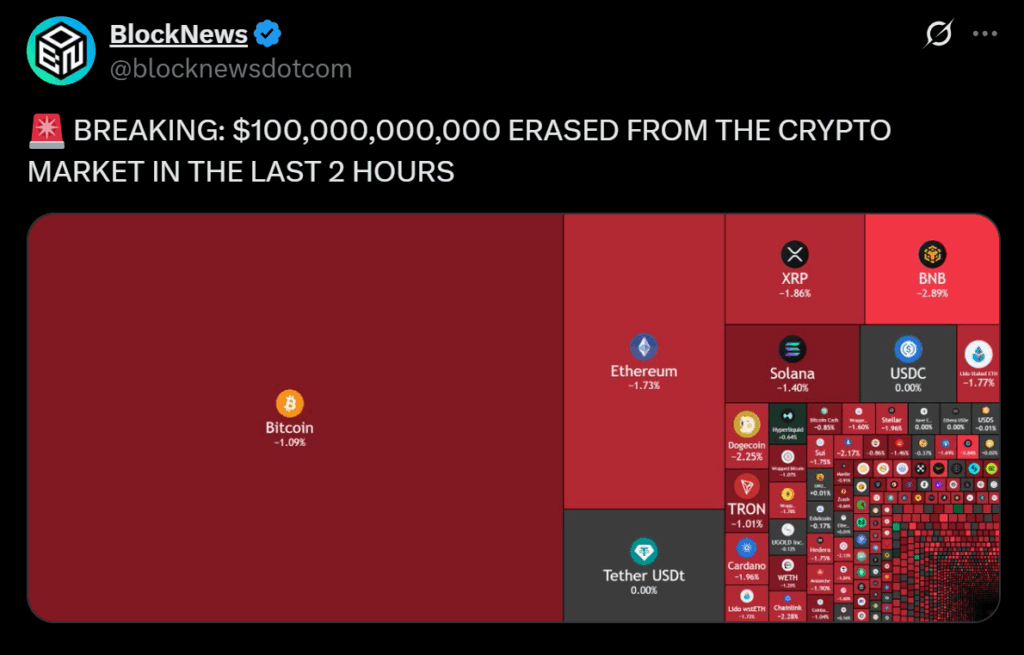

• Over $100B erased as Fed uncertainty, tariff tensions, and leverage unwind triggered mass liquidations.

• Crypto acted as a high-beta proxy for global risk, with BTC and ETH leading declines.

• A Fed reassurance and slower liquidation pace are key to near-term market stabilization.

1) Pre-FOMC Anxiety Is Freezing Liquidity

With the Federal Open Market Committee (FOMC) decision just hours away, traders are pulling risk rather than betting on the Fed’s tone. The market had been pricing multiple rate cuts in 2025, but recent sticky inflation data and firmer Fed commentary have revived hawkish concerns. When rate expectations become uncertain, high-beta assets like crypto get hit first, and intraday liquidity collapses.

The result is a market trading headline-to-headline, with shallow order books and wider spreads. Dealers are essentially choosing to “sell first, ask later,” especially in altcoins that depend on leverage and momentum. Until the Fed clarifies its path, expect thin bids and exaggerated reactions to every headline.

2) Trump–China Tariff Tensions Are Back

Renewed U.S.–China tariff risk has reappeared as a top-tier macro threat. Reports of fresh restrictions on rare earth exports and retaliatory tariff proposals have shaken confidence across global markets. The result: another wave of risk-off sentiment that spilled over from equities into crypto.

For digital assets, which still behave like high-volatility tech stocks, trade-war fears hit hard. Investors rotated out of speculative sectors, favoring gold and defensive plays. The selloff in BTC, ETH, and other Layer-1 tokens reflected that de-risking across portfolios, as traders braced for further escalation heading into November.

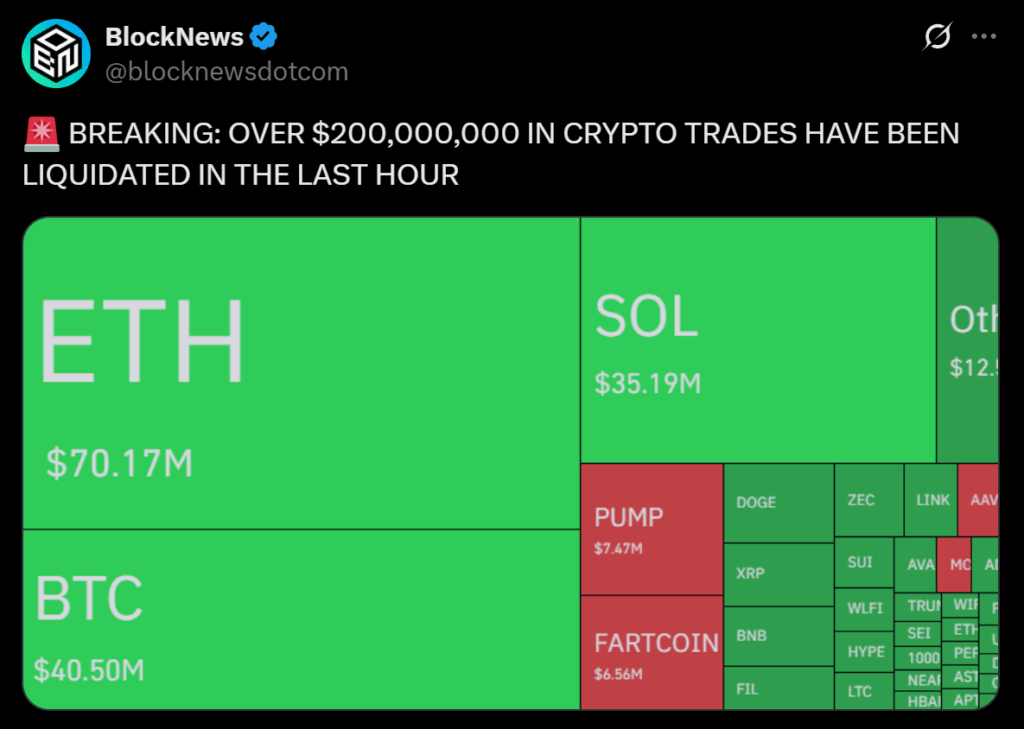

3) Leverage Fueled the Cascade

Once prices dipped below key support zones, forced liquidations did the rest. The sequence was textbook: Bitcoin cracked, Ethereum lagged, and altcoins plunged as leveraged positions unwound. Liquidation trackers showed hundreds of millions in margin calls within hours, turning a controlled pullback into a reflexive free fall.

Thin liquidity amplified every move. With each stop triggered, another wave of selling hit, creating a cascading chain reaction. Analysts say the key to stability now is watching liquidation pace—if it slows, price discovery can resume; if it accelerates into the U.S. close, expect further volatility and sold bounces.

The Bottom Line

Today’s $100B wipeout wasn’t caused by one headline—it was an overlap event: pre-Fed caution, tariff panic, and leverage unwinds colliding at once. Traders moved capital into metals and cash, leaving crypto without its usual liquidity buffers.

For stability to return, markets need clearer Fed guidance that doesn’t shock hawkishly and a visible cooldown in liquidations. Until then, smaller positions, wider stops, and strict risk management remain the rule.