- HYPE token briefly spiked to $98 due to a runaway trading bot on Lighter Exchange.

- Lighter removed the distorted wick from public charts, sparking controversy over transparency.

- No users lost funds, but the event renewed debate over liquidity and trust in DeFi platforms.

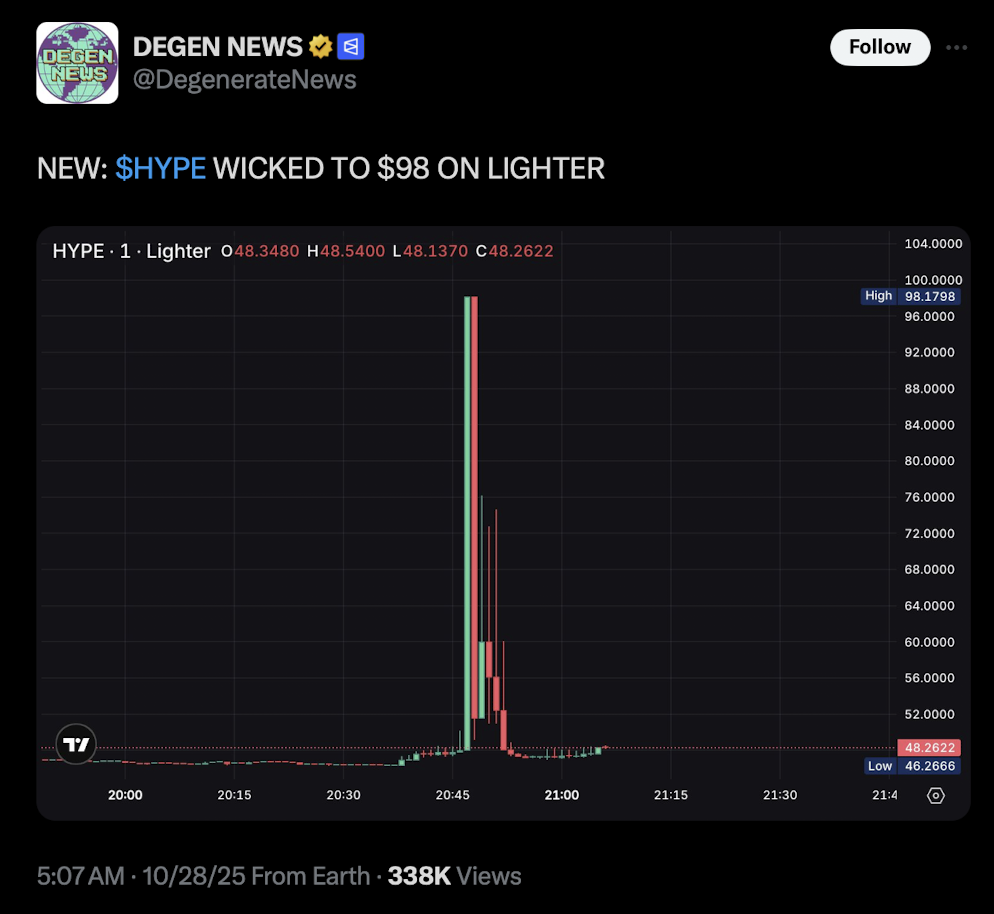

The crypto crowd got a shock today when HYPE, the native token of the Hyperliquid platform, suddenly surged to $98 on the Lighter Exchange — an Ethereum Layer-2 futures platform — before crashing right back down. What looked like a massive breakout turned out to be nothing more than a runaway trading bot, according to the Lighter team.

The exchange later confirmed that the bizarre move wasn’t the result of genuine market activity but an automated system glitch. Still, the event caused quite a stir, with traders and analysts jumping in to debate what really happened — and whether Lighter handled it the right way.

What Actually Caused the HYPE Price Spike?

The strange spike unfolded early in the morning, catching traders off guard. Screenshots shared on X (formerly Twitter) showed a wild green candle shooting HYPE from around $48 straight to $98 in just minutes — more than doubling in value before dropping back to reality.

Lighter’s team moved quickly to calm the chaos. “A runaway bot jammed through the HYPE book with size,” they wrote in a statement. They also clarified that no users were liquidated, and nobody lost funds beyond temporary chart distortions. To avoid confusion, the exchange later removed the exaggerated wick from its public charts, though the data still exists on-chain for anyone who wants to verify it.

“On-chain data isn’t modified — it’s fully visible through the block explorer,” the team explained. “But as the main frontend, we make decisions about how to display information in a way that’s useful for traders.”

Community Reactions: Transparency or Censorship?

That explanation didn’t sit well with everyone. Some users praised Lighter’s decision to remove the distorted wick, calling it a practical fix to maintain cleaner visuals. “Perfectly reasonable to remove the wick from the frontend, tbh,” one supporter posted.

But many others weren’t buying it. Critics argued that Lighter’s decision blurred the line between user experience and censorship. Duo Nine, a well-known crypto analyst, blasted the move, saying it “hid the truth” about Lighter’s liquidity issues.

“You should just admit your order books are thin instead of censoring the data,” he wrote. “You’re basically lying to users — if someone gets liquidated next time, what then?”

Others echoed the sentiment, accusing the platform of trying to “erase history” to protect its image. “Calling it a ‘runaway bot’ is just a convenient excuse,” one post read. “If a single bot can move your price 100% in seconds, that’s a liquidity problem, not a bug.”

Traders Shaken, But No Major Losses

While no automatic liquidations occurred, the sudden spike triggered panic among traders, some of whom manually closed their positions at a loss just to avoid potential wipeouts. Meanwhile, a few opportunists may have scored quick profits during the chaos before the correction hit.

As of Tuesday morning, HYPE was trading around $47.8, back to its pre-spike levels. Lighter’s charts now show a perfectly smooth baseline — no sign of the wild candle that set the internet buzzing.

Still, the event has reignited concerns about liquidity and transparency across decentralized trading platforms. For some, it’s a reminder of how fragile even advanced DeFi systems can be when automation goes wrong. For others, it’s a warning that user trust in decentralized platforms depends as much on honesty as on technology.