- Bill Morgan says Chainlink’s strategic reserve acts like a slow-motion stock buyback, tightening supply as adoption grows.

- Evernorth’s XRP Treasury will recycle yield into more XRP purchases, potentially offsetting Ripple’s escrow releases.

- Both projects could see reduced supply and increased institutional demand heading into 2026, setting up for long-term strength.

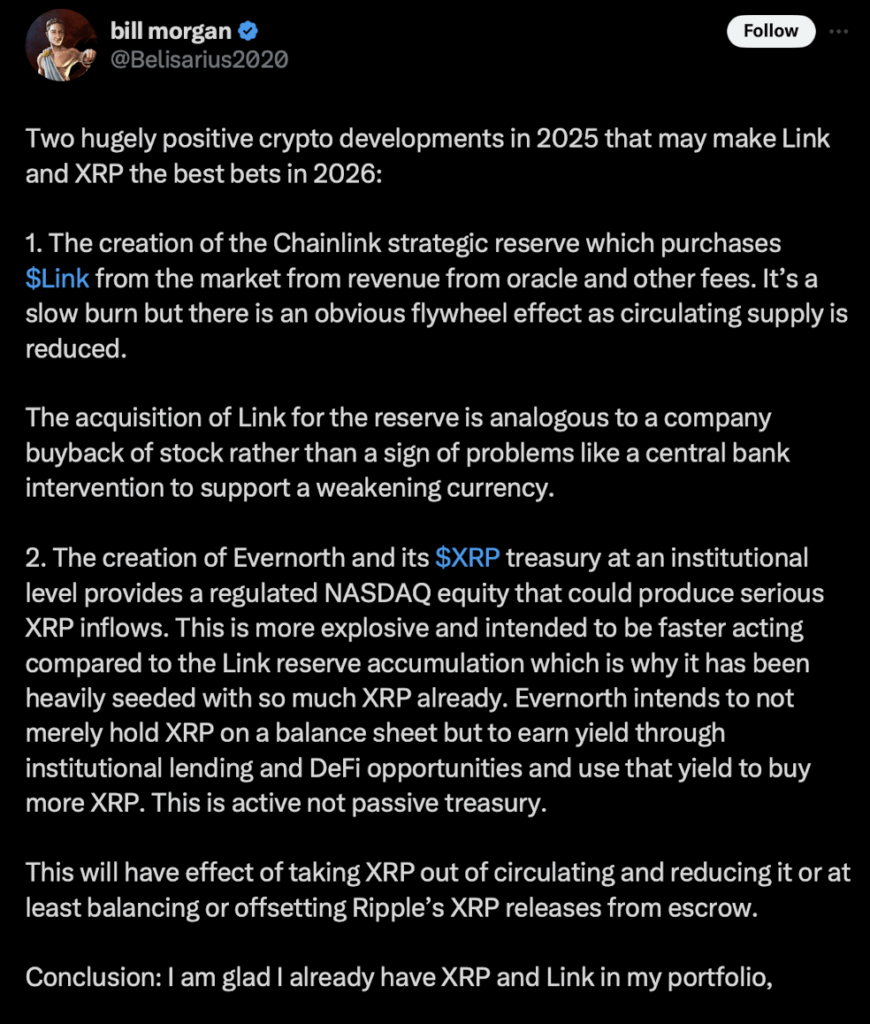

Pro-Ripple lawyer Bill Morgan believes both XRP and Chainlink (LINK) might be on track for standout performances in 2026 — thanks to two key developments unfolding in 2025. In a detailed post, Morgan explained how both projects are introducing mechanisms that could reduce circulating supply and strengthen long-term market health.

Chainlink’s Strategic Reserve Could Tighten Supply Over Time

Morgan began by pointing to Chainlink’s new strategic reserve, a feature that quietly accumulates LINK from the open market using revenue generated from oracle and service fees. He likened it to a corporate stock buyback, saying it reflects “confidence and sustainability — not desperation.”

This mechanism, he explained, creates a sort of “flywheel effect” where the reserve keeps absorbing LINK over time. As more fees roll in and adoption grows across DeFi and enterprise networks, this slow but steady accumulation tightens supply, driving scarcity. The setup, according to Morgan, gives LINK a natural price support mechanism that strengthens the longer the system runs.

In short — Chainlink’s design rewards long-term patience. As its oracle network expands, fewer tokens remain in circulation, which could give LINK a steady upward push heading into 2026.

Evernorth’s XRP Treasury: Institutional Demand Accelerator

On the XRP side, Morgan spotlighted the launch of Evernorth, a regulated NASDAQ-listed entity built to manage an institutional XRP treasury. Unlike passive holding models, Evernorth’s approach is active — it uses XRP for lending, staking, and DeFi yield generation, then recycles the profits back into purchasing more XRP.

Morgan called it “an accumulation loop,” saying it could eventually neutralize Ripple’s escrow releases by constantly pulling XRP off the market. This cycle could gradually reduce the total circulating supply while simultaneously creating sustained buying pressure.

He also noted that Evernorth offers institutional investors a compliant entry point into the XRP ecosystem — something the crypto industry has been waiting for. If regulatory clarity continues to improve in 2025, he believes Evernorth could trigger “serious institutional inflows” into XRP.

2026 Outlook: Long-Term Holders Could Win Big

Morgan wrapped up by reaffirming his own conviction, saying he’s “glad to already hold XRP and LINK.” His outlook frames both assets as benefiting from two distinct but complementary systems of accumulation — Chainlink through steady, revenue-driven buybacks, and XRP through institutional, yield-based acquisition.

If these mechanisms keep building momentum into 2025, he predicts 2026 could be a breakout year for both tokens. With reduced supply pressure, improving liquidity conditions, and growing institutional confidence, XRP and LINK might be poised for a strong, sustained rally — one driven more by fundamentals than hype.