- Chainlink rebounded from its $17 support zone, with analysts eyeing a potential breakout toward $100.

- Whales accumulated over 13 million LINK in two weeks, signaling strong confidence despite market weakness.

- The Chainlink Foundation’s ongoing buybacks have reduced supply, helping stabilize price momentum.

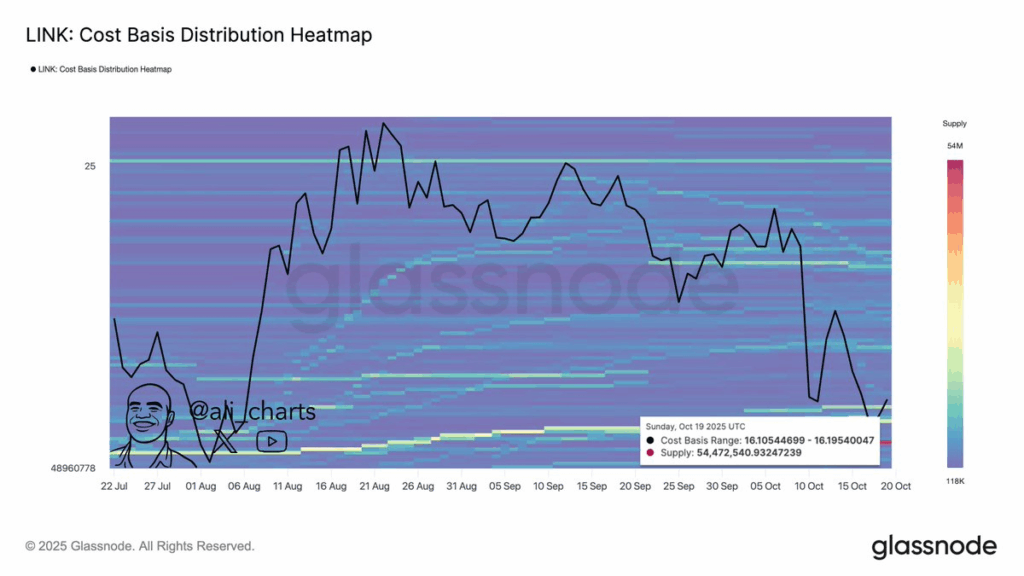

Chainlink’s price is sitting right at a key support zone, and traders are watching closely. After bouncing off the $17 range — where more than 54.5 million LINK have been accumulated — the token has started to show real strength. It’s up nearly 10% this week, with its market cap hovering around $12 billion. Analysts say a breakout past $25 could trigger a major rally, one that might even push LINK toward $100 in the months ahead.

The Setup Before the Surge

Crypto analyst Ali Martinez pointed out that LINK is currently forming a symmetrical triangle — a pattern that often precedes massive price swings. According to him, the accumulation at $17 has created a “huge support wall,” showing that buyers are stepping in aggressively. Technically, once LINK clears the $25 resistance level, the path could open for a sharp move to $53 and potentially even triple digits. It’s the kind of setup traders love — tight consolidation, strong volume, and whale accumulation building beneath the surface.

Whales and Foundation Buybacks Fueling Confidence

Big players are clearly moving. Over the last two weeks alone, whales have added more than 13 million LINK to their holdings, taking advantage of the market’s hesitation. At the same time, the Chainlink Foundation has been actively buying back tokens to support the ecosystem. On Thursday, it repurchased 63,481 LINK — the second-largest buyback since the program began. The foundation’s reserves now sit at roughly 586,000 LINK worth over $10 million, effectively reducing market supply and adding stability to price action.

Can LINK Really Hit $100?

While a $100 target sounds wild, it’s not impossible. Chainlink has been steadily expanding its oracle network and integrating with major DeFi protocols, creating stronger demand for its services and token. With whales accumulating and the foundation tightening supply, market sentiment is shifting bullish. If LINK breaks that key $25 level and momentum carries through, traders could finally see one of the biggest altcoin rallies of the cycle. For now, the $17 zone remains the battlefield — and whales seem determined to defend it.