- TRX drops below $0.30 amid growing selling pressure and negative funding rates.

- Open Interest climbs to $230M as traders confidently short the market.

- Failure to reclaim $0.30 support could drag TRX toward the next target at $0.264.

TRON’s price has stumbled under key pressure this week, dipping below the $0.30 support after sellers tightened their grip on the market. Once seen as one of the few altcoins holding relative strength against Bitcoin, TRX is now showing cracks as bearish sentiment grows across both spot and derivatives markets.

Selling Pressure Mounts as Traders Turn Cautious

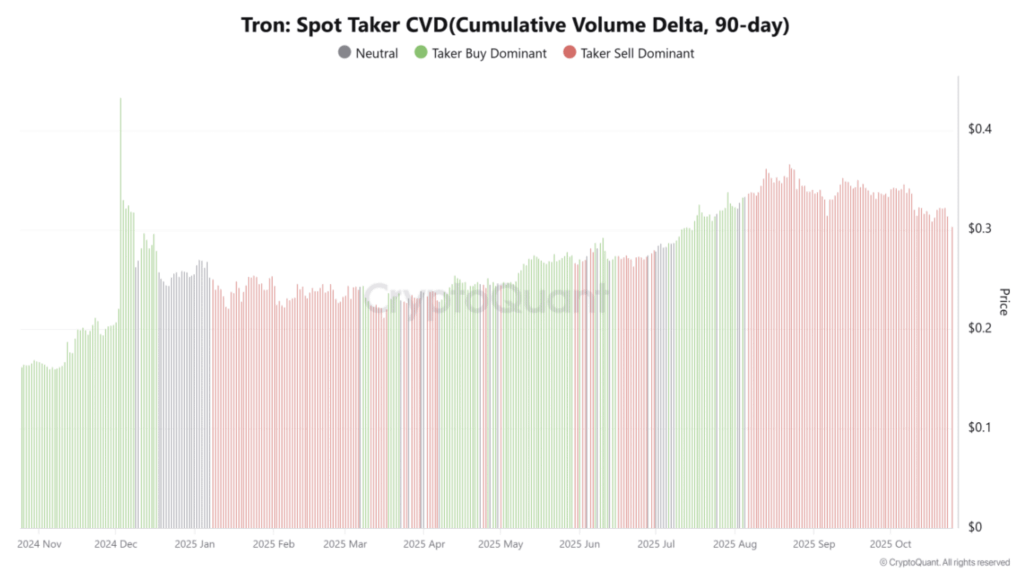

Just a few days ago, TRX seemed resilient following the wider market crash on October 10. But that strength faded quickly. The decline began after TRX was rejected at $0.325 on October 21, a local resistance level that has now become the focal point for bearish traders. Over the last 48 hours, the spot CVD (Cumulative Volume Delta) flipped negative — a clear sign that sellers are dominating in spot markets.

Funding rates have also turned negative, meaning short positions are increasing, while Open Interest has stayed near $230 million. Interestingly, OI rose by about $10 million over the past day even as prices fell — showing that traders are confidently adding shorts, betting that TRX has more downside ahead.

TRON Reaches Local Lows as Momentum Weakens

According to CryptoQuant data, the spot taker CVD has stayed bearish since late August, signaling that aggressive sell orders are still leading price action. Each wave of selling has kept pressure on the $0.30 zone — a level that’s acted as support multiple times before.

On the daily chart, TRX has been printing lower highs since August, which alone doesn’t confirm a bearish trend, but it’s a clear warning flag. For weeks, bulls have defended $0.30, but this latest move may finally break that streak. A daily close below this level could officially flip TRX into a bearish structure. The RSI is already sitting below neutral 50, while both short and long-term moving averages continue to lean downward, showing momentum remains with the bears.

Key Levels to Watch and What Comes Next

If TRX manages to reclaim the $0.30–$0.31 zone in the coming days, it might see a short-term bounce, but traders should treat that as a potential retest rather than a recovery. The $0.325 resistance remains the crucial pivot — flipping it into support would be the first real sign of strength returning.

If bears maintain control and TRX confirms a breakdown below $0.30, the next likely target sits around $0.264, a level that aligns with historical demand from earlier this year. Until sentiment shifts, cautious traders may prefer to wait out the volatility and watch how TRX behaves near these levels before jumping in.