- Cardano whales added 50M ADA worth $32.5M in just two days.

- Dormancy is rising, signaling fewer coins moving and early signs of accumulation.

- A breakout above $0.66 could send ADA toward $0.79, while failure might drag it back to $0.50.

Cardano has been moving quietly under the radar lately, but the calm might not last much longer. On-chain data and price charts are beginning to show the first flickers of life, hinting that something could be brewing. Large ADA holders are gradually stacking up again, and a few key technical signals suggest that a breakout might be closer than most expect. With the price hovering near a major resistance zone, the next few trading sessions could make or break ADA’s short-term trajectory.

Whales Slowly Return to the Game

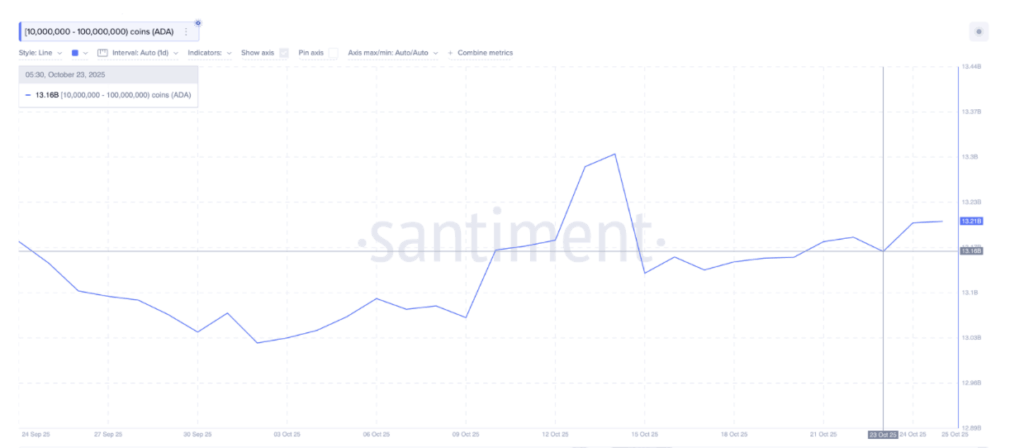

Data from Santiment shows that wallets holding between 10 million and 100 million ADA have been on a mild accumulation streak. In just two days, this group added roughly 50 million ADA, bumping their total holdings from 13.16 billion to 13.21 billion. That’s around $32.5 million worth of ADA at current prices — not a small bet.

While the move isn’t explosive, it’s a clear shift in sentiment. Whales tend to act early, and when they start accumulating again, it often signals that they’re positioning for something down the line. Still, analysts warn that a stronger confirmation would come only if the trend continues with higher volume over several sessions. For now, the buying looks cautious but deliberate.

Dormancy Suggests Investors Are Holding Tight

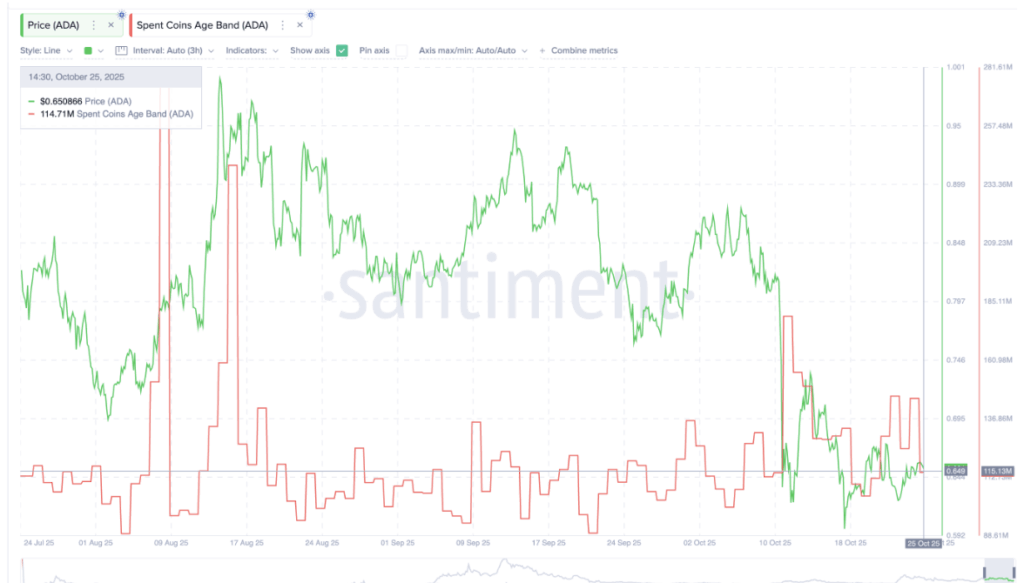

Another interesting detail comes from ADA’s dormancy metrics. The Spent Coins Age Band — which tracks how old coins move — has dropped by about 36% since mid-October, from 179 million ADA to around 114 million. In simple terms, fewer coins are moving around, meaning more holders are sitting tight instead of selling.

That said, dormancy levels are still a bit higher than the deep lows seen before major rallies. On September 22, dormancy fell to around 89 million ADA, right before a small price bump. For now, we’re not quite at that level, but we’re getting closer. If dormancy keeps falling toward or below 90 million, it could mark stronger conviction among long-term holders — a classic sign of quiet accumulation before bigger moves.

Chart Patterns Point to Bullish Potential

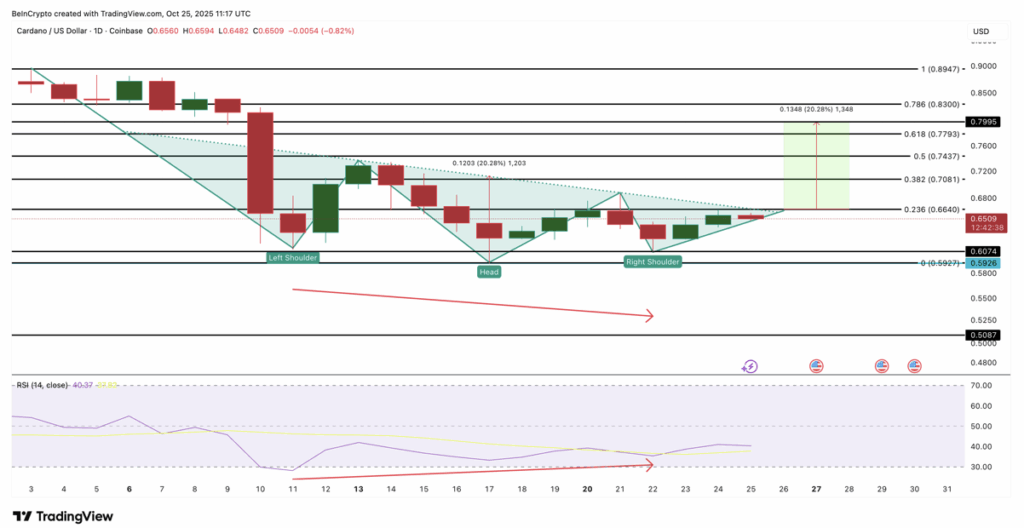

Cardano’s daily chart has started to sketch what looks like an inverse head-and-shoulders pattern — a formation that often shows up before bullish reversals. ADA is currently hovering near $0.66, which lines up with the 0.236 Fibonacci retracement zone. A clean breakout and daily close above this resistance could open the door to $0.79, with further potential up to $0.83 and $0.89 if momentum sticks around.

The only catch is that the neckline of the pattern is sloping downward, a sign that sellers haven’t disappeared yet. Still, ADA holding above $0.60 keeps the setup valid. If it dips below that, though, the structure collapses and support shifts down to $0.50 — a level that’s been tested several times before.

RSI Divergence Adds to Bullish Case

The Relative Strength Index (RSI) is quietly hinting at strength too. Between October 11 and October 22, ADA’s price made a lower low, but the RSI made a higher low — a bullish divergence. That’s usually an early sign that sellers are losing steam while buyers begin creeping back in.

When RSI divergence shows up on a daily chart, it often leads to a shift in trend direction — if price confirms it. For ADA, that confirmation lies right at the $0.66 mark. Break that cleanly, and the bulls might finally take the reins. But if resistance holds firm, Cardano could easily slide back toward $0.50 and stay trapped in its range a bit longer.