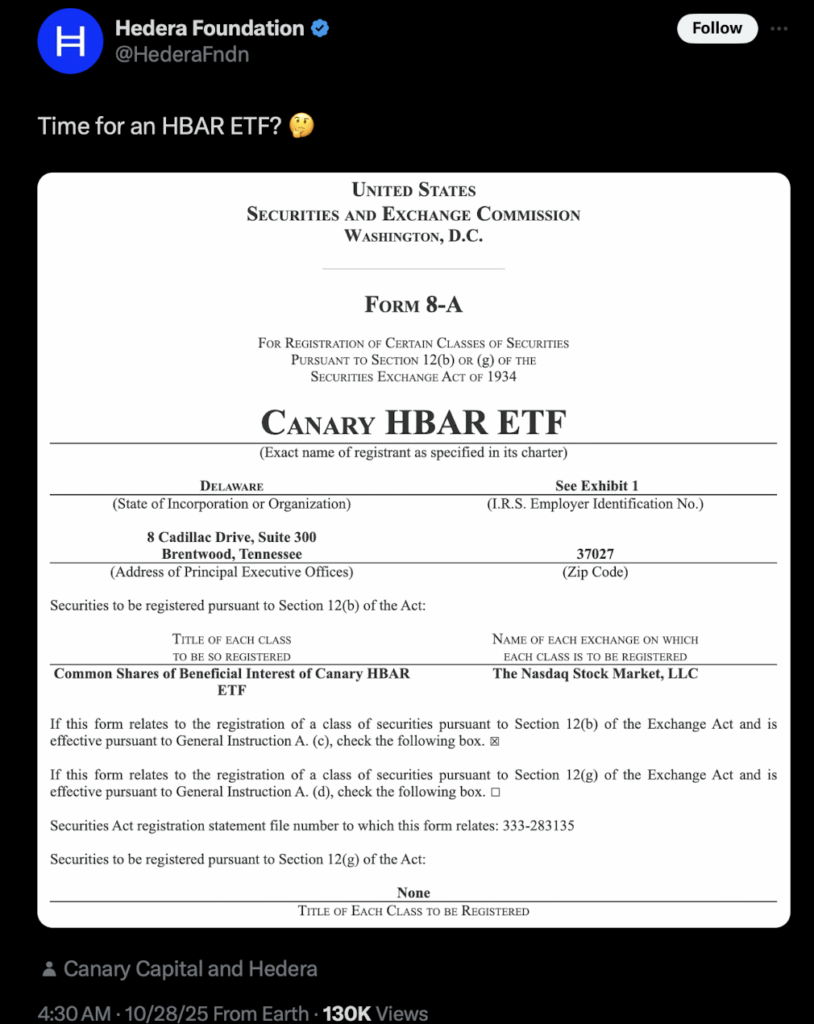

- Hedera’s first U.S. ETF (HBAR ETF) launches Tuesday on Nasdaq via Canary Capital.

- The ETF benefits from new SEC listing standards and automated approval rules.

- Tight creation/redemption design and enterprise-focused tech could attract institutional capital.

The crypto market is gearing up for another big moment this week. Hedera’s native token, HBAR, is getting its first-ever U.S. exchange-traded fund (ETF), courtesy of Canary Capital. The fund — simply called the HBAR ETF — will start trading on Nasdaq alongside Canary’s Litecoin ETF, marking a fresh wave of institutional access to digital assets.

Canary’s CEO, Steven McClurg, confirmed the launch after the firm wrapped up its required filings with the SEC earlier this week. The move comes as regulators adopt a more streamlined process under the so-called “shutdown playbook,” which allows ETF registrations to go effective automatically after 20 days if no delaying amendments are in place.

A Strategic Launch Amid SEC Policy Shifts

The timing isn’t random. Just last month, the SEC introduced new generic listing standards allowing exchanges to list spot commodity ETFs faster — a major change from the long, bespoke review process used before.

That shift, combined with temporary shutdown guidance from the SEC’s CorpFin division, explains how several crypto ETFs — including Bitwise’s Solana ETF on the NYSE and Canary’s HBAR and Litecoin ETFs on Nasdaq — are hitting the market at nearly the same time.

For Hedera, this debut means more than just publicity. It’s a key step toward mainstream adoption, giving registered investment advisors (RIAs) and institutional players a compliant, brokerage-accessible way to invest in HBAR without managing private wallets or dealing with direct custody.

Market watchers say early trading flows will reveal how much appetite there is for enterprise-grade Layer 1 blockchain exposure in traditional finance. It’ll also show whether capital from offshore ETPs or centralized exchanges starts migrating into these newly approved U.S. vehicles.

Why This HBAR ETF Is Different

This isn’t just another crypto ETF launch. The HBAR ETF stands apart from earlier Bitcoin and Ethereum products in a couple of important ways.

First, its creation and redemption mechanics — based on newer ETF rules — are designed to keep its market price tightly aligned with net asset value (NAV). That’s a big improvement over early crypto funds that often traded at wide premiums or discounts.

Second, Hedera’s unique Hashgraph technology and its enterprise-focused governance model make it a non-EVM alternative in a market dominated by Ethereum-compatible networks. For portfolio managers who want to diversify beyond EVM-based smart contract platforms, this could be a refreshing option.

If Canary’s ETF attracts strong liquidity and maintains tight spreads from day one, analysts expect other issuers to follow quickly with their own HBAR products — much like what happened with Solana’s ETF lineup earlier this year.

The Bigger Picture: Timing, Volatility, and Market Mood

The launch also arrives at an interesting macro moment. This week’s lineup includes major tech earnings and an upcoming FOMC decision, both of which could shake investor sentiment across risk assets.

How the HBAR ETF performs in its opening days will depend on whether buyers treat it as a long-term vehicle for exposure or as a short-term speculative trade. The balance between primary market creations (fresh inflows) and secondary market trading will reveal whether it becomes a liquidity magnet — or just another volatility amplifier in an already unpredictable market.

Either way, this launch signals something bigger: Hedera is stepping firmly into Wall Street’s playing field. And if history’s any guide, once institutional doors open, capital rarely stays on the sidelines for long.