- Solana dropped 6% to $182 after Jump Crypto sold $205M in SOL and shifted into Bitcoin.

- Derivatives data showed a surge in short positions, signaling strong bearish sentiment.

- The selloff overshadowed optimism from Solana’s first U.S. spot ETF launch.

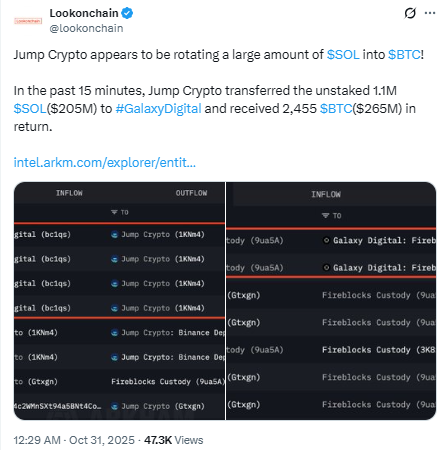

Solana’s price took a steep fall this week, plunging nearly 6% to around $182 after Jump Crypto dumped 1.1 million SOL tokens worth roughly $205 million. The firm didn’t wait long either—it rotated straight into Bitcoin, scooping up around $265 million worth within minutes. That sudden pivot sent a wave of fear across derivatives markets, where traders quickly piled into short positions, pushing the long-to-short ratio down to 0.93.

Jump Crypto’s Big Move Sparks Shockwaves

The selloff marks Solana’s sharpest single-day drop since early October, when market-wide panic was triggered by global trade headlines. Solana’s market cap briefly hovered just above $100 billion before slipping lower, a worrying signal given its recent momentum and the approval of the first Solana ETFs in the U.S. According to StakingRewards data, Jump Crypto’s staked assets have dropped almost 30% in value over the last month. Even so, SOL still makes up roughly 73% of the firm’s total $202 million in staked holdings—so they’re far from walking away entirely.

Derivatives Data Turns Red

Market data from Coinglass paints a bearish picture. Futures volume jumped 7% to $32.6 billion, while open interest rose 2.28% to $10.3 billion. The sharp rise in trading activity, combined with that sub-1.0 long/short ratio, shows traders leaning heavily toward downside bets. Many long positions were liquidated or manually closed to avoid deeper losses, and the increased short exposure suggests traders are bracing for further decline—possibly testing the $180 level soon.

Timing and Sentiment Shift

Jump Crypto’s rotation out of SOL into BTC is being read by traders as a “flight to safety.” With U.S.–China trade talks looming, large institutions seem to be leaning into Bitcoin’s relative stability. The timing also raised eyebrows—it came just days after Bitwise launched the first spot Solana ETF, which had a decent debut on the NYSE, pulling in $69.5 million in its first day. But the optimism from that milestone was quickly overshadowed by Jump’s big move and the sharp market reaction that followed.