- Analyst Lingrid warns that XRP could drop to $2.10 if the current descending channel holds.

- A breakout above $2.45–$2.50 could invalidate the bearish setup and spark a rebound toward $2.83.

- Other analysts note signs of a possible short-term bounce, with market sentiment and Bitcoin’s movement likely to influence XRP’s next move.

Crypto market analyst Lingrid believes XRP might be on the verge of hitting a fresh yearly low — but she’s also pinpointed the exact price zone that could flip the trend around. In her latest market breakdown, she noted that while the short-term structure still looks bearish, there’s a narrow window where bulls could regain control.

XRP Struggles to Regain Strength

At the time of her analysis, XRP was trading near $2.44, down roughly 14% for the month. The token’s weak recovery after the October 10 market-wide crash hasn’t been enough to reverse the broader downtrend. Despite brief relief rallies, XRP keeps lagging behind other major cryptos in terms of strength.

Lingrid’s earlier forecast, posted on October 18 when XRP hovered around $2.33, outlined a descending channel pattern on the 4-hour chart — one that’s been guiding price action since late August. Each attempt to break higher has met resistance, keeping the asset trapped in this falling structure.

Bears in Control: A Move Toward $2.10?

Her chart analysis showed a blue descending trendline cutting through the middle of the channel — acting as a kind of dividing line between weak recoveries and deeper drops. Every time XRP approached that internal resistance, sellers took over.

Earlier in October, the coin even managed a brief breakout above it, reaching $3.10, but the move quickly unraveled as sellers slammed it back below. The October 10 crash deepened the fall, sending XRP under $2.70. Even after a rebound attempt to $2.63 on October 13, the token failed to close above resistance.

Lingrid highlighted that XRP continues to form lower highs and lower lows, the textbook definition of a downtrend. If that pattern stays intact, she expects a slide toward $2.10, which she marked as the bottom of the descending channel— and possibly the next strong demand zone.

The Key to a Reversal

Still, it’s not all doom and gloom. Lingrid pointed out the exact levels that could invalidate the bearish case. A decisive breakout above $2.45, she said, could be the first sign of strength. If bulls manage to push past $2.50 and hold, that could confirm a short-term reversal, potentially driving XRP toward $2.83 in the coming sessions.

She also mentioned that broader market sentiment could shift things. If Bitcoin turns bullish, altcoins like XRP often follow. On a macro level, she referenced JPMorgan’s recent comments suggesting that the U.S. Federal Reserve might soon end its quantitative tightening phase — a move that could loosen liquidity and inject optimism across risk markets, including crypto.

Analysts Divided as Sentiment Wavers

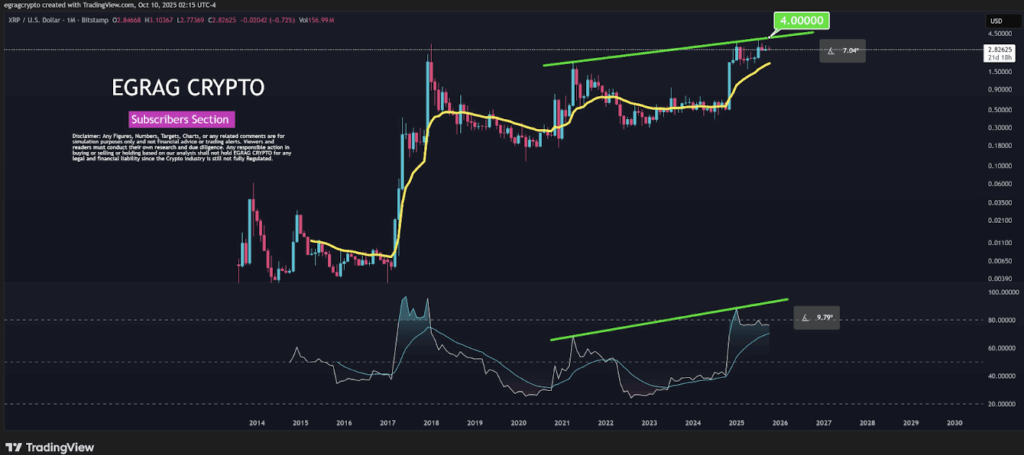

Lingrid’s view leans cautious, but not everyone agrees. Fellow analyst EGRAG Crypto argues that XRP’s monthly chart still shows structural strength, noting that no major support has been decisively broken yet. Meanwhile, Ali Martinez pointed to a TD Sequential buy signal on the 4-hour chart, hinting that a short-term bounce might already be in motion.

At this stage, XRP’s direction depends on how it handles the $2.45–$2.50 region. A break above that range could flip sentiment bullish again. But if the rejection continues, a retest of the $2.10 zone seems more and more likely — a level that could define whether this correction ends… or deepens.