- Ethereum dropped to $3,800 as spot ETF outflows surged to $184 million, led by BlackRock’s ETHA fund.

- Analysts warn ETH could break down further unless it closes above $4,000 soon.

- Institutional demand is fading, with treasury firms resuming sales and weakening market momentum.

Ethereum’s price has slipped another 3%, landing near $3,800 — a key level that could determine the next major move. Crypto analyst Ted Pillows says ETH remains fragile and could face deeper losses unless it reclaims strength above $4,000 soon. He noted that Ethereum has repeatedly tested the $3,700–$3,800 support zone, showing signs of a short-lived rebound but lacking solid momentum. On X, Pillows cautioned that treasury firms may not have reached a full bottom yet, with some resuming ETH sales despite short-term stabilization last week. He added that for a real recovery to take shape, these firms must stop offloading and rebuild holdings, or ETH risks breaking down further.

Analysts Warn of Weak Momentum

Echoing that caution, analyst Mister Crypto believes Ethereum is on the verge of slipping out of its consolidation pattern. He warned that a clean break below $3,800 could open the door to sharper declines, as bears take firm control. “Any fall below this pattern can trigger further losses,” he explained, pointing to weakening on-chain sentiment and fading buyer conviction. The ongoing outflows from Ethereum ETFs are amplifying that pressure, signaling less institutional interest compared to earlier in the year.

ETF Outflows Signal Institutional Fatigue

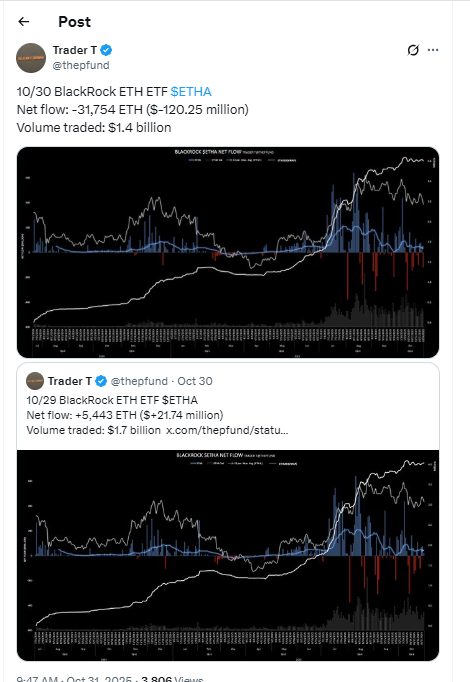

Institutional demand appears to be cooling fast. Spot Ethereum ETFs recorded $184 million in outflows on October 30, led by BlackRock’s iShares Ethereum Trust (ETHA), which alone saw $120 million withdrawn. According to 10x Research, Ethereum’s once-strong “digital treasury” narrative is starting to lose traction. The report highlighted that declining institutional activity has hurt both liquidity and on-chain metrics, suggesting that ETH’s fundamental momentum may be weakening.

What Comes Next for Ethereum?

Despite the sell pressure, analysts haven’t ruled out a short-term bounce as ETH consolidates near its critical support. Traders are closely monitoring today’s $2.5 billion in expiring Ethereum options, which could spark fresh volatility across the market. For now, though, the path forward depends on whether bulls can defend $3,800—or risk watching Ethereum slide toward $3,500 and beyond.