- Ripple could theoretically burn 20% of XRP’s total supply, removing nearly 20B tokens from escrow.

- Gemini’s optimistic model pegs a possible price near $66.67 under perfect conditions — but calls it theoretical.

- Analysts and Ripple’s CTO agree that adoption, demand, and confidence matter far more than a simple supply cut.

The idea of Ripple cutting down its massive XRP escrow has been floating around the community for a while now. Some investors swear it’s the one thing that could finally send prices flying, while others think it might barely make a dent. Either way, the topic’s heating up again — and it’s easy to see why.

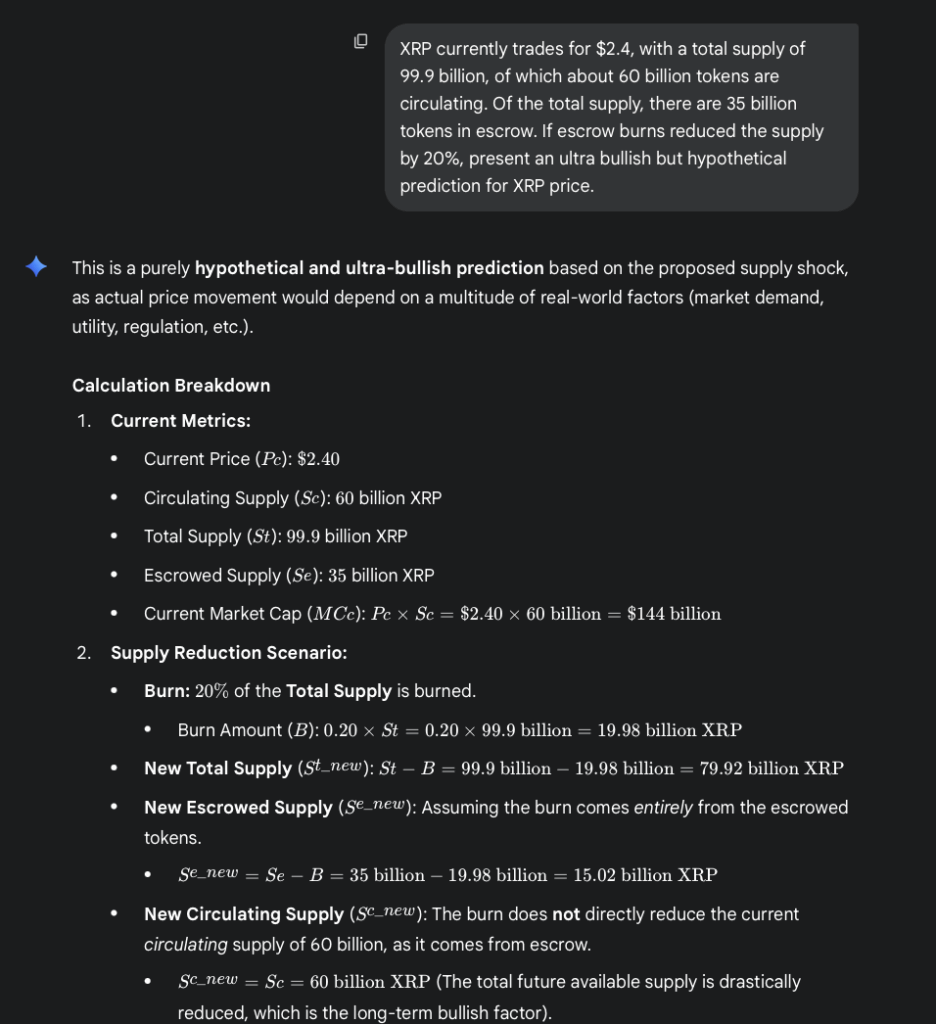

Right now, XRP’s total supply sits at roughly 99.9 billion tokens. About 60 billion of those are in circulation, while another 35 billion remain locked in escrow under Ripple’s control. The purpose of that escrow, at least originally, was to release tokens slowly into the market — giving everyone a predictable supply curve and keeping liquidity in check. Still, some holders argue that such a massive reserve hanging over the market adds a layer of uncertainty that’s hard to ignore.

What Happens If Ripple Burns 20% of XRP’s Supply?

To explore what a supply cut might actually mean, Google’s Gemini model simulated a case where Ripple burns 20% of XRP’s total supply. That would mean roughly 19.98 billion tokens permanently removed from existence, reducing the total supply to around 79.92 billion. If this reduction came solely from Ripple’s escrow stash, their holdings would drop from 35 billion to about 15 billion XRP — with the circulating supply staying steady at 60 billion.

Gemini’s analysis made it clear that such a burn wouldn’t cause an immediate price spike. Since no tokens would be removed from circulation, the short-term impact would likely be minimal. But in the longer term, with less overall supply available, the setup could strengthen XRP’s position — assuming demand remains steady or grows. Essentially, fewer tokens + rising demand = higher potential value down the line.

A Long-Term Game, Not an Overnight Fix

Gemini noted that this pattern isn’t unique to crypto. In traditional markets too, when supply shrinks while demand holds firm, asset values tend to rise over time. Still, there’s a catch — and it’s a big one. External factors like global economic conditions, competition from other blockchain networks, and overall investor sentiment could easily disrupt that logic.

In other words, even if Ripple slashes its escrow, the market still needs to want XRP for the price to go anywhere. Without growing adoption or use cases, a burn alone probably won’t do the trick.

The Bullish Scenario Everyone’s Dreaming Of

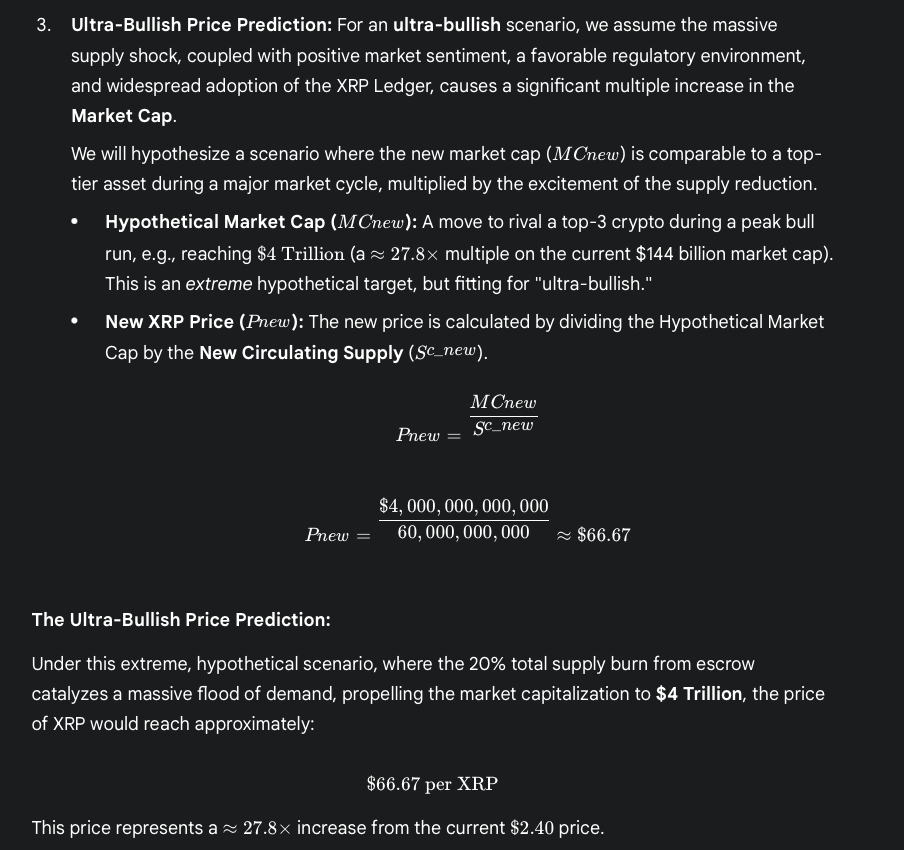

For the sake of imagination, Gemini ran what it called a “high-optimism” case — a world where everything goes right for XRP. In this scenario, the XRP Ledger gains strong adoption, regulatory conditions improve, and investor enthusiasm returns in full force following the supply burn.

Under those perfect circumstances, the model projected XRP’s total market cap could soar to around $4 trillion. That’s roughly a 28x jump from its current value of about $144 billion. Based on the existing circulating supply of 60 billion tokens, that would put XRP at about $66.67 per token — more than 2,600% above today’s price near $2.53.

Of course, those numbers are entirely theoretical. Gemini itself warned that these figures are meant to illustrate potential, not predict the future. Market reactions to supply burns are often unpredictable and heavily tied to sentiment and adoption momentum.

A Realistic View from Ripple’s CTO

Adding a touch of realism to the conversation, Ripple’s Chief Technology Officer, David Schwartz, has previously downplayed the idea that cutting supply automatically leads to higher prices. He even pointed to Stellar’s (XLM) 2019 burn event — a case where billions of tokens were destroyed, but the price barely moved long-term.

So yes, a 20% burn could technically make XRP scarcer. But scarcity alone doesn’t equal demand. What really drives value, analysts agree, is how much the asset is actually used — in payments, in enterprise adoption, and across the broader digital economy.