- Resistance between $2.40–$2.60 is key; holding it keeps the bullish case alive.

- A close below $2.30 could trigger a deeper correction following the reflection pattern.

- Egrag emphasizes time, rhythm, and patience as the core of successful market alignment.

Markets move in cycles—waves that echo through time, sometimes repeating in reverse. Every rise and fall leaves a mark, and those who catch the rhythm often see what others miss. That’s the core idea behind Egrag Crypto’s latest XRP analysis, a study rooted in the balance between time, structure, and patience.

The Mirror Effect: Egrag’s Market Reflection Theory

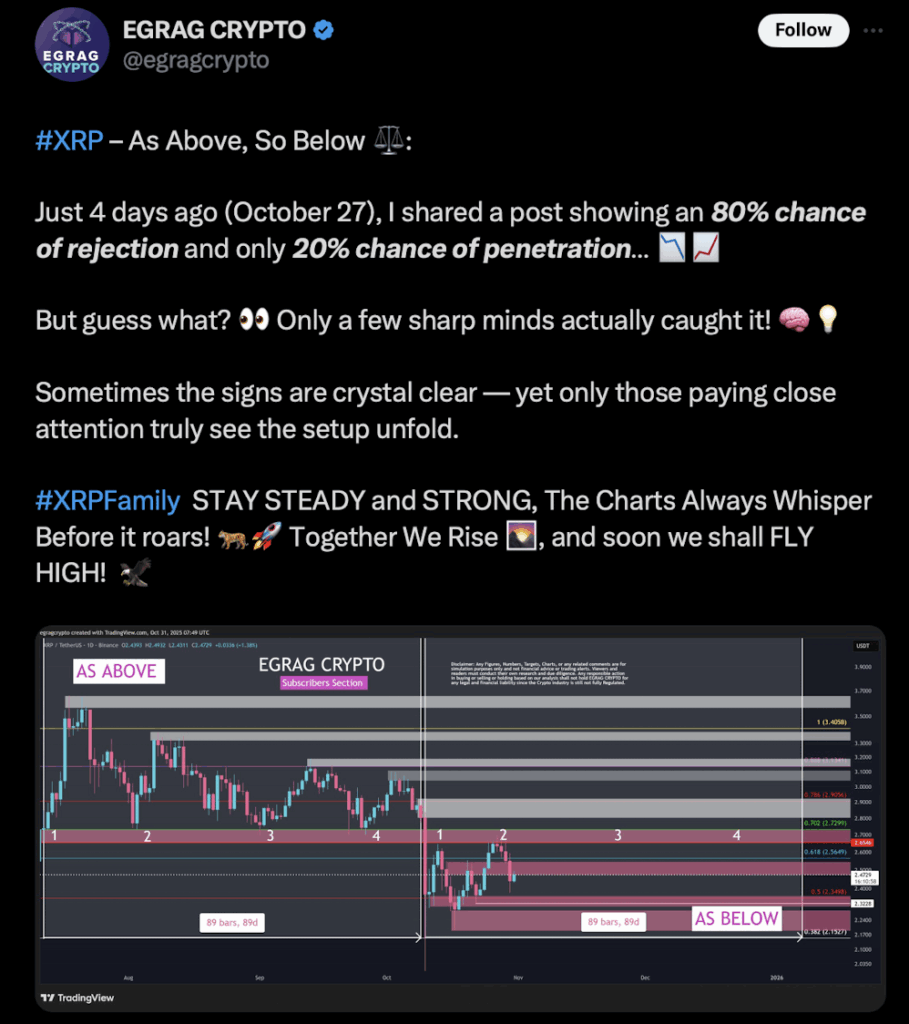

In his newest update, Egrag revisits his “As Above, So Below” model. The theory suggests that XRP’s price structure reflects itself across different timelines, repeating key highs and lows in mirrored sequences. On his updated chart, two 89-bar cycles show nearly identical patterns—what he calls the “universal rhythm” of the market.

According to Egrag, this rhythm is now pointing toward an 80% probability of rejection near the current resistance area, with only a 20% chance of a confirmed breakout. In other words, the market may be replaying an earlier cycle in reverse.

XRP’s Current Setup: The Mid-$2 Battleground

At the moment, XRP sits in the mid-$2 range, right around a critical resistance band highlighted by Egrag. The price recently tried to break higher but stumbled again near the same structural level that capped gains months ago. Analysts note that holding above the Fibonacci support range of $2.40 to $2.60 is crucial. Slip below that, and XRP could retest $2.20 or even lower.

The Two Scenarios: Breakout or Breakdown

For bulls, the path is simple but not easy — XRP needs to push through this resistance area with volume behind it. A confirmed breakout could open the door to $3.00 and beyond.

On the flip side, if XRP fails to hold support, Egrag’s mirrored “As Below” reflection may come into play. That would mean a drop toward the $2.30 level or lower, aligning with his cyclical symmetry pattern. Declining volume and bearish moving-average crossovers could add more pressure to that scenario.

Timing, Patience, and the Rhythm of the Market

For Egrag, time isn’t just a background factor — it’s everything. He believes real traders learn to wait in rhythm with the market, not fight against it. Patience, in his view, isn’t about doing nothing; it’s about moving in sync with market cycles.

His “As Above, So Below” theory ties time, symmetry, and emotion together into one framework. It’s not about predicting exact prices but recognizing balance — where every high has its reflection, and every low has its echo.

Final Thoughts

Whether XRP breaks out or falls back again, Egrag’s message remains steady: the market always mirrors itself in time. Understanding that rhythm, he says, is what separates emotion-driven trading from strategic patience.