resistance lines intersect. A clean break above that, and the setup for a stronger rally starts to make a lot more sense.

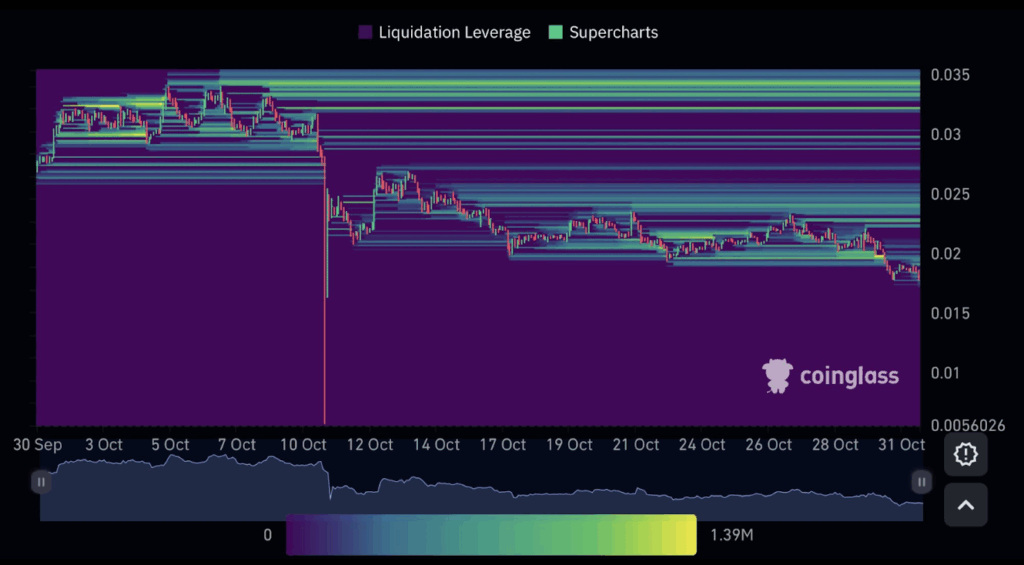

Liquidation Map Shows Room for a Short Squeeze

Analyst Kwiik’s liquidation heatmap adds another layer to the story. There’s a dense cluster of short liquidations sitting near $0.034 — basically a magnet if price starts to climb. With most leveraged shorts sitting below the current range, any strong push upward could easily trigger a squeeze.

Historically, these kinds of setups have a habit of snowballing once open interest resets. If PENGU can reclaim the $0.025–$0.030 zone with conviction, that could be the ignition point for a move toward that $0.034 level — the same zone where shorts start to get squeezed out hard.

The Bearish Case: One More Dip Left?

Not everyone’s convinced, though. Analyst BRUH’s chart suggests PENGU might still have 20–30% downside left before it finds a solid base. His analysis shows a descending triangle pattern, with lower highs pressing down toward the horizontal support at $0.014–$0.0135. That range has acted as strong demand in past cycles, so a retest wouldn’t be shocking.

If PENGU fails to reclaim $0.021, the bearish structure stays intact, meaning another drop could come before the rebound. But if bulls manage to flip that resistance cleanly, it would likely invalidate the bearish setup and confirm that a reversal’s already underway.

Final Thoughts — PENGU at a Crossroads

At the moment, PENGU trades around $0.0181 with daily volume near $170 million and a market cap sitting above $1.1 billion. The price action still screams consolidation, but the growing volume, chatter, and key technical confluence suggest we’re approaching a make-or-break moment.

If buyers defend the $0.017–$0.018 range and volume kicks back in, the path to $0.025–$0.030 opens up pretty quickly, with $0.034 as a stretch target. But if this support cracks, the slide could extend deeper before any meaningful recovery starts. Either way, PENGU looks ready to make its next big move — it’s just a matter of which direction fires first.