• BNB trades above $1,100 after breaching the $1,000 mark with strong market support.

• Analysts predict a move toward $1,180 if momentum holds through November.

• CoinCodex forecasts $1,138 by month-end, with sentiment staying bullish overall.

Binance Coin (BNB) has been one of the most consistent gainers in recent weeks, managing to break above the $1,000 mark for the first time in months. The token, which powers the Binance ecosystem, has been holding firm despite volatility across the broader crypto market. As of press time, BNB is trading near $1,102, slightly down 2% in 24 hours but still showing strong structural support above the key $1,100 zone.

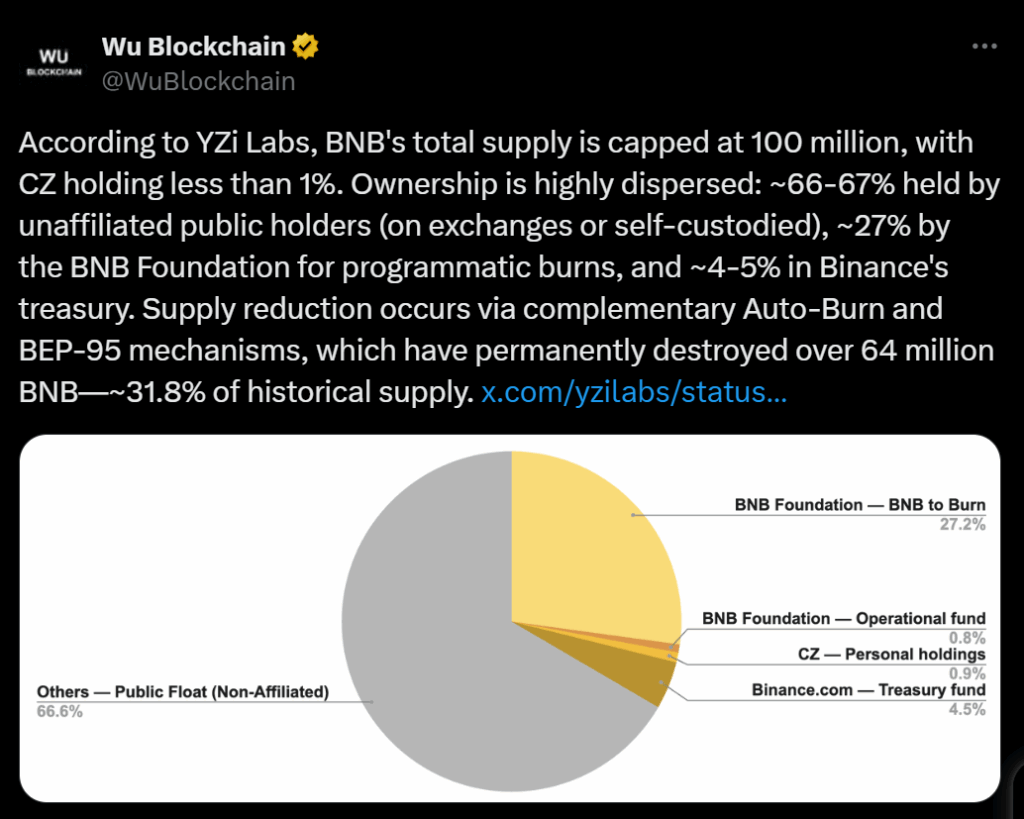

Market watchers say BNB’s resilience reflects renewed investor confidence following Binance’s ongoing regulatory clarity and network expansion. Data from Yzi Labs also revealed that BNB’s total supply is capped at 100 million tokens, with Changpeng Zhao now owning less than 1%. Around two-thirds of supply is held by unaffiliated public holders, showing a highly decentralized ownership base — a healthy sign for long-term sustainability.

Analysts Predict a Push Toward $1,180

Technical analysts remain optimistic heading into November. Popular trader Satoshi Owl believes BNB could soon retest higher resistance levels if momentum holds:

“BNB is looking solid short term. The price is currently holding above $1,120 and is gradually gaining momentum. If it can break $1,145 with volume, the next stop could be $1,160–$1,180. Still watching for a pullback if BTC wobbles, but the structure looks bullish for now.”

Such price behavior aligns with a pattern seen after major Binance ecosystem developments — where BNB often consolidates briefly before launching into a fresh leg higher.

November Outlook: Bullish but Cautious

According to CoinCodex, BNB could climb to $1,138 by November 28, representing a modest but steady 2.1% gain from current levels. The platform’s technical indicators show a bullish market sentiment, while the Fear & Greed Index sits at 51 (neutral), hinting at cautious optimism. Over the past month, BNB has recorded 15 green days out of 30, with 6.95% volatility, suggesting stable market participation.

If Bitcoin maintains its position above $110,000, analysts believe Binance Coin could easily outperform in November — particularly as investor focus returns to major exchange tokens.

Can BNB Hold Its Strength?

BNB’s long-term case remains anchored in utility. It powers Binance Smart Chain (BSC) transactions, fuels exchange fee discounts, and plays a role in BNB Chain’s DeFi and Web3 projects. With Binance’s global user base expanding and new integrations on the horizon, BNB’s position as a top-five crypto asset looks increasingly secure.

Still, traders caution that short-term corrections are possible if broader market conditions turn risk-off. For now, though, BNB remains one of the few large-cap cryptos flashing sustained bullish structure heading into the final stretch of 2025.