• Cardano remains range-bound with downside risk toward $0.55 if momentum fails.

• Remittix (RTX) rises as a PayFi-focused rival with exchange listings and strong investor backing.

• Analysts say RTX could hit $1 before ADA — here is why it’s gaining ground among payment-driven crypto projects.

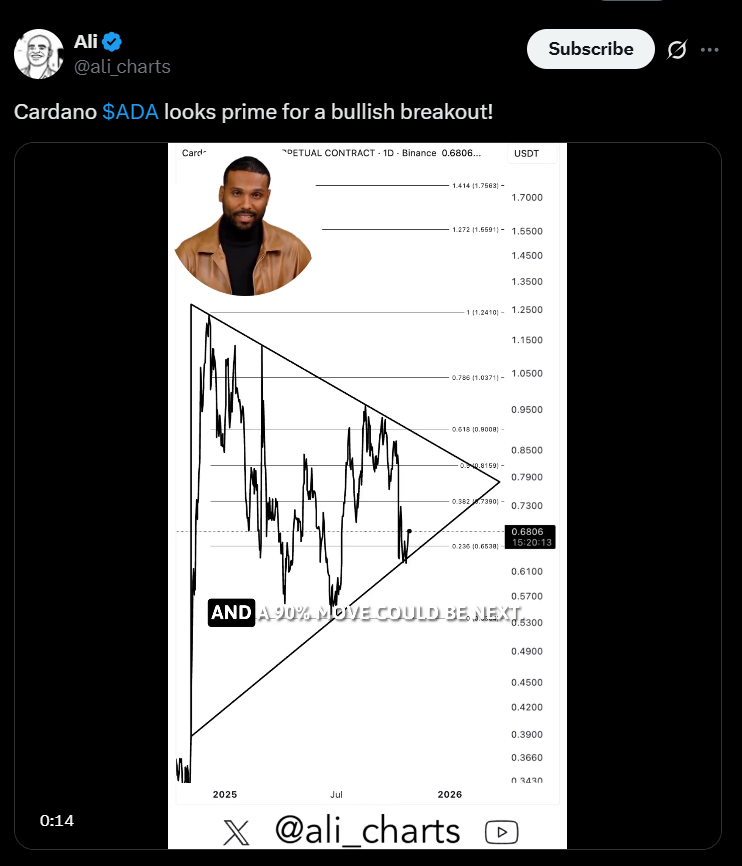

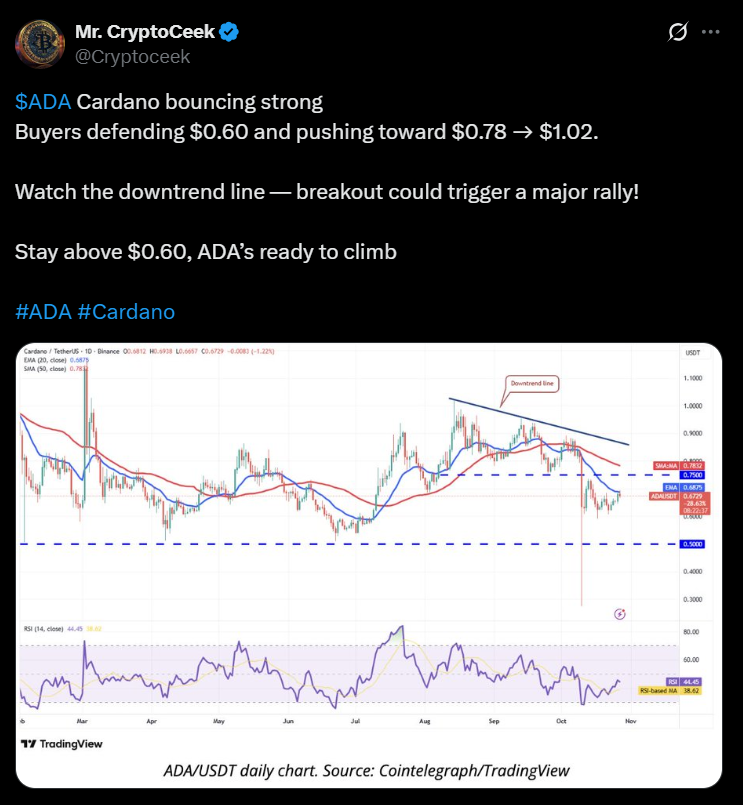

Cardano (ADA) continues to face pressure after repeated rejections near its upper resistance levels. Analysts report that ADA is still moving inside a descending channel, unable to sustain momentum around $0.85. This pattern of lower highs and lower lows has led many traders to target a short-term correction toward $0.55, unless ADA can break above the upper boundary and regain bullish momentum. Despite its strong ecosystem, ADA’s near-term setup remains cautious amid market uncertainty.

The Rise of Remittix and Its $1 Potential

While ADA consolidates, attention is shifting toward Remittix (RTX) — a PayFi-focused DeFi project currently priced at $0.1166. With over 40,000 investors joining recently, Remittix has raised $27.5 million and secured confirmed listings on BitMart and LBank, with another major exchange listing on the way. Analysts note that Remittix is emerging as a contender in the payments sector, blending DeFi speed with real-world finance through low-cost, cross-border transfers aimed at freelancers, expats, and small businesses.

Why Analysts See RTX Reaching $1 Before ADA

Remittix’s bullish outlook comes from its combination of fintech integration and decentralized architecture. The project’s CertiK-verified smart contracts, expanding ecosystem, and #1 Skynet ranking for Pre-Launch Tokens are driving investor enthusiasm. Its PayFi rails connect blockchain to traditional banking systems, creating a bridge between Web3 and mainstream finance. For this reason, some analysts argue that RTX could reach $1 before ADA, benefiting from strong early momentum and exchange exposure.

What This Means for Crypto Investors

While ADA’s technical picture remains neutral to bearish, projects like Remittix highlight how innovation and utility continue to drive capital toward newer entrants in the crypto space. For investors watching the next growth cycle, ADA may still require a confirmed breakout to retest higher ranges, while RTX could benefit from its ongoing presale and payment use case traction. Still, as always, analysts advise independent research — both assets remain subject to high volatility in a shifting macro environment.