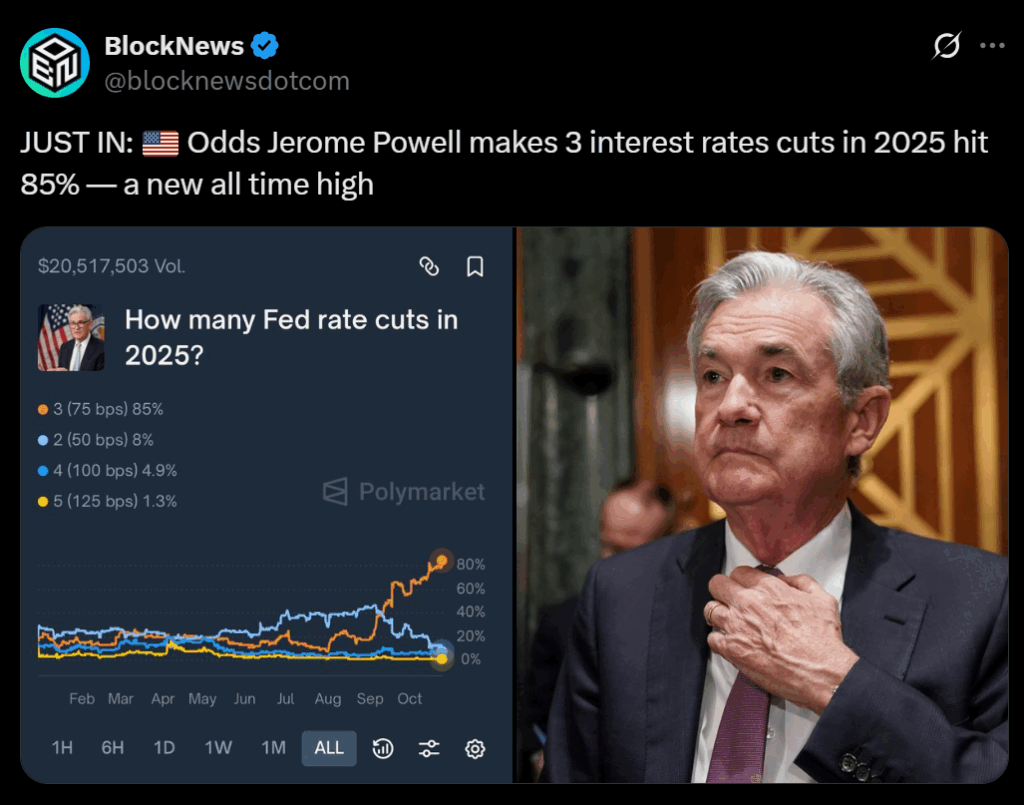

• Polymarket odds for three 2025 Fed rate cuts jumped to 85%, signaling strong market conviction.

• Softer inflation data and futures pricing show broad alignment on a “soft-landing” outlook.

• Easier policy could fuel a crypto liquidity surge, lifting BTC, ETH, and major altcoins.

Prediction markets are lighting up with fresh optimism after Polymarket traders pushed odds of three Federal Reserve rate cuts in 2025 to a record-high 85%. The “3 (75 bps)” contract now leads all outcomes, with volume exceeding $20.5 million as investors position for easier monetary policy. A cooler-than-expected inflation report earlier today gave the rally legs, prompting futures markets to fully price in two cuts — one in October and another in December — setting the stage for a third in early 2025.

The Soft-Landing Narrative Takes Hold

Wall Street’s base case is shifting toward what traders call a “soft landing” — where inflation cools, growth slows but doesn’t collapse, and the Fed gradually lowers rates. Bond desks now see a path to a lower terminal rate through 2025, and Polymarket’s odds reflect that same optimism. CME’s FedWatch tool shows a sharp decline in the likelihood of any aggressive hikes, confirming that investors expect smaller, steady trims instead. The takeaway? Markets believe the Fed can ease without triggering panic — a recipe that often fuels risk-taking across equities and crypto.

Why Crypto Traders Should Care

For crypto markets, this setup could be a major tailwind. Lower interest rates typically boost liquidity, risk appetite, and inflows into digital assets. When the Fed signals or delivers easing, traders often rotate into higher-beta assets like Bitcoin, Ethereum, and altcoins. With two cuts already baked into futures pricing and a third now viewed as almost guaranteed, liquidity-sensitive tokens could benefit most. Historically, such conditions tighten perpetual funding rates and accelerate spot ETF inflows — both signs of a healthier, more active market.

The Caveat: Inflation Still Looms

Of course, the path isn’t locked in. If inflation surprises on the upside again, it could quickly unravel this dovish setup — forcing traders to unwind bullish bets just as fast. For now, though, the data and odds are aligned: the Fed looks ready to ease, and risk assets are cheering the shift. If the next CPI and payroll reports stay friendly, 2025 could open with the most accommodative policy backdrop crypto has seen since 2021.